Bitcoin Drops 7% as Wall Street Futures Slide Before Monday’s Open

Dow Tanks 1,500 Points; Bitcoin Sinks as Economic Anxiety Spreads

Between 5 p.m. and 8 p.m. on Sunday, Apr. 6, the digital asset economy contracted by another $50 billion, falling from $2.53 trillion to $2.48 trillion. Bitcoin ( BTC ) hit its lowest point—$77,098—at approximately 7:24 p.m. ET and has since rebounded slightly to $77,654. The cryptocurrency appears to be functioning as a proxy indicator for Wall Street’s upcoming open, a theory that aligns with futures market behavior.

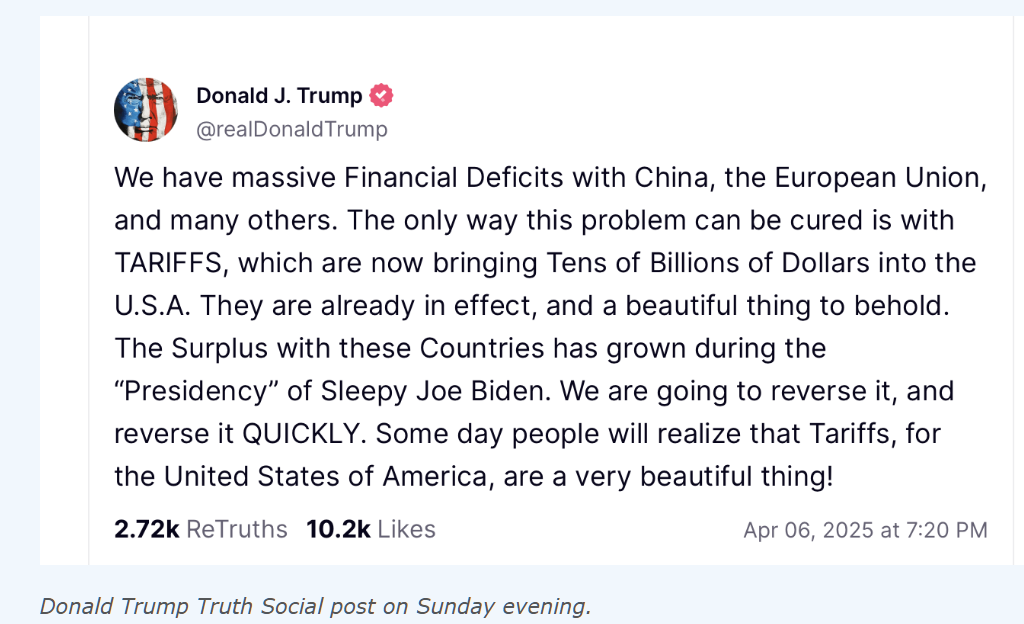

The Dow Jones Industrial average declined by 4.1% , while the SP 500 fell 4.6%. Analysts have pointed to President Trump ’s recently announced tariff policies as a key factor. These measures, introduced earlier last week, include a blanket 10% tariff on imports, with escalated rates reaching up to 50% for certain countries, notably China and Vietnam. Interestingly, the decline extended beyond equities— gold , too, is trading lower.

The precious metal is down 1.9% over the past 24 hours, now changing hands at $2,980 per ounce, below the $3,000 threshold. Market participants are turning their focus to Monday’s Wall Street open, which is shaping up to be volatile. Adding to the week’s economic narrative, first-quarter earnings will begin rolling out, accompanied by Thursday’s anticipated consumer price index (CPI) release.

Alongside BTC , alternative cryptocurrencies saw considerable drawdowns on Sunday, dragging the collective valuation of all non-bitcoin digital assets below the $1 trillion mark, settling at $930 billion. BTC itself has declined 6.3% today and sits 28.3% beneath its all-time peak achieved three months ago. Although it briefly neared $76,900, the coin has yet to breach the $76,600 figure last recorded on March 10, 2025—but it’s been inching ever closer to that foundation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services