Earlier that same day, Coindesk revealed in a report that Sun had stepped in to rescue the TUSD stablecoin project following claims that close to $500 million in reserves were suddenly out of reach. According to the editorial, Techteryx, the Asia-based consortium that manages TUSD, launched legal action against First Digital CEO Vincent Chok, accusing the firm of funneling $456 million in TUSD reserves into illiquid investments that were inaccessible.

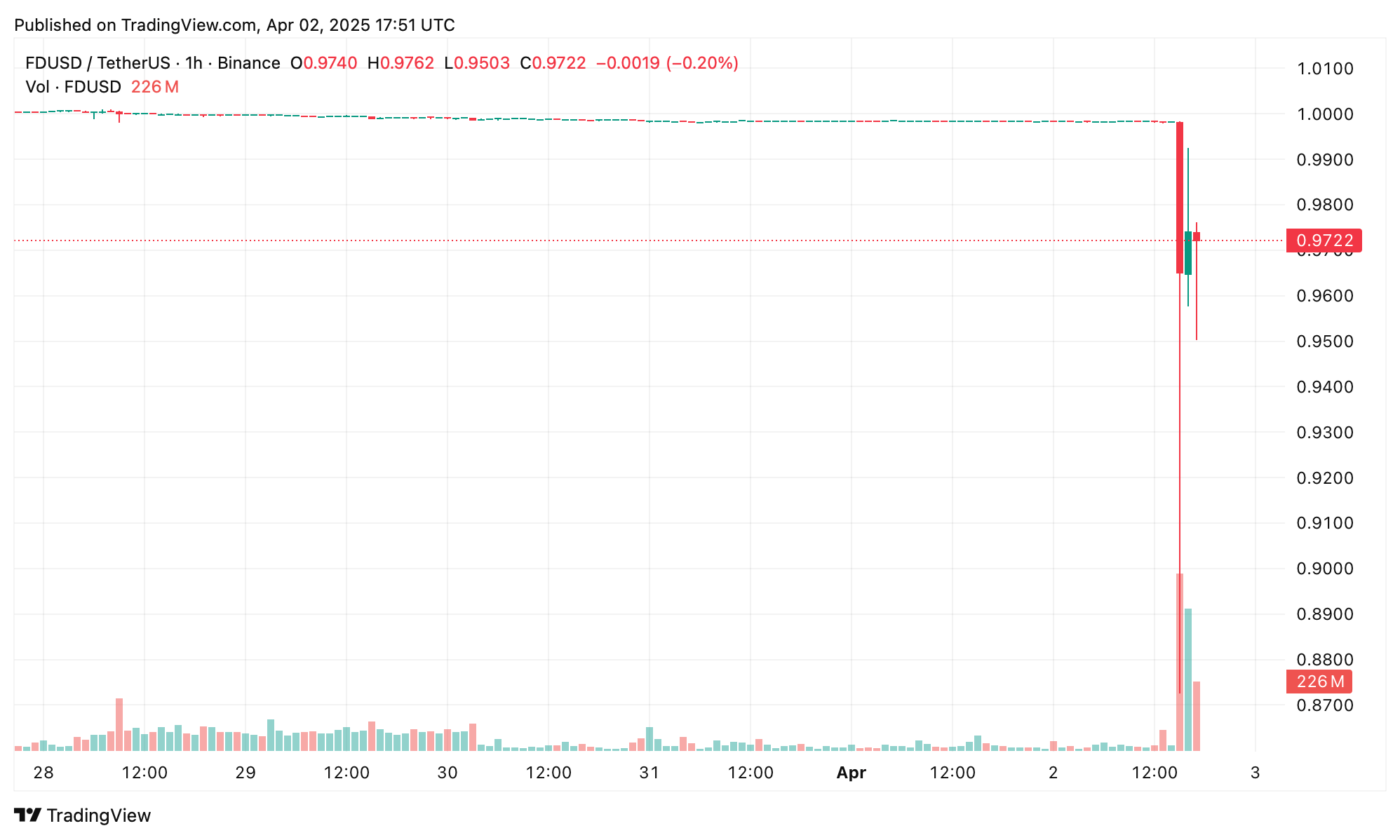

FDUSD/ USDT on Binance on April 2, 2025. FDUSD is the sixth-largest stablecoin by market cap.

Alongside the report, Sun commandeered X with an urgent plea, urging users to abandon the FDUSD project without delay. “First Digital Trust (FDT) is, in fact, already insolvent. This is a factual statement, devoid of any emotion,” Sun stated.

The Tron founder added:

If you have any ties with them, please sever them as soon as possible to protect your assets. As for what consequences its founder, Vincent Chok, will face for his fraudulent actions—that will be up to the justice system and regulators to decide.

FDUSD plunged beneath the $0.90 threshold amid the very public feud, clawing back to $0.9737 by press time. First Digital issued a fiery rebuttal, storming onto X to dismantle the allegations. “The recent allegations by Justin Sun against First Digital Trust are completely false,” the company’s X account said. “This dispute is with TUSD and not with FDUSD. First Digital is completely solvent.”

The X post added:

Every dollar backing FDUSD is completely, secure, safe and accounted for with U.S. backed T-Bills. The exact ISIN numbers of all of the reserves of FDUSD are set out in our attestation report and clearly accounted for.

First Digital dismissed the accusations as a “smear campaign,” vehemently declaring it would “pursue legal action to protect its rights and reputation.” The firm is scheduled to hold an ask-me-anything (AMA) Thursday in a bid to address mounting scrutiny. Not one to mince words, Sun amplified his cautionary stance in a parallel and identical post, reiterating the warning in Chinese. The stablecoin FDUSD sees significant activity on Binance, with the exchange holding 87% of all the circulating coins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。