Bitcoin ( BTC ) risks falling into a fresh bear market as a large collection of BTC price metrics has produced a “bearish divergence.”

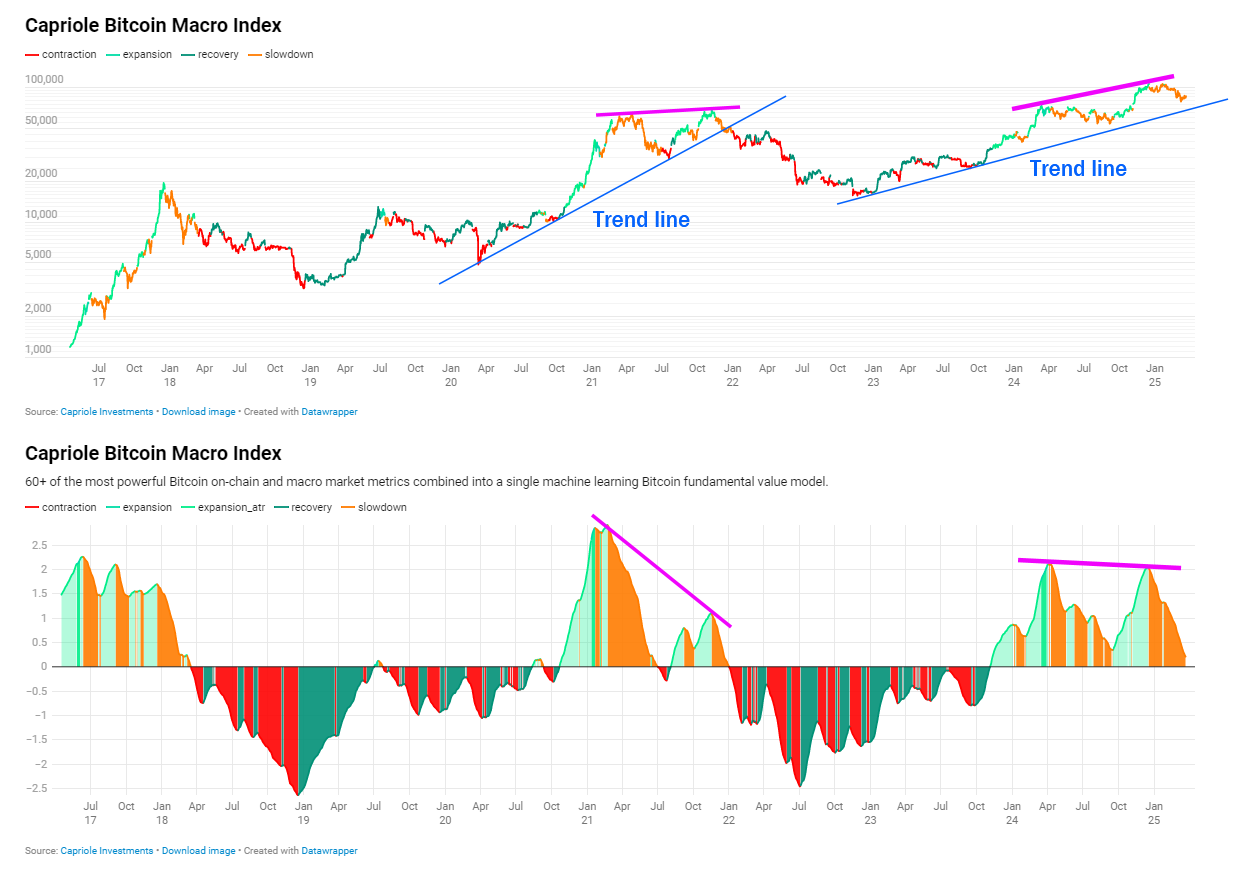

In a social media discussion on March 27, Bitcoin commentators flagged troubling signals from the Capriole Investments’ Bitcoin Macro Index.

Bitcoin Macro Index slump “not great,” says creator

As BTC/USD struggles to return to the area around all-time highs, onchain metrics are beginning to lose their bull market edge.

The Bitcoin Macro Index, created by Capriole in 2022, uses machine learning to analyze data from a large number of metrics that founder Charles Edwards says “give a strong indication of Bitcoin’s relative value throughout historic cycles.”

“The model only looks at onchain and macro-market data. Uniquely, price data and technical analysis is not considered as an input in this model,” he explained in an introduction to the tool at the time.

Since late 2023, the metric has been printing lower highs while price prints higher highs, creating a “bearish divergence.” While common to previous bull markets, a potential implication is that BTC/USD has already put in a long-term peak.

“Not great,” Edwards reacted while reposting a print of the Index uploaded to X by another user.

“But... when Bitcoin Macro Index turns positive, I won't be fighting it.”