Litecoin Bucks Market Trend, Gains 10% as Whales Increase Holdings

From beincrypto by Abiodun Oladokun

Layer-1 coin Litecoin has emerged as the market’s top gainer over the past 24 hours, bucking the prevailing downtrend seen in the broader cryptocurrency market.

The 10% rally comes amid a notable increase in whale accumulation, with large investors gradually building their positions over the past week. With a growing bullish bias, LTC appears poised to extend its current gains.

Litecoin Whales Increase Holdings

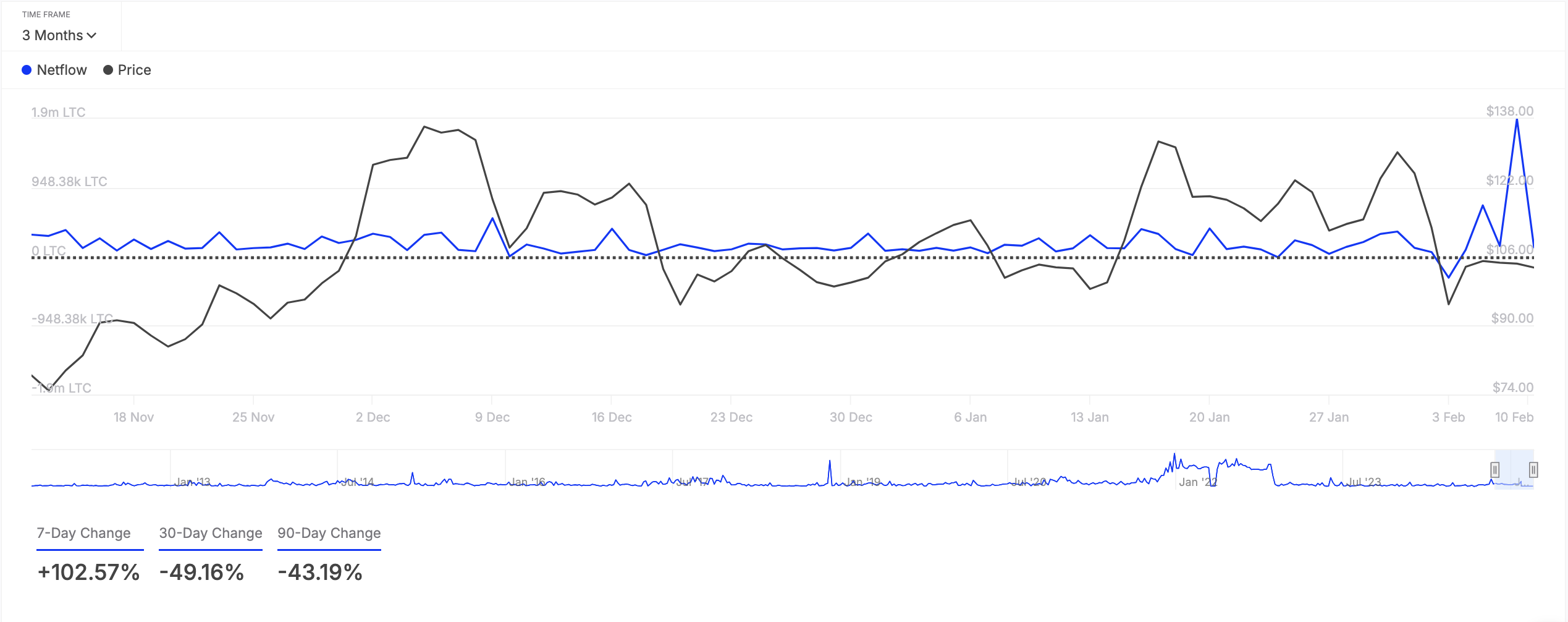

On-chain data reveals that LTC has seen a triple-digit surge in its large holders’ netflow over the past week. According to IntoTheBlock, this has climbed by 103% during that period.

