XRP Price Crash Recovery Hinges on Bitcoin’s Next Move

XRP’s price struggles after losing key support, but Bitcoin’s recovery could trigger a rebound. Can XRP break resistance and resume its uptrend?

XRP recently attempted to form a new all-time high but faced resistance due to market top pressure. The failure led to significant losses for investors as selling pressure increased.

Now, the cryptocurrency’s recovery hinges on Bitcoin’s trajectory, with its price movement influencing XRP’s future performance.

XRP Loses Key Supports

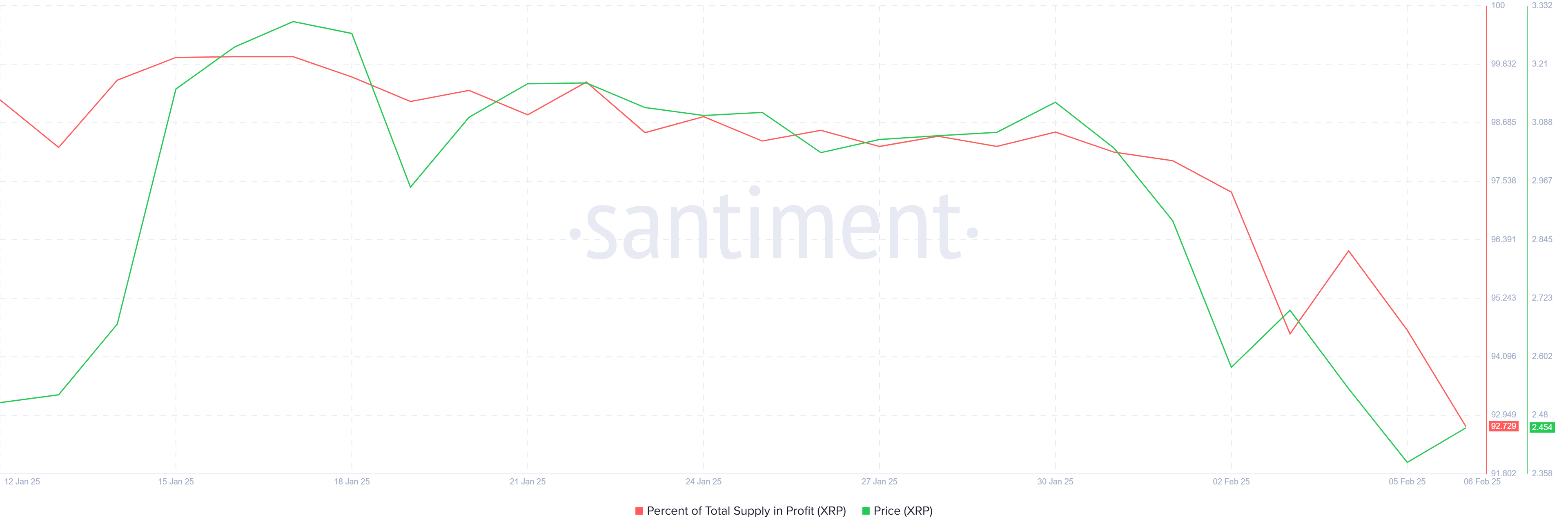

The percentage of XRP’s supply in profit surpassed 95% earlier this week, signaling a market top. This development triggered a wave of selling pressure, resulting in a sharp drawdown. As a consequence, 3% of the profit supply has already been wiped out, increasing concerns among investors.

Declining profits present a significant risk, as more holders may sell to lock in gains. If this trend continues, downward pressure could further drive prices lower. The asset’s ability to retain investor confidence will be crucial in determining its next move.

XRP Supply In Profit. Source:

Santiment

XRP Supply In Profit. Source:

