Leveraged ETFs tied to bitcoin stockpiler Strategy drop nearly 50% in just five days

Quick Take Two leveraged exchange-traded funds linked to Michael Saylor’s Strategy have declined in price by nearly 50% during the last five days after BTC dropped below $87,000 on Tuesday. After the Strategy-tied funds MSTX and MTSU traded over $43 and $9 a share as of last week, respectively, the two ETFs have each fallen significantly as volume soared.

Two leveraged exchange-traded funds linked to bitcoin stockpiler Strategy have declined in price by nearly 50% during the last five days after BTC dropped below $87,000 on Tuesday.

Strategy-tied ETFs MSTX and MTSU, which traded above $43 and $9 per share, respectively, last week, plummeted on Tuesday amid a surge in trading volumes. MSTX traded at $23.83 a share and MSTU at $4.94 as of 3:07 p.m. ET, according to Yahoo Finance.

Broadly, equity markets have suffered a widespread selloff after U.S. president Donald Trump announced Monday he intends to impose tariffs on Canada and Mexico once a 30-day suspension expires next week. Bitcoin, the world’s largest cryptocurrency by market cap, was down nearly 7% to $87,942.26 as of 3:08 p.m. ET, according to The Block Price Page . Earlier in the day BTC traded hands at below $87,000, its lowest price since last November.

Leveraged ETFs use derivatives and debt to boost the possible returns of the specific asset they track. While the financial instruments offer a chance to realize greater returns, they carry more risk.

Strategy, formerly known as MicroStrategy, was down nearly 10% to roughly $255 per share on Tuesday, according to Yahoo Finance . Shares in the company, which owns nearly 500,000 bitcoin, tend to trade at a premium to the price of BTC.

Standard Chartered Global Head of Digital Assets Research Geoffrey Kendrick said Tuesday that the risk-off sentiment in traditional markets is impacting the digital asset sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

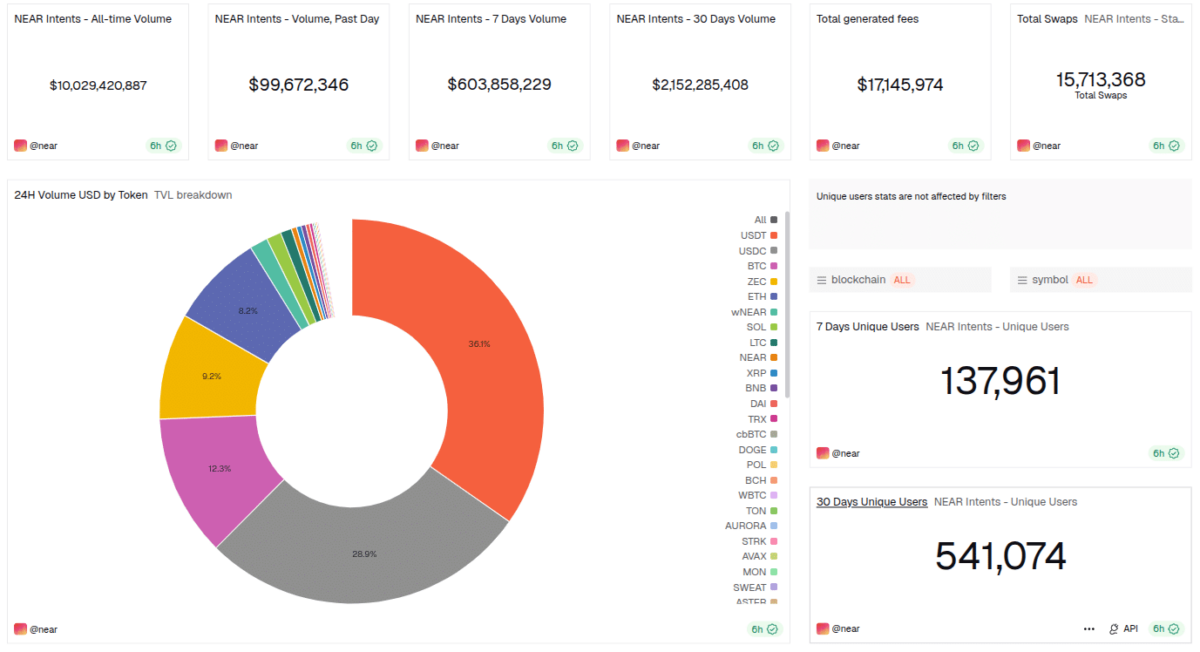

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow

PNC Bank CEO says stablecoins must choose: be a payment tool or a money market fund