LINK Faces Volatility Amid Whale Activity: Can It Hold Support?

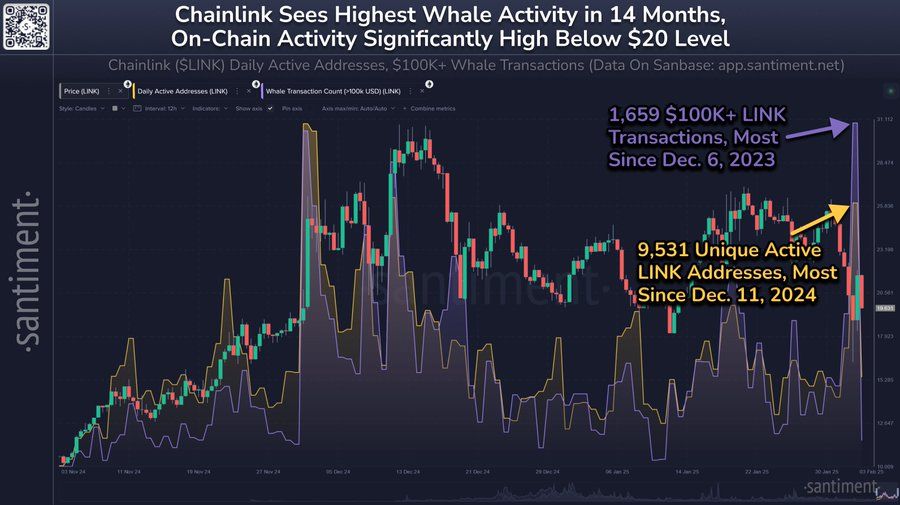

- Chainlink records 1,659 transactions over $100K, the highest since December 2023.

- 9,531 active wallets recorded, marking the most since December 2024 for Chainlink.

- Whales offload 4.13 million LINK in 48 hours, triggering volatility in price action.

Chainlink (LINK) attracts significant investor interest levels during a recent market correction period. At press time, LINK price stands at $19.93, which has decreased by 4.39% throughout the day. Chainlink experiences heightened scrutiny because of significant whale transaction patterns, including market buying and selling behaviors during market volatility. What impact will whale movements have on LINK’s ongoing price recovery from its recent market drop?

Whale Activity Influences LINK’s Price

Chainlink’s recent price action shows fluctuations between $19 and $21. Based on its price consolidation, LINK appears to have reached an essential support zone. According to Santiment, LINK saw 1,659 transactions exceeding $100K, the highest level since December 2023. The asset also recorded 9,531 active wallets, the highest number since December 2024. The rising whale transactions and active wallet numbers show growing LINK investor interest, suggesting the digital asset could experience a market price movement when market stability returns.

Source:

X

Source:

X

LINK shows signs of downward pressure despite increased whale activity as whales completed recent sell-offs. According to Ali Martinez’s analysis, the offloading of 4.13 million LINK by whales in the last 48 hours is significant since it might cause additional pricing pressure. The substantial price decline of LINK occurred after whales unloaded their vast holdings, which reached highs of $21. The chart Ali provides shows how whale movement affects LINK price trends during this substantial market dump.

