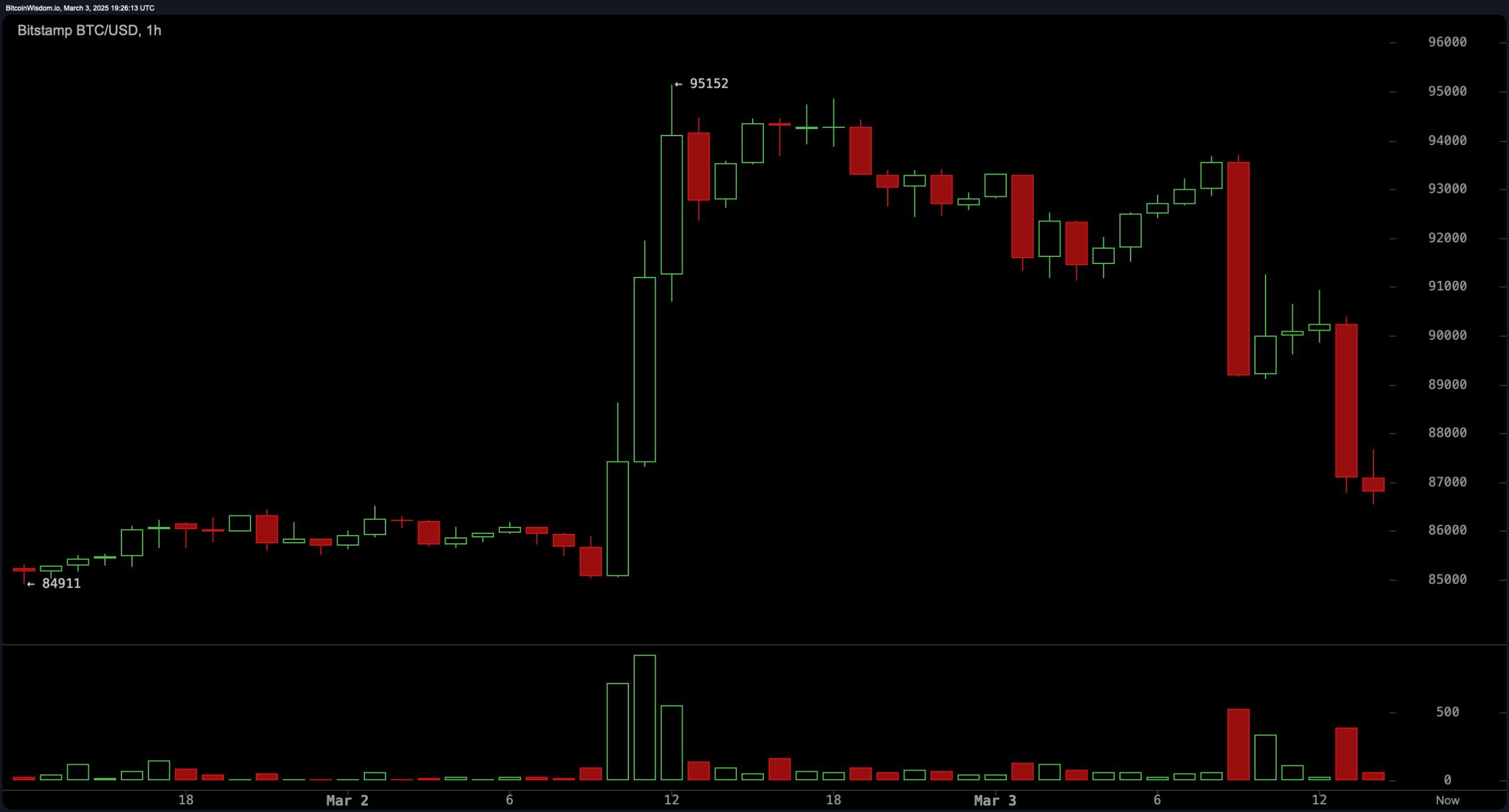

Though a prior policy reveal involving crypto reserves propelled assets like BTC and ether upward, the subsequent day told a divergent tale. After hovering just above $93,000 in early trading, BTC abruptly cascaded below $90,000. By afternoon, it stabilized near $87,000 as markets digested Trump’s plan to levy tariffs on foreign farm products starting next month.

The 47th U.S. President proclaimed:

To the Great Farmers of the United States: Get ready to start making a lot of agricultural product to be sold INSIDE of the United States. Tariffs will go on external product on April 2nd. Have fun!

Cryptocurrency markets contracted 6.81% to $2.88 trillion post-announcement, with BTC teetering near $87,000 after its sharp descent. Over $55.74 million in BTC long positions evaporated within an hour, compounding a daily total of $172 million erased.

Trump’s tariff rhetoric has repeatedly rattled BTC valuations, marking the fourth occasion such proclamations have depressed prices. The pattern underscores—er, illuminates—a recurring vulnerability in crypto markets to geopolitical fiscal shifts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。