Litecoin Large Holders Netflow. Source: IntoTheBlock

Litecoin Large Holders Netflow. Source: IntoTheBlock

Large holders refer to whale addresses that hold over 0.1% of an asset’s circulating supply. Their netflow measures the difference between the coins these investors buy and the amount they sell over a specific period.

When an asset experiences a spike in large holder netflow, its whale addresses are increasing their holdings. This is a bullish signal, typically driving upward price momentum as these big investors bet on the asset’s future growth.

Retail investors often follow this trend, seeing the increased whale activity as a sign of confidence. As whales accumulate, the rising demand could push LTC’s price higher, creating a positive feedback loop in the market.

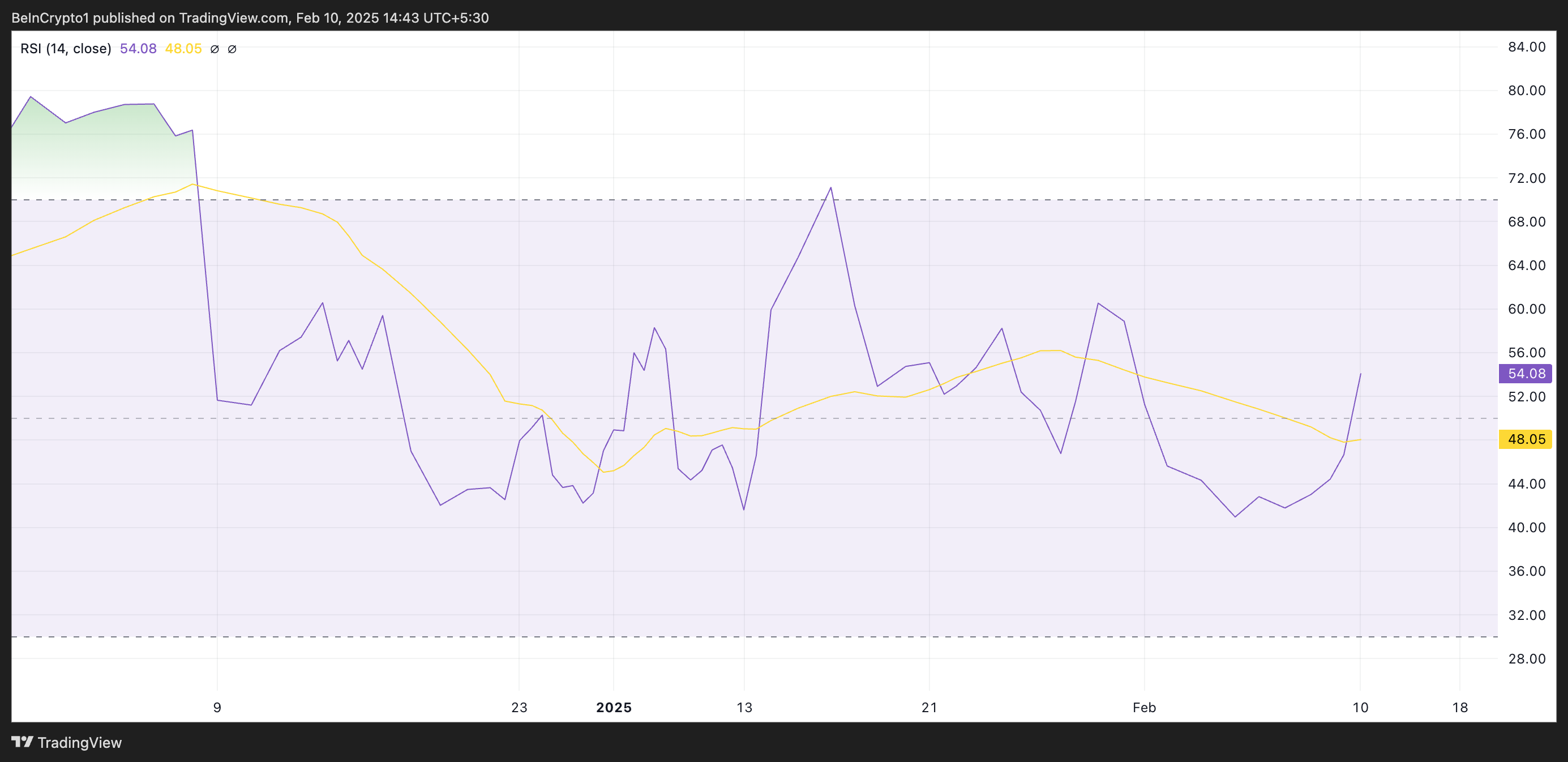

Further, the coin’s Relative Strength Index ( RSI ), assessed on the daily chart, confirms the surge in demand. At press time, LTC’s RSI is at 54.08 and is on an upward trend.

Litecoin RSI. Source: TradingView

Litecoin RSI. Source: TradingView

This momentum indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Conversely, values under 30 suggest that the asset is oversold and may witness a rebound.

At 54.08 and climbing, LTC’s RSI suggests a moderate bullish momentum. It indicates growing buying pressure with the potential for further upward movement if the trend continues.

LTC Price Prediction: Could $124 Be Next?

LTC’s Elder-Ray Index has posted a positive value for the first time in eight days, highlighting the bullish shift in market trends. At press time, it is at 4.26.

An asset’s Elder-Ray Index measures the relationship between its buying and selling pressure in a market. When the index is positive, it indicates that bullish momentum is dominant, suggesting that buyers are in control and the asset’s price is likely to continue increasing.

If this holds, LTC’s value could rocket above $120 to trade at $124.03.

Litecoin Price Analysis. Source: TradingView

Litecoin Price Analysis. Source: TradingView

However, if profit-taking resurfaces, LTC’s price could shed current gains and drop to $109.81.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: S&P Rating Drop Highlights Tether’s Risky Asset Holdings and Lack of Transparency

