Bitcoin enjoys 'plenty' of demand at $98K as analyst eyes RSI breakout

From cointelegraph by William Suberg

Bitcoin $97,309circled $98,000 into the Feb. 6 Wall Street open as traders flagged multiple bull signals.

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

BTC/USD 1-hour chart. Source: Cointelegraph/TradingView

Traders reject bearish BTC price takes

Data from Cointelegraph Markets Pro and TradingView showed consolidation taking over on BTC/USD, which traded in a tight channel.

While still unable to tackle the $100,000 mark, Bitcoin cooled volatility as market participants adopted a wait-and-see attitude.

“Higher low locking in,” popular trader Jelle wrote in one of his latest posts on X.

“Objective remains the same, reclaiming $100k. Coincidentally the range mid-level as well. Flip that, and another test of $110,000 is next.”

BTC/USD chart. Source: Jelle/X

BTC/USD chart. Source: Jelle/X

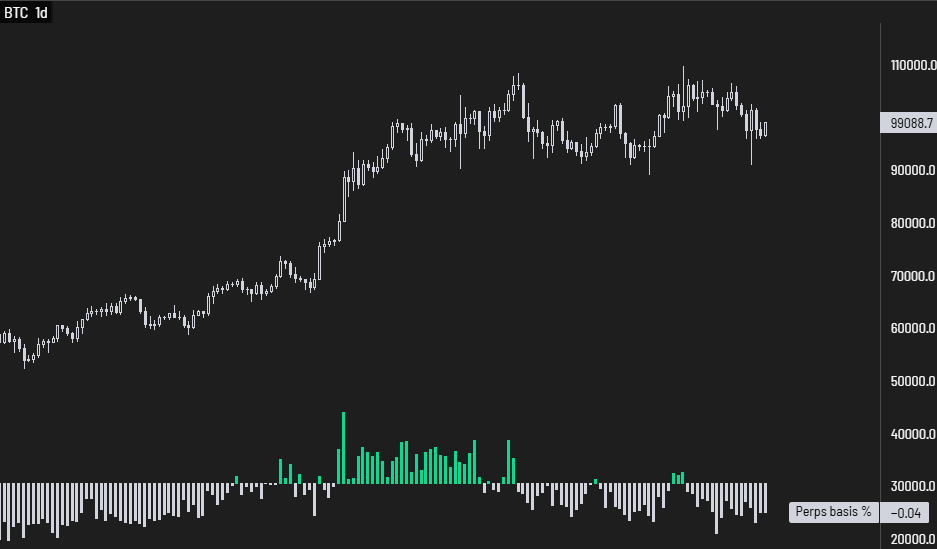

Fellow trader Daan Crypto Trades identified spot-market demand as a reason for optimism about BTC price trajectory.

“$BTC Trading at a pretty solid spot premium showing there's plenty of spot demand around these levels which have made it so Bitcoin has held strong during all the recent turbulence,” he told X followers.

An accompanying chart demonstrated derivatives traders’ relative caution versus spot buyers.

“With Spot ETFs and Institutions like Strategy (MicroStrategy) accumulating coins at a rapid pace, there's a constant changing of hands going on,” Daan Crypto Trades added.

“I think this should eventually lead to supply drying up around this region and a move higher.”

BTC/USD 1-day chart with perp basis. Source: Daan Crpyto Trades/X

BTC/USD 1-day chart with perp basis. Source: Daan Crpyto Trades/X

Another bullish event in the making came courtesy of Bitcoin’s relative strength index (RSI) indicator on daily timeframes.

As highlighted by popular trader and analyst Rekt Capital, daily RSI was forming a narrowing channel — with a breakout anticipated in future.

“Aside from Bitcoin's price action successfully retesting the blue trendline as support... The Daily RSI is forming a distinctive Channel,” Rekt Capital explained alongside the 1-day BTC/USD chart.

“The RSI is holding support at the Channel Bottom in preparation for a rally to the Channel Top over time.”

BTC/USD 1-day chart with RSI data. Source: Rekt Capital/X

BTC/USD 1-day chart with RSI data. Source: Rekt Capital/X

Earlier, Cointelegraph reported on a rare 4-hour RSI chart event revealing Bitcoin’s latest local bottom.

Bitcoin, crypto “lack” upside catalysts

Adopting a more risk-off tone, trading firm QCP Capital suggested that Bitcoin was not immune from further external volatility shocks.

Related: ‘Atypical’ Bitcoin bull market can extend beyond March 2025 — Research

In particular, geopolitical events could spark another trip lower for BTC/USD, it warned on Feb. 5, just days after nerves over a US trade war punished risk-assets across the board.

“BTC's resilience above $90k is impressive, but we remain cautious about negative geopolitical shocks from U.S.-China tensions, particularly amid global market uncertainty,” QCP summarized in a bulletin to Telegram channel subscribers.

“Furthermore, the lack of near-term crypto-specific catalysts leaves the market vulnerable to negative price shocks. In this environment, a defensive approach and risk management are key, especially given the large liquidations observed on Monday.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP ETFs Near 1B AUM as Over 400M XRP Lock Into Institutions

Quick Take Summary is AI generated, newsroom reviewed. Five spot XRP ETFs now manage over $909 million in total assets under management (AUM) as of December 4. Institutions have locked up $400.01 million XRP in ETF vaults, absorbing supply from the open market into long-term custody. Canary Capital is the current AUM leader with $351 million and over $162 million XRP locked. The rapid institutional accumulation follows regulatory clarity and mirrors the early flow patterns seen in Bitcoin ETFs.References T

Ethereum Validators Told to Disable Prysm Due to Outdated State Risk

Quick Take Summary is AI generated, newsroom reviewed. Prysm, the second-largest Ethereum consensus client, urgently instructed validators to add the --disable-last-epoch-targets flag. The measure is a preemptive fix to stop nodes from generating old states when processing outdated attestations, which can cause performance issues. The issue was a client-side bug and did not cause a chain halt or finality failure, demonstrating Ethereum's rapid operational maturity. The incident underscores the importance o

Ethereum Fusaka Upgrade Goes Live With a Major Leap in Network Scaling

Quick Take Summary is AI generated, newsroom reviewed. Fusaka brings major gains in Ethereum scalability with PeerDAS. Validators verify smaller data segments for faster validator data processing. The Ethereum Fusaka upgrade reduces costs and improves network performance. The update supports long-term growth for builders, rollups, and users.References ⚡️ETHEREUM FUSAKA UPGRADE IS LIVE! Fusaka, #Ethereum’s second major upgrade this year, is now live. It boosts scalability and cuts costs with PeerDAS, lettin

Ethereum Short Squeeze Warning as Price Pushes Toward $3,500

Quick Take Summary is AI generated, newsroom reviewed. Over $3B in ETH shorts sit near the $3,500 level. A breakout could trigger a sharp short squeeze. Forced buying may push ETH higher fast. Analysts expect increased volatility ahead.References Over $3 billion in Ethereum shorts will be liquidated if $ETH breaks above $3,500.