‘Rare’ Signal Flashing for Bitcoin As Two Macro Factors Align in Favor of BTC, According to Analyst

A popular crypto strategist says that a confluence of macroeconomic factors is flashing bullish for Bitcoin ( BTC ).

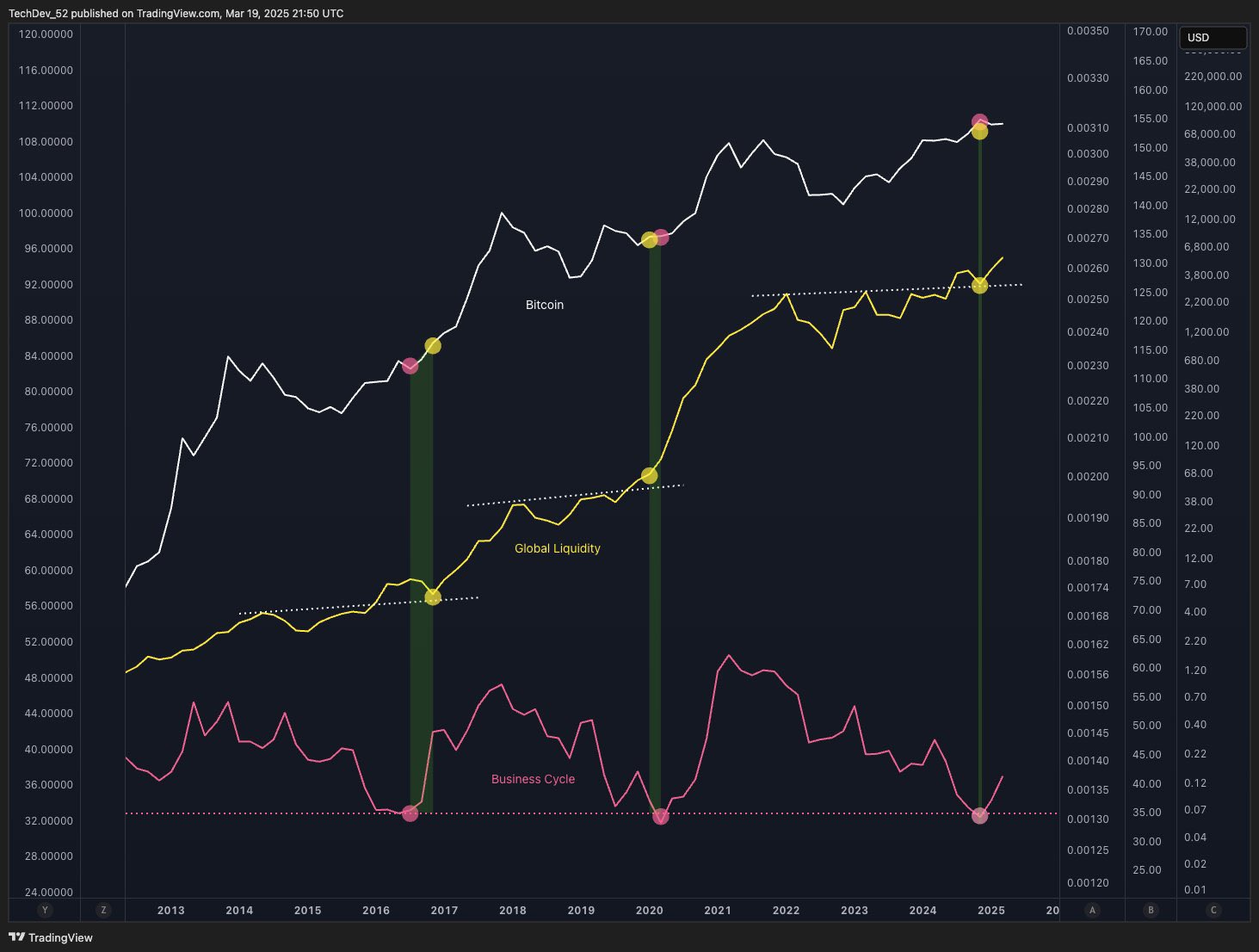

Pseudonymous analyst TechDev tells his 517,800 followers on the social media platform X that the Bitcoin bull market is not yet over based on a setup that features rising global liquidity and a bottoming business cycle.

Global liquidity measures the amount of money sloshing in the world’s financial system, while the business cycle refers to the rise and fall of economic activity over time.

According to the crypto trader, Bitcoin tends to witness the most explosive part of its bull market whenever global liquidity rises to new record highs just as the economy hits a bottom and starts recovering.

“We’re at that rare point where liquidity retested its breakout and is surging higher…

Right as the business cycle bottomed and reversed.

Only the third of these setups in the last 12 years.

The other two propelled the crypto market to its steepest legs.

Ignore the noise.”

Source: TechDev/X

Source: TechDev/X

Looking at the trader’s chart, he appears to suggest that Bitcoin will follow in the footsteps of its 2016 and 2020 bull markets when BTC rallied and printed new highs as global liquidity soared and the business cycle reversed to the upside.

At time of writing, Bitcoin is trading for $86,635.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services