- S&P downgrades Tether's USDT to "5 (weak)" due to high-risk reserves and transparency gaps. - Tether's 5.6% BTC exposure exceeds overcollateralization margins, risking undercollateralization if prices drop. - CEO dismisses critique as traditional finance bias, claiming no "toxic" assets in reserves. - Regulators intensify scrutiny as stablecoin centralization risks emerge amid $184B USDT circulation. - S&P urges Tether to reduce risky assets and enhance reserve disclosure to rebuild trust.

Dogecoin Latest Updates: Is a Repeat Performance on the Horizon? Holding $0.15 May Signal a 611% Rally for Dogecoin

- Dogecoin (DOGE) stabilized near $0.15 support, triggering historical 611% rally potential to $1 by 2026. - Grayscale's GDOG ETF and pending Bitwise BWOW ETF mark institutional adoption, though initial inflows remain muted. - Technical indicators show mixed momentum with RSI near oversold levels and key resistance at $0.16. - Market remains divided as ETF-driven liquidity and on-chain infrastructure contrast with macroeconomic and regulatory risks.

Turkmenistan’s Approach to Cryptocurrency: Centralized Oversight Amidst a Decentralized Age

- Turkmenistan legalizes crypto trading under strict 2026 regulations, granting state control over exchanges, mining , and custodial services. - Law mandates KYC/AML compliance, bans traditional banks from crypto services, and classifies digital assets into "backed" and "unbacked" categories. - Central bank gains authority to operate state-monitored distributed ledgers, contrasting with decentralized approaches in South Korea and Bhutan. - Framework aims to balance innovation with oversight, testing Turkme

Bitcoin News Update: Has $162 Billion Left Crypto Due to Institutional Buying or a Broader Market Pullback?

- BlackRock deposited 4,198 BTC and 43,237 ETH into Coinbase amid crypto sell-offs, despite $355.5M Bitcoin ETF outflows. - A 1.8M BTC ($162B) overnight exchange withdrawal sparks speculation about institutional accumulation or portfolio rebalancing. - $40B in BTC/ETH exchange inflows and record $51.1B Binance stablecoin reserves highlight institutional demand for regulated crypto products. - On-chain data shows 45% of large deposits (≥100 BTC) and 1.8M BTC withdrawals, indicating mixed market sentiment ah