Quant Analyst PlanB Says Bitcoin Correction ‘Normal Bull Market Dip’ After 30% Drop for BTC

Widely followed on-chain analyst PlanB says that Bitcoin’s ( BTC ) current correction is part and parcel of regular bull market conditions.

The pseudonymous analyst tells his 2.1 million followers on the social media platform X that the indicators he watches are still signaling bullishness for the flagship crypto asset.

Says PlanB,

“Even with today’s low bitcoin prices my on-chain indicators still signal bull market. So in my opinion this is a normal bull market dip and not a transition from bull phase to distribution phase (and then bear phase).”

Source: PlanB/X

Source: PlanB/X

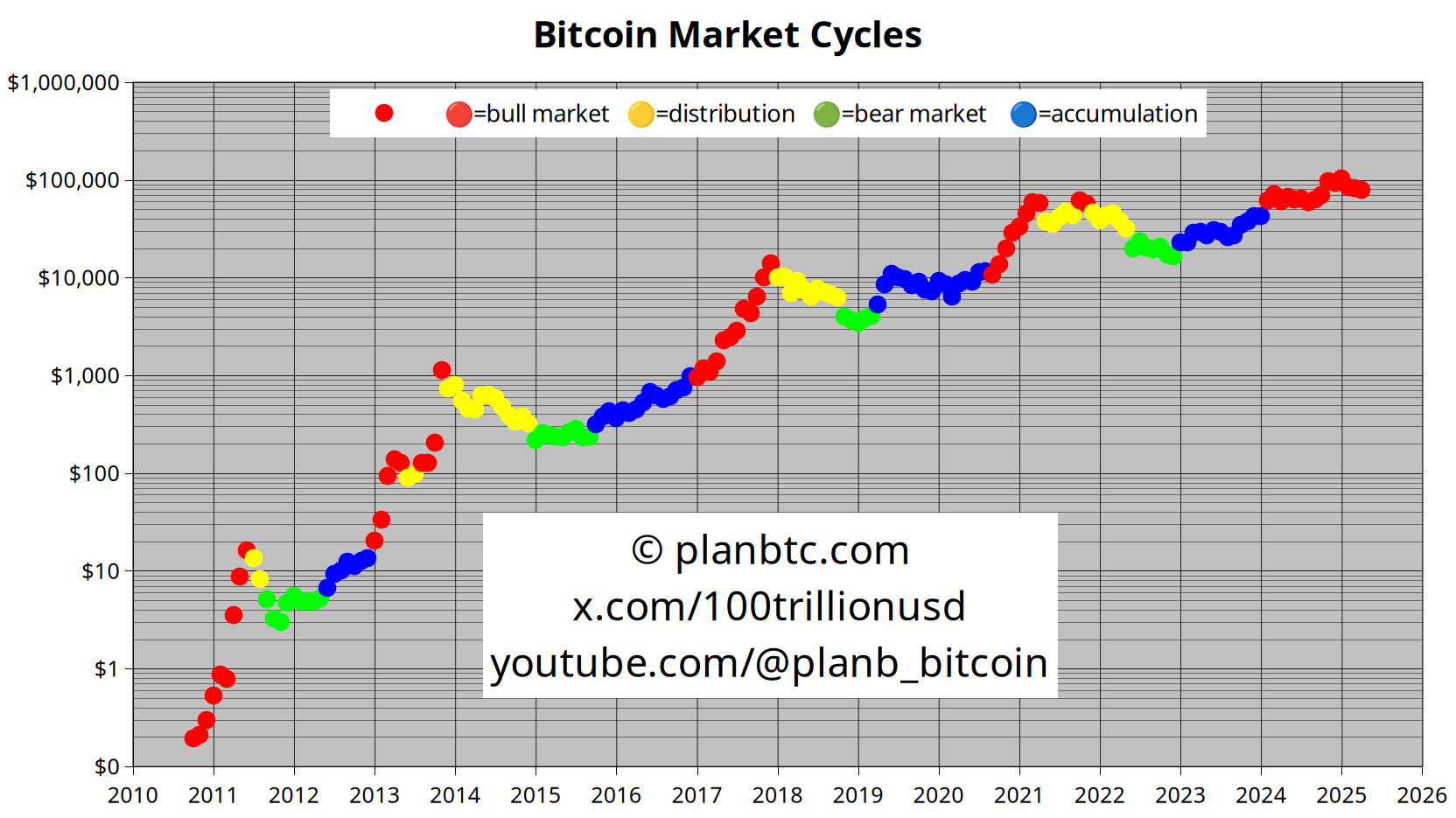

PlanB’s color-coded dot chart indicates the number of months until each halving – when BTC miners’ rewards are cut in half – with the red dots representing the beginning of the halving cycles.

In a recent video update, the analyst told his 209,000 YouTube subscribers that a combination of 200-week means suggests Bitcoin may soon enter an explosive uptrend based on historical precedent.

The analyst says that the 200-week arithmetic and the 200-week geometric are currently running close together on the chart, signaling a possible Bitcoin breakout.

“It might be that the bull market is still forming and that the [arithmetic mean] will separate again, will diverge again, from the geometric mean.

One more thing on those two lines. Notice that you can’t have a bear market or a big crash when the 200-week [arithmetic mean] and the geometric mean are together. The big crashes here [in 2021 and 2022] are happening when there’s a diversion between the two lines. Also, here in 2018, there was a big gap between the two [means]. Same here in 2014 and 2015.”

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Bitcoin's Value Drops in Parallel with Declining Political Clout of Trump

