XRP Price Prediction after the SEC Appeal Tomorrow

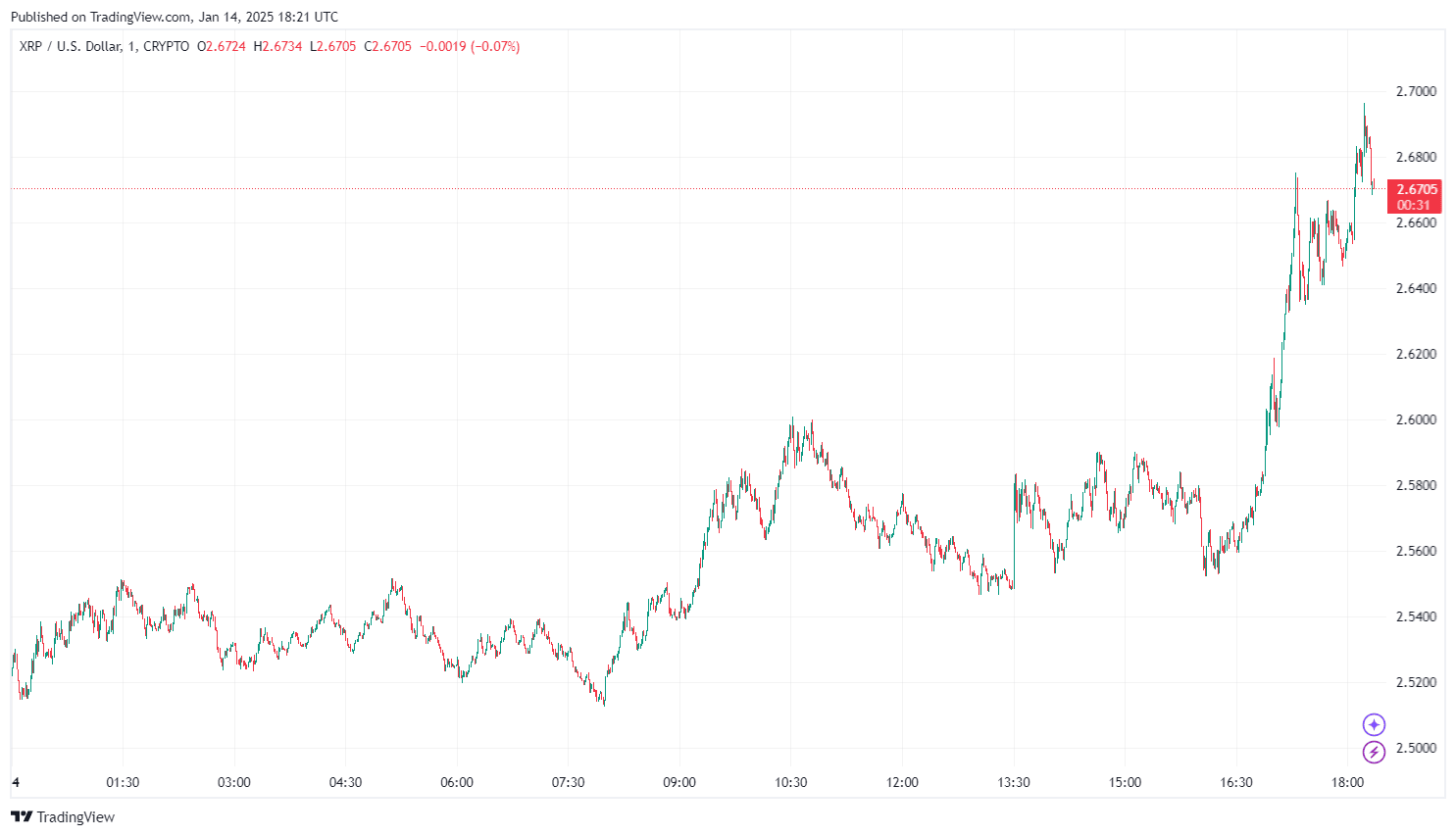

XRP price surged today , gaining over 10% in the last 24 hours and reaching an intraday high of $2.68. As Ripple Labs and the U.S. Securities and Exchange Commission (SEC) approach a critical legal milestone with the SEC’s appeal deadline on January 15, 2025, market participants are closely watching XRP's price movements . The next 48 hours are crucial for the XRP price which is currently fueled by momentum and investor confidence , will it keep or lose them?

