Bitcoin Will Hit $500,000 by 2028 – Standard Chartered

Standard Chartered’s Geoffrey Kendrick envisions a dramatic rise for Bitcoin, forecasting a price of $500,000 by 2028.

He links this potential surge to easier investor access and reduced market volatility, particularly as institutional participation grows.

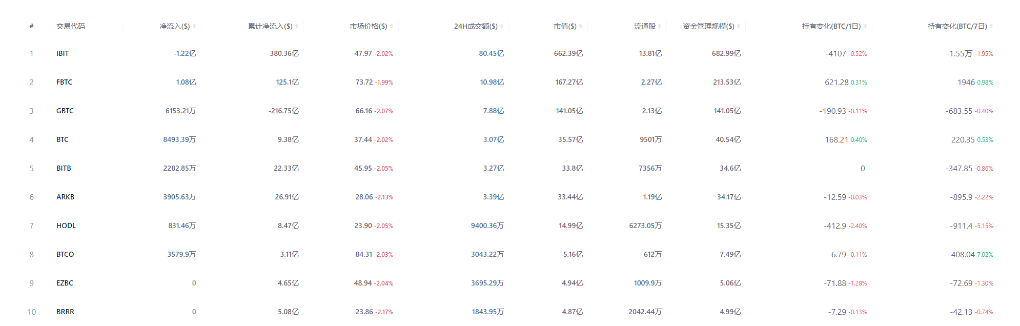

Kendrick highlights the impact of U.S. spot Bitcoin ETFs, which launched in early 2024 and have already attracted substantial inflows.

He argues that as these ETFs mature and financial instruments like options expand, Bitcoin’s volatility will decline, making it more attractive to long-term investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRON Industry Weekly: "Increased Probability of a December Rate Cut?" Could This Ease Market Downturn? Detailed Analysis of the Privacy DA ZK Engine Orochi Network

TRON Industry Weekly Report Summary

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $1.216 billion; US Ethereum spot ETFs saw a net outflow of $500 million

BlackRock has registered the iShares Ethereum Staking ETF in Delaware.

CEX suffers massive outflows: Who is draining the liquidity?