Date: Tue, February 11, 2025 | 04:05 AM GMT

The cryptocurrency market has kicked off the week with much-needed relief, as major altcoins flash green after weeks of correction. This downturn was largely due to Bitcoin’s rising dominance, the DeepSeek launch, and tariff-related uncertainties from global leaders that impacted market sentiment.

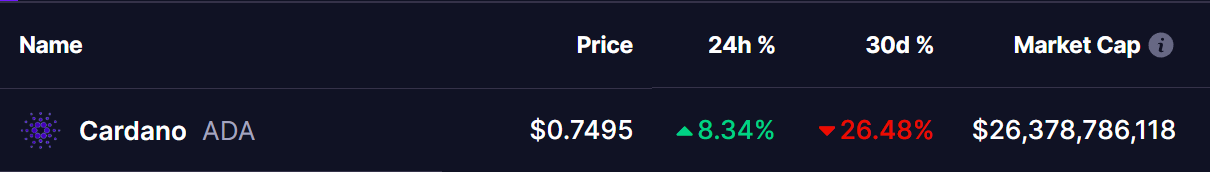

Following this shift in momentum, Cardano (ADA) has staged an impressive comeback, surging over 8% after enduring a 26% correction over the last 30 days.

Source: Coinmarketcap

Source: Coinmarketcap

Broadening Wedge Setup – A Bullish Reversal?

On the daily chart, ADA initially witnessed a massive 300% rally in November 2024, soaring from $0.33 to a local high of $1.32 on December 2. However, since then, the price has been consolidating within a descending broadening wedge, a pattern widely recognized as a bullish reversal formation.

Cardano (ADA) Daily Chart/Coinsprobe (Source: Tradingview)

Cardano (ADA) Daily Chart/Coinsprobe (Source: Tradingview)

During this correction phase, ADA has consistently tested both the upper resistance and lower support of the wedge. The recent sharp decline saw ADA retesting the lower boundary at $0.50, but it managed to stage a strong bounce from the 200-day moving average (MA), bringing the price back to the current level of near $0.75.

If this pattern continues to play out, ADA will soon face its next resistance at the 15-day MA. A decisive breakout above this level would confirm bullish momentum and could pave the way for a major recovery towards the upper wedge resistance near $1.00.

The MACD indicator is flattening out, and if the blue line crosses above the orange signal line, it could further strengthen ADA’s upward momentum.

Final Thoughts – Can ADA Rally Above $1?

ADA’s recent bounce is an early sign of recovery, but the real confirmation will come with a breakout above the 15-day MA and the descending wedge resistance. If bulls can push ADA above $1.00, it could trigger a strong rally toward new highs.

However, failure to sustain this momentum might lead to another retest of the $0.60–$0.65 support zone before any significant breakout occurs. Traders should watch for volume confirmation and MACD crossover to gauge the next move.

Disclaimer This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.