By TradingView - XRPUSD_2025-01-14 (1D)

By TradingView - XRPUSD_2025-01-14 (1D)

The SEC Appeal and the XRP Price Momentum

Ripple’s legal battle with the SEC has been a defining narrative for XRP’s performance over the past few years. The SEC must file its opening brief tomorrow, challenging previous court rulings that declared XRP not a security when sold to retail investors. Failure to meet this deadline could lead to the dismissal of the appeal, solidifying Ripple’s victory and potentially providing much-needed regulatory clarity for XRP and the broader crypto market.

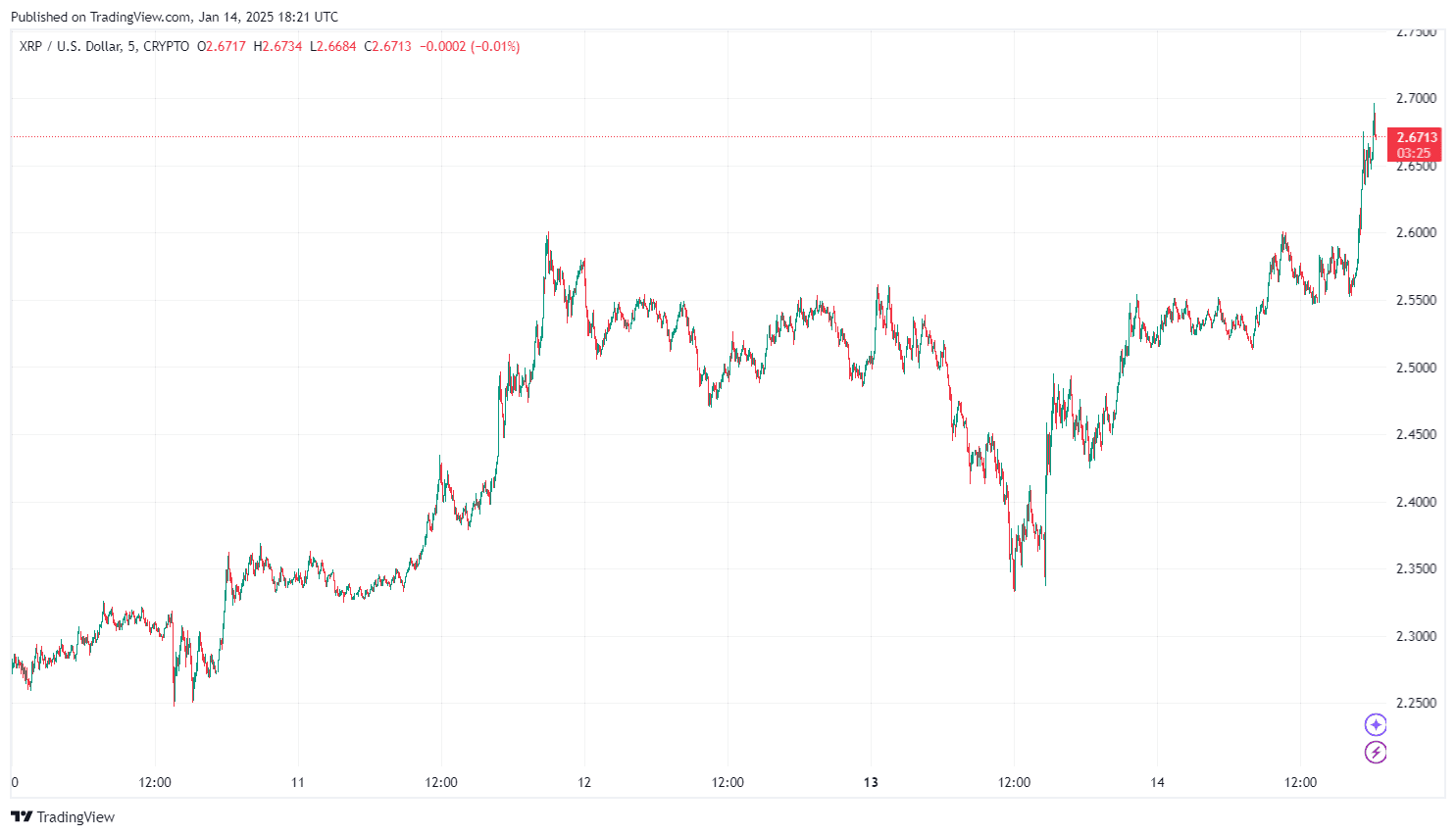

This clarity is a major driver behind XRP’s current momentum, with investors betting on a favorable outcome . Market analysts suggest that if the SEC’s appeal is dismissed or Ripple gains further ground, XRP could break through the $2.86 intra-year high, paving the way for new targets around $3 and beyond to a new ATH. Some analysts forecast potential rallies toward $4 and even $8 in the long term.

By TradingView - XRPUSD_2025-01-14 (5D)

By TradingView - XRPUSD_2025-01-14 (5D)

XRP Price Predictions and Analysis

1- Why XRP Is Outperforming Bitcoin

XRP’s recent surge, marked by a 10% gain in 24 hours, has significantly outpaced Bitcoin’s performance. Several factors are contributing to XRP’s bullish momentum:

- SEC Deadline Catalysts: The looming appeal deadline has heightened market activity around XRP, with traders positioning for potential positive outcomes.

- Pro-Crypto Political Environment: The imminent inauguration of pro-crypto President Donald Trump on January 20, coupled with expected leadership changes at the SEC , has fueled optimism about a more favorable regulatory environment.

- Investor Confidence: The XRP market reflects growing confidence, supported by robust trading volume and technical indicators signaling further upside potential.

2- Technical Analysis: Can XRP Break Its Intra-Year High?

At $2.68, XRP is approaching critical resistance levels. Analysts believe that sustained momentum, driven by the SEC’s appeal outcome, could push XRP toward or beyond its intra-year high of $2.86. Key support levels around $2.55 have been holding strong, while resistance above $2.70 remains the next hurdle.

