MicroStrategy has been buying Bitcoin for nine consecutive weeks, with a total holding amounting to approximately 44.3 billion US dollars

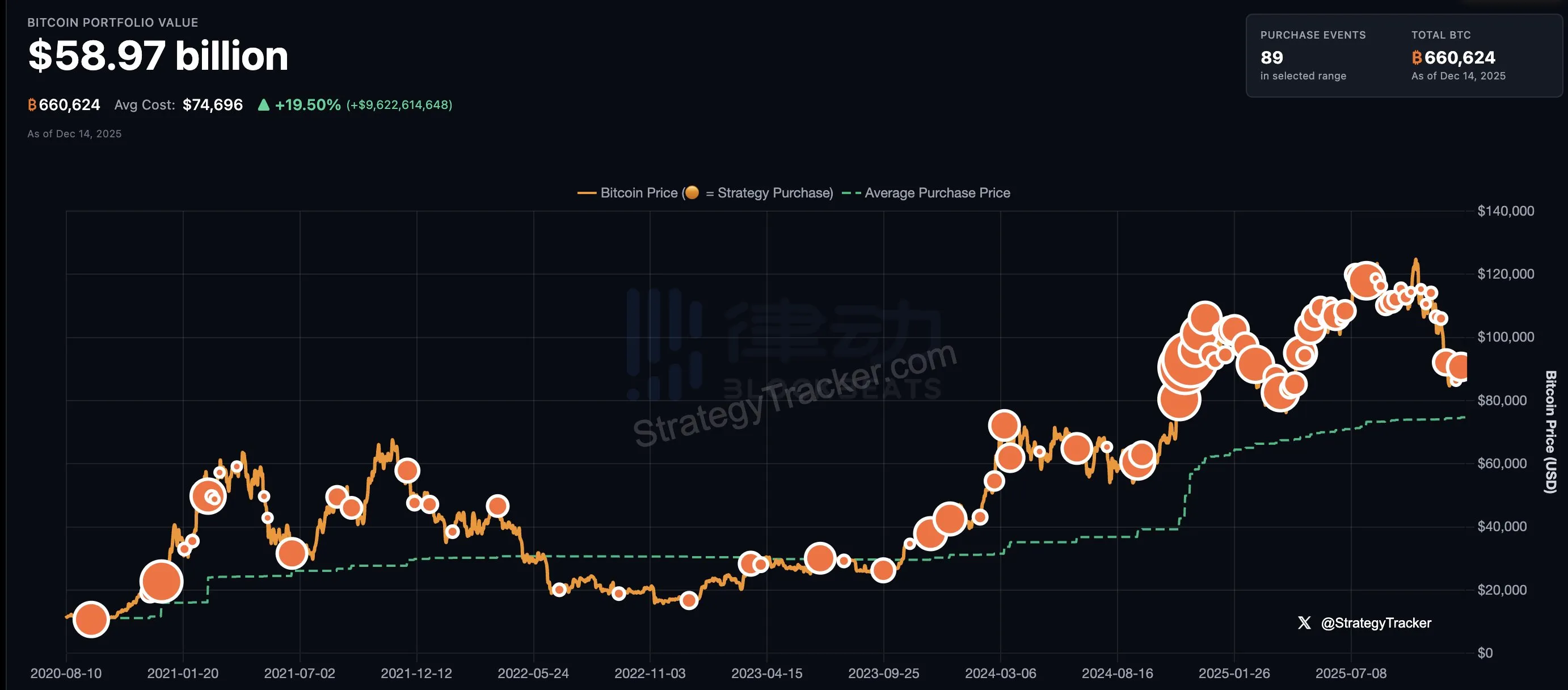

MicroStrategy Inc. has purchased $101 million worth of Bitcoin, having previously announced it would use perpetual preferred shares, common shares and debt to buy more cryptocurrencies. The enterprise software company, headquartered in Tysons Corner, Virginia, has been buying Bitcoin for nine consecutive weeks. Its co-founder and chairman Michael Saylor hopes to advance its strategy of holding Bitcoin. The company holds about $44 billion in Bitcoin.

According to documents from the U.S. Securities and Exchange Commission, MicroStrategy bought 1,070 Bitcoins at an average price of about $94,000 on December 30th and 31st. The company said on Friday that it plans to raise up to $2 billion through one or more issuances of perpetual preferred shares in the first quarter. The issuance of preferred shares is part of a plan to raise $42 billion in capital by issuing public stock and convertible bonds until 2027.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cathie Wood: The crypto market may have bottomed out, Bitcoin remains the top choice for institutions

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC accumulation

Analyst: Bitcoin’s key support level is at $86,000; a breach could trigger a deeper correction

Aevo confirms that the old Ribbon DOV vaults were attacked and lost $2.7 million, and will compensate active users.