Santiment

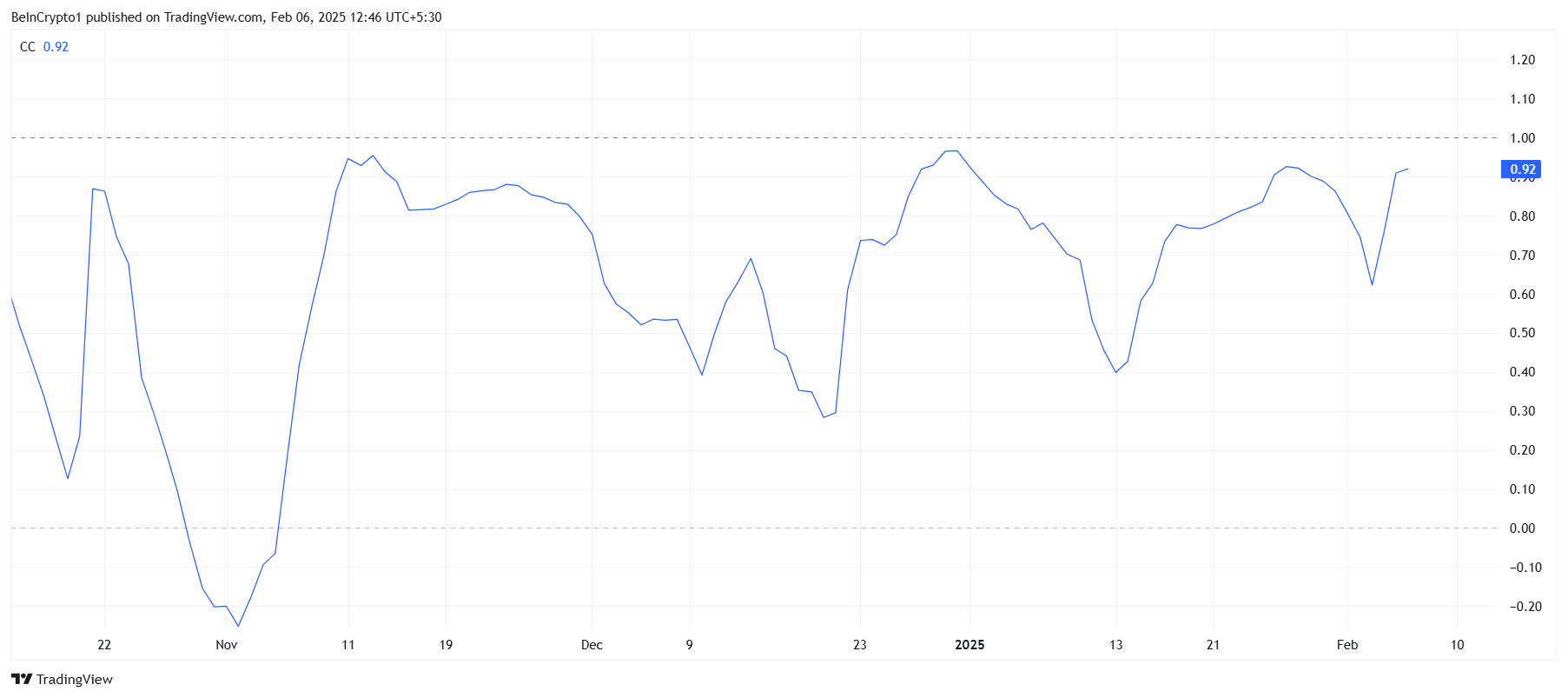

XRP’s macro momentum remains closely tied to Bitcoin, with its correlation now at 0.92. This strong relationship means XRP is likely to mirror Bitcoin’s price movements, which could be beneficial given Bitcoin’s bullish outlook.

Bitcoin appears poised to reclaim support at $100,000, which would likely uplift the broader market, including XRP. If Bitcoin’s price stabilizes and trends upward, XRP could find the support it needs to resume its own recovery.

XRP Correlation With Bitcoin. Source:

TradingView

XRP Correlation With Bitcoin. Source:

TradingView

XRP Price Prediction: Escaping The Bears

XRP is currently trading at $2.46, having dropped below critical support levels at $2.95 and $2.70. The price decline paused when the altcoin tested support at $2.33, preventing further losses for the time being.

The altcoin’s next challenge lies in reclaiming lost ground. However, breaking past $2.70 may prove difficult, as resistance at this level remains strong. Consolidation under this price point is a possible scenario unless stronger bullish momentum emerges.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

If XRP follows Bitcoin’s lead, a significant recovery could be on the horizon. Reclaiming $2.70 would be a key turning point, potentially opening the path for further gains. A move beyond $2.95 would invalidate the current bearish-neutral outlook, paving the way for a full recovery and further upside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PUMP Tops Solana With $205M Buybacks, 13.8% Supply Retired

Quick Take Summary is AI generated, newsroom reviewed. PUMP's buyback program has reached over $205 million, making it the largest cumulative repurchase effort on Solana. The program, funded by daily Pump.fun revenues, has retired 13.86% of the token's total circulating supply in just five months. Surpassing Raydium in buyback volume signals a major shift toward retail-led activity shaping Solana's economic footprint. The sustained buybacks reinforce token value and may prompt other Solana projects to reth

Phoenix Perpetuals Launch Positions Solana for a New Era of On-Chain Derivatives

Quick Take Summary is AI generated, newsroom reviewed. Fed’s T-bill purchases focus on liquidity management, not real QE. Ellipsis Labs launches Phoenix Perpetuals to deliver Solana-native, high-speed on-chain derivatives trading. The demo shows sub-1 bps slippage on multimillion-dollar trades with gasless and crankless execution. Phoenix builds on the success of its $1B+ spot DEX and positions Solana as a leading chain for institutional-grade DeFi.References X Post

Vitalik Says Fileverse Now Stable for Secure Web3 Collaboration

Quick Take Summary is AI generated, newsroom reviewed. Vitalik Buterin confirmed Fileverse's stability and reliability for secure, decentralized document sharing and collaboration. The platform's design allows for instant use without needing crypto wallets, tokens, or prior blockchain knowledge. This usability fills a crucial gap, making Web3 tools practical for real-world document collaboration and secure online coordination. The endorsement highlights a shift toward high-quality, practical infrastructure

Ripple’s Push for a Federal Reserve Master Account Pushes Financial Shift

Quick Take Summary is AI generated, newsroom reviewed. Ripple pursued a Federal Reserve master account for RLUSD. Ripple acquired Hidden Road and launched Ripple Prime. Riksbank shifted to urgent stablecoin regulation. U.S. digital asset policy accelerated in 2025. Ripple positioned itself for global financial infrastructure dominance.References X Post