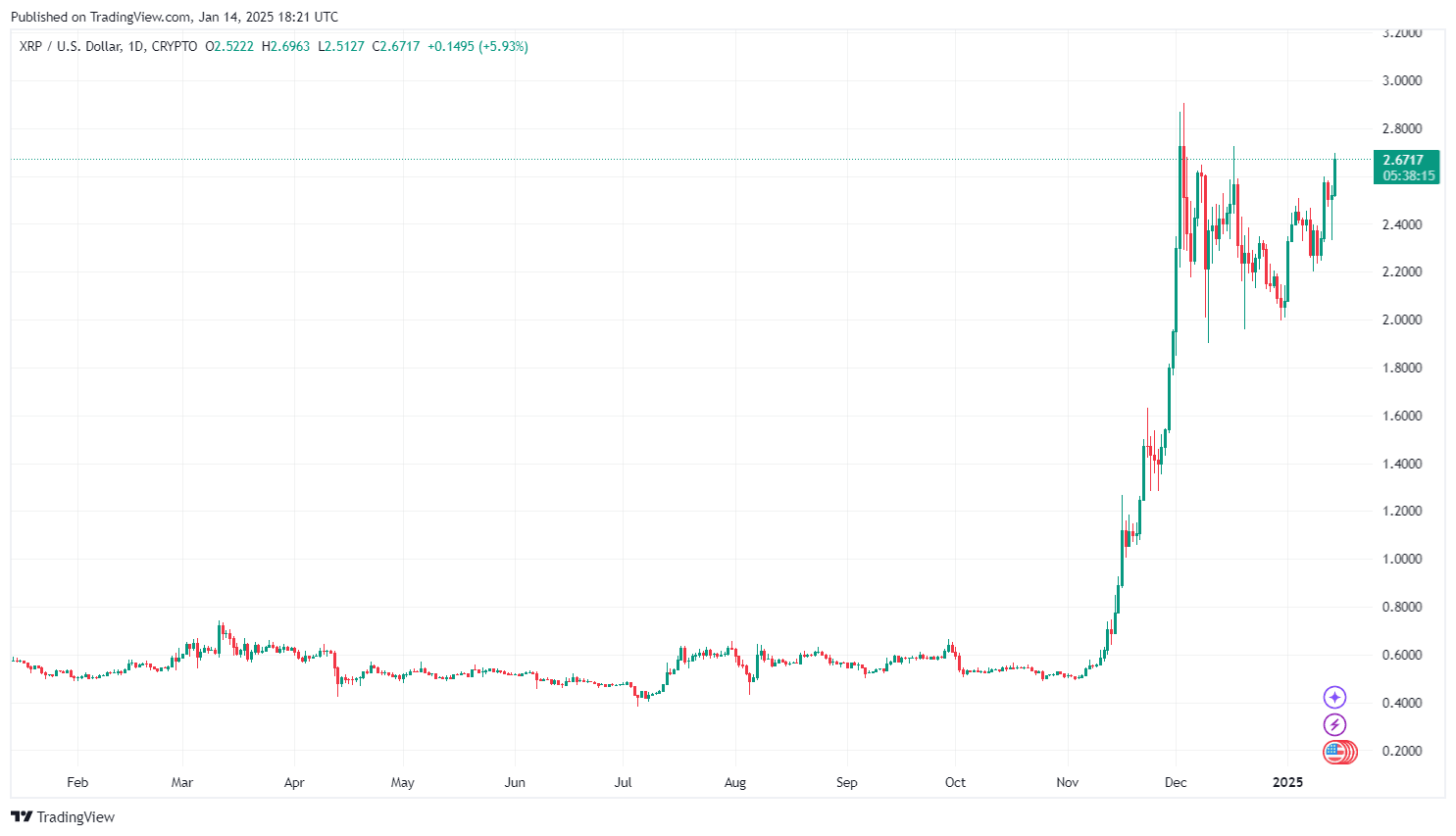

By TradingView - XRPUSD_2025-01-14 (1Y)

By TradingView - XRPUSD_2025-01-14 (1Y)

If XRP successfully breaks through $2.86, its next targets could include $3 and even $3.20, driven by a combination of technical and fundamental factors, approaching its $3.84 ATH of 7 years for the first time in a long time, to maybe even surpassing it and hitting a new one.

By TradingView - XRPUSD_2025-01-14 (All)

By TradingView - XRPUSD_2025-01-14 (All)

3- What to Expect Before and After the SEC Appeal?

XRP Price Predictions

- Before the Deadline: XRP’s price is likely to remain volatile as traders react to news and speculation. A favorable signal, such as the SEC missing its deadline or filing a weak brief, could trigger a rally.

- After the Decision: The SEC appeal process is expected to extend into 2026 , but early decisions could set the tone for the case. A Ripple victory could strengthen XRP’s market position, potentially attracting institutional investors and driving long-term growth.

Broader Market Impact of the Ripple SEC Lawsuit Outcome

The outcome of this Ripple SEC lawsuit case will not only affect XRP tokens, but will influence the regulatory landscape for cryptocurrencies in the U.S., affecting tokens beyond XRP, as all eyes are on Ripple’s legal battle and its potential to reshape the future of cryptocurrency regulation. And now a pro-crypto administration under Trump could amplify this impact , encouraging innovation and investment in blockchain technologies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum undergoes "Fusaka upgrade" to further "scale and improve efficiency," strengthening on-chain settlement capabilities

Ethereum has activated the key "Fusaka" upgrade, increasing Layer-2 data capacity eightfold through PeerDAS technology. Combined with the BPO fork mechanism and the blob base price mechanism, this upgrade is expected to significantly reduce Layer-2 operating costs and ensure the network’s long-term economic sustainability.

Down 1/3 in the first minute after opening, halved in 26 minutes, "Trump concept" dumped by the market

Cryptocurrency projects related to the Trump family were once market favorites, but are now experiencing a dramatic collapse in trust.

Can the Federal Reserve win the battle to defend its independence? Powell's reappointment may be the key to victory or defeat

Bank of America believes that there is little to fear if Trump nominates a new Federal Reserve Chair, as the White House's ability to exert pressure will be significantly limited if Powell remains as a board member. In addition, a more hawkish committee would leave a Chair seeking to accommodate Trump's hopes for rate cuts with no room to maneuver.

From panic to reversal: BTC rises above $93,000 again, has a structural turning point arrived?

BTC has strongly returned to $93,000. Although there appears to be no direct positive catalyst, in reality, four macro factors are resonating simultaneously to trigger a potential structural turning point: expectations of interest rate cuts, improving liquidity, political transitions, and the loosening stance of traditional institutions.