- Bitcoin dip-buying interest surges, reaching the highest levels since April 2024.

- Key Bitcoin support lies at $92K, resistance at $97.5K, and $100K psychological barrier.

- RSI and MACD hint at potential recovery if Bitcoin sustains above $96,000 levels.

Bitcoin’s volatile price has grabbed the attention of traders and analysts, sparking fresh discussions about opportunities to buy on dips.

As prices have corrected, Binance CEO CZ shared a sardonic remark on social media about Bitcoin’s “crash” from $101,000 to $85,000. He later shared a post suggesting Bitcoin could reach another all-time high (ATH) soon, showing his positive outlook despite market fluctuations.

Investors Eye the Bitcoin Dip

Social media platforms show a rise in discussions about strategically buying the dip. Santiment reports that mentions of Bitcoin and “buying the dip” across platforms like Reddit, Telegram, and 4Chan are at their highest levels since April 2024.

Read also: Bitcoin Dips and Kiyosaki’s Buying Message Gains Traction

This activity suggests optimism among retail and institutional investors, with many seeking to take advantage of Bitcoin’s lower price. Notably, this enthusiasm comes as Bitcoin’s value fell to $95,478, a 6.85% decrease in 24 hours. Analysts see the market as potentially setting up for a recovery.

Bitcoin’s Price: Key Trends to Watch

Bitcoin’s price is trying to stabilize after the sharp correction. After dipping below $97,500, the cryptocurrency recovered slightly, now trading near $95,986. A critical support level lies at $92,000, with significant buyer activity seen at these levels.

On the other hand, resistance levels around $97,500 and the psychological barrier of $100,000 are key hurdles for Bitcoin’s upward movement. Breaking through these levels could signal a short-term recovery, but failing to hold support may lead to further declines.

Read also: Bitcoin Price Rises, but Wallet Activity Hits a Low Point

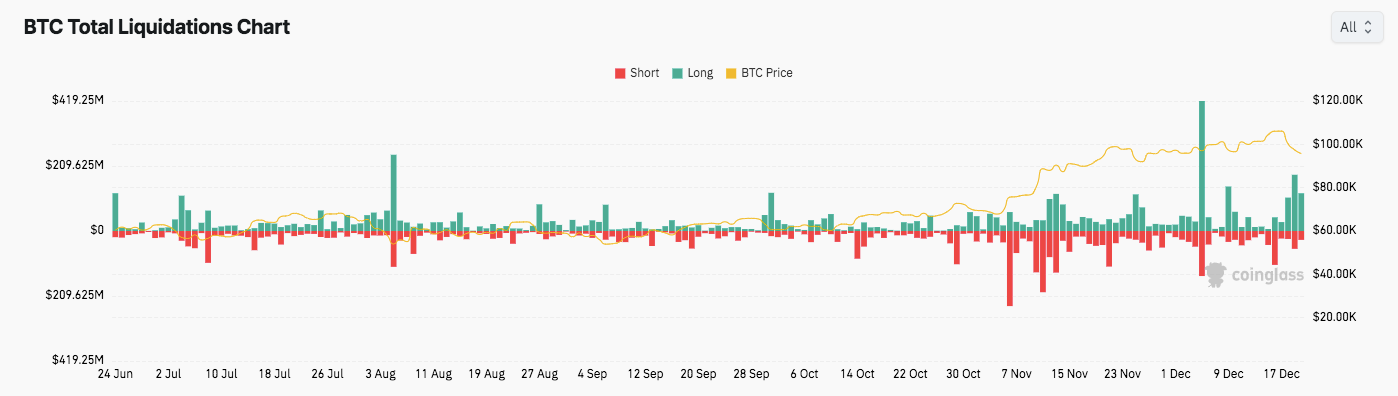

Market Volatility and Liquidation Trends

Well-known analysts, including Ali Martinez , note that over 62.07% of Binance traders with open Bitcoin positions are betting on a price increase, adding to the bullish sentiment. Bitcoin’s price swings have led to significant liquidations on both long and short positions.

Source: Coinglass

Source: Coinglass

There were notable spikes in short liquidations when prices rose in November and early December, while long liquidations jumped when prices fell in mid-August and late November. This pattern shows traders tend to underestimate market fluctuations, often resulting in liquidation cascades during sharp price reversals.

Is a Bitcoin Rebound on the Horizon?

BTC/USD 4-hour price chart, Source: Trading view

BTC/USD 4-hour price chart, Source: Trading view

Technical indicators give mixed signals for Bitcoin’s short-term outlook. The Relative Strength Index (RSI) is at 36.84, hinting at oversold conditions with potential for recovery. Also, the Moving Average Convergence Divergence (MACD) shows a small bullish divergence, suggesting that momentum may shift if Bitcoin stays above $96,000.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.