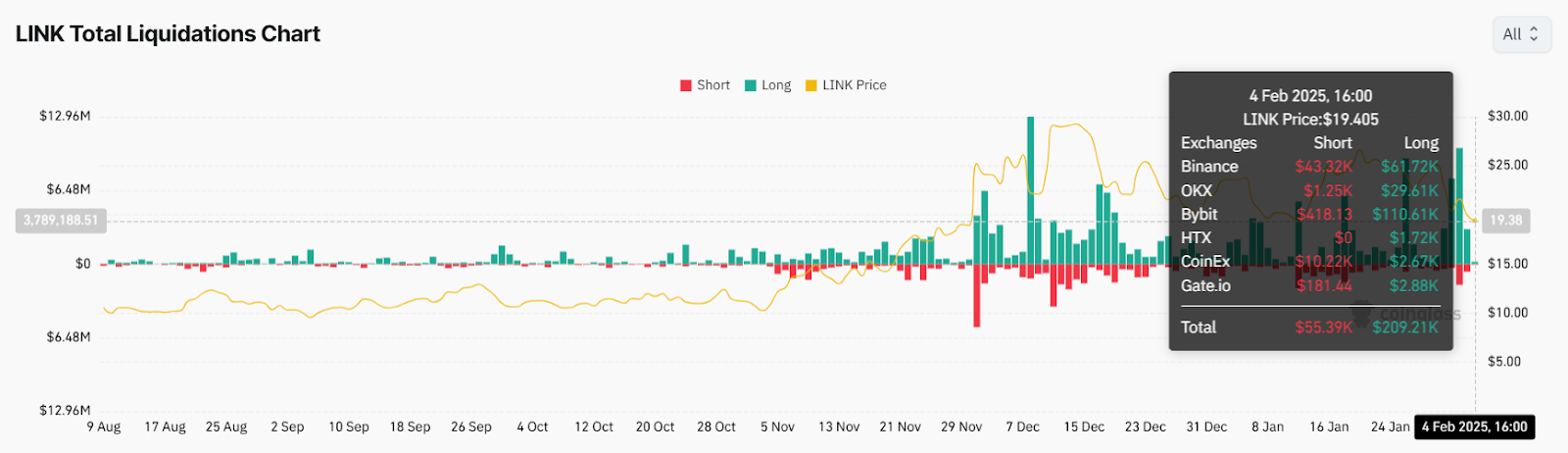

Chainlink’s Total Liquidations: How Are Traders Reacting?

Total liquidations indicate that Chainlink has faced major market oscillations. On February 4, 2025, traders faced extensive position closures that strongly affected holders investing long. The market data suggests traders are both collecting profits and closing their positions due to market confusion. Increasing market liquidations threatens to decrease LINK prices when market sentiment turns more negative.

Source:

Coinglass

Source:

Coinglass

Related: Chainlink Eyes $35 Amid Developments and Technical Strength

Conclusion: Can Chainlink Maintain Its Momentum?

Despite recent market dips, investor attention toward Chainlink remains intact based on the data showing major transactions coupled with multiple wallet address activities. The offloading of 4.13 million LINK by whales, while the technical indicators point to bearish behavior, presents potential negative risks for LINK. Link’s recovery to a bullish trend will become more likely once market conditions strengthen and temporary selling pressure declines. LINK has a neutral market direction that reveals multiple challenges and prospective benefits to traders at the present time.

The post LINK Faces Volatility Amid Whale Activity: Can It Hold Support? appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investment Prospects in STEM Learning and Workforce-Ready Talent Streams: Linking with Astar 2.0

- Global STEM education demand surges as AI, blockchain, and biotech reshape industries, creating workforce skill gaps. - Astar 2.0's DeFi innovations (ZK Rollups, interoperability) indirectly support STEM through blockchain infrastructure and cross-chain collaboration. - U.S. and Singapore prioritize tech-integrated workforce strategies, aligning with Astar 2.0's potential to bridge DeFi and STEM education via scalable tools. - Investors can leverage Astar 2.0's $1.399B TVL and hybrid AMM-CEX model to fun

The ZK Transformation: Evaluating How Zero-Knowledge Technology Influences the Future Development of Blockchain

- ZK-rollups scale blockchain networks by bundling transactions, achieving 43,000 TPS and 30% lower gas fees, attracting institutions like Goldman Sachs and JPMorgan . - ZK technology resolves privacy-scalability paradox by enabling verifiable transactions without data exposure, adopted by EU regulators and enterprises like Nike and Sony . - Challenges persist: ZK-SNARKs require heavy computation, trusted setup risks exist, and privacy conflicts with AML regulations in some jurisdictions. - $725M+ VC inves

The Influence of Vitalik Buterin's Support for ZKsync on the Advancement of Scalable Blockchain Technologies: Evaluating the Prospects for Long-Term Investment in Pr

- Vitalik Buterin's 2025 endorsement of ZKsync accelerated its rise as a scalable Ethereum Layer-2 solution with 30,000 TPS and $3.3B TVL. - ZKsync's EVM compatibility and institutional partnerships contrast with StarkNet's quantum-resistant STARK proofs and Aztec's privacy-first architecture. - Analysts project ZK token prices at $0.40–$0.60 by 2025, while StarkNet faces adoption barriers and Aztec navigates regulatory challenges in privacy-focused DeFi. - The $7.59B ZKP market (2033 forecast) hinges on b

ZK Atlas Enhancement: Transforming Blockchain Scalability and Paving the Way for Institutional Integration

- ZKsync’s 2025 Atlas Upgrade achieves 15,000–43,000 TPS with $0.0001/transaction costs, boosting blockchain scalability for institutions. - Deutsche Bank , Sony , and Citi adopt ZKsync for tokenized assets and privacy-driven transactions, citing compliance and efficiency gains. - Market forecasts predict 60.7% CAGR for ZK Layer-2 solutions through 2031, with Fusaka upgrade targeting 30,000 TPS to solidify ZKsync’s leadership.