- Bitcoin maintains market dominance with Altcoin Season Index at 24, indicating most altcoins lag behind. - Bitcoin’s price decline correlates with waning Trump support, as highlighted by economist Paul Krugman. - BlackRock’s IBIT ETF sees $3.2B unrealized gains as Bitcoin rebounds to $90,000. - Technical indicators show mixed near-term prospects, while a few altcoins like Aster surged over 1,200%. - Analysts suggest regulatory clarity or tech breakthroughs could trigger next altcoin season after prolonge

XRP News Today: Is the $2.25 Barrier for XRP the Gateway to a Bullish Surge or a Signal for a Bearish Turn?

- XRP stabilized near $2.226 support, showing ETF-driven demand and improved technical indicators amid market rotation. - A $2.25 breakout is critical for confirming an upward trend, with failure risking a retest of $2.15 support. - Broader crypto-USD rotation and Bitcoin halving anticipation create favorable conditions but remain sensitive to equity market shifts. - Traders must monitor $2.25 resistance and maintain tight risk management as ETF inflows and macroeconomic factors shape near-term volatility.

Fed's Leadership Ambiguity and Divergent Policy Views Fuel Market Fluctuations Ahead of December Meeting

- U.S. Federal Reserve faces speculation over Chair Powell's future amid mixed signals and internal divisions on rate cuts. - Market expectations for a December rate cut surged to 84.7% as officials like John Williams shifted toward easing, while dissenters like Stephen Miran face criticism. - Trump's reported plan to nominate Kevin Hassett as next Fed chair risks politicizing monetary policy, with Treasury yields dipping below 4% on speculation. - OPEC+ supply pauses and political pressures complicate the

XRP News Today: Clearer Regulations Propel XRP ETFs to $628M as the Asset Earns Greater Legitimacy

- Canary Capital's XRPC ETF dominates XRP ETF market with $250M inflows, outpacing all competitors combined. - Grayscale's GXRP and Franklin Templeton's XRPZ drove $164M debut inflows, boosting total XRP ETF AUM to $628M. - 2025 SEC ruling cleared XRP's secondary sales as non-securities, enabling institutional adoption and $2.19 price rebound. - XRPC's 0.2% fee waiver and institutional focus fueled $6B+ ETF trading volumes, reversing prior outflows. - Analysts project $6.7B XRP ETF growth within 12 months