3 Altcoins that Look Bullish After Trump’s Tariff Pause

Altcoins are rebounding post-tariff pause, with XRP, HYPE, and ONDO standing out thanks to regulatory shifts, revenue gains, and RWA growth.

Altcoins are showing fresh signs of life following Trump’s 90-day tariff pause, and three names in particular—XRP, HYPE, and ONDO—are catching investor attention.

Each has its own catalyst: XRP is getting a regulatory boost with Paul Atkins taking over the SEC, HYPE is defying the broader market downturn with impressive protocol revenue, and ONDO is riding the wave of rising institutional interest in Real-World Assets (RWA).

XRP

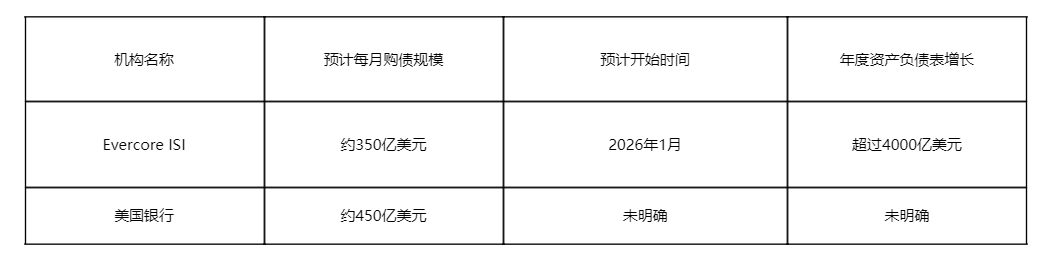

XRP fell sharply in the past month, losing 34% and dropping below $1.70 for the first time since November 2024. The decline came as macro uncertainty and regulatory pressure weighed on sentiment.

However, with Trump’s 90-day tariff pause and Paul Atkins confirmed as the new, pro-crypto SEC Chair, optimism is starting to return.

These developments could give XRP the regulatory breathing room it needs to regain momentum as one of the top-performing altcoins.

XRP Price Analysis. Source:

TradingView.

XRP Price Analysis. Source:

TradingView.

If that shift materializes, XRP may retest resistance at $2.17 and $2.23.

A break above those levels could set the stage for a push toward $2.50. Standard Chartered has even suggested XRP could overtake Ethereum by 2028, and Ripple’s acquisition of Hidden Road has fueled new expectations for rising institutional demand.

Still, holding $1.96 as support is key—if that level fails, a drop back toward sub-$1.70 lows remains possible.

Hyperliquid (HYPE)

HYPE has climbed 21.5% over the past week, defying the broader altcoin market downturn. The rally comes despite lingering criticism of the platform following the JELLY crisis, which raised concerns about Hyperliquid’s stability.

Still, traders seem to be regaining confidence, especially as the macro backdrop improves after Trump’s 90-day tariff pause.

HYPE Price Analysis. Source:

TradingView.

HYPE Price Analysis. Source:

TradingView.

Hyperliquid remains a powerhouse in terms of protocol revenue, pulling in $38 million in fees over the past month—$2.4 million of that in just the last 24 hours—ranking it 6th globally, ahead of names like PancakeSwap and Tron.

If momentum holds, HYPE could push toward resistance at $14.77, and a breakout could lead to $17.33 or even $21. But if the rally stalls support at $12.81 becomes key; losing that could send the price back to $11 or even below $10 in a deeper correction

Ondo Finance (ONDO)

Real-world asset (RWA) tokens are gaining momentum as a defensive narrative in crypto, especially in light of global economic uncertainty.

Binance Research recently stated that RWA altcoins remain safer than Bitcoin during tariff-driven volatility.

At the same time, BlackRock’s BUIDL token is nearing $1.5 billion in assets, and Fidelity has entered the RWA tokenization race—signaling growing institutional commitment to this emerging sector.

ONDO Price Analysis. Source:

TradingView.

ONDO Price Analysis. Source:

TradingView.

ONDO, one of the key tokens in the RWA space, is showing signs of strength on the charts, with a golden cross nearly forming.

If confirmed, ONDO could climb toward resistance levels at $0.90 and $0.95, with a breakout possibly pushing it above $1.

However, the price is hovering just above a key support at $0.82. If that level fails, the next downside target is $0.73, with a deeper slide potentially taking it below $0.70.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

The U.S. financial system is undergoing its most significant transformation in a century.

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts