Ethereum: Why the Hate? (Other Than Over 3 Years of Disappointment)

If you're an Ethereum holder and like to torture yourself from time to time, you probably take a sneak peak at the long-term price ratio between BTC and ETH. And, well... it's not the most pleasant sight:

Since the start of December, 2021, Ethereum's price ratio vs. Bitcoin is a whopping and painful -77% for the faithful holders of crypto's #2 market cap asset.

But when adding on the price against the dollar, things don't look quite as grim (albeit you'd still have never gotten an opportunity to sell for profit if you bought your coins during the November, 2021 $4.76K all-time high:

From a price perspective, things have gotten so grim that many traders are unironically comparing it to a regular old "shitcoin".

Many non-ETH holders are even laughing from the sidelines as they know that many "shitcoins" have significantly outperformed ETH over the short, mid, or long term timeframes.

And there are legitimate arguments on why the once darling coin that would one day "flip" Bitcoin's market cap and become the top asset in crypto is now the laughing stock amongst top cap assets from the crowd's perspective... and yes, it is still the 2nd largest market cap by a wide margin (28.2% higher) over Tether.

But avoiding favoritism and biases, especially for the largest market caps in crypto (which have either made or broken many traders) is difficult for the community. And we need to understand what may have happened since late 2021 that has left Ethereum so high and dry while so many smaller cap coins have made up so much ground (irrespective of Bitcoin). Here is a short list of some of the more common narratives and theories that the "ETH bear" community has latched on to (whether all are valid criticisms or not):

- Competition from Layer-2: Ethereum created Layer-2 solutions to speed transactions, but these took away investment directly from Ethereum itself, spreading user interest thin.

- Investor Confusion: Ethereum’s complex upgrades confused investors, making them cautious and hesitant compared to simpler investments like Bitcoin.

- Slow Updates and High Fees: Ethereum's slow improvements and high transaction fees frustrated users, pushing them toward cheaper and faster alternatives.

- Regulatory Worries: Uncertainty about government rules made investors wary of Ethereum, favoring Bitcoin due to its clearer legal status.

- Rising Blockchain Rivals: Newer blockchains like Solana or Cardano attracted users with cheaper and faster platforms, pulling investment away from Ethereum.

- Unclear Investment Narrative: Bitcoin was seen as stable "digital gold," and new altcoins promised higher returns. Ethereum, caught in-between, lacked a clear, appealing narrative.

- Constant Selling Pressure: Regular selling from staked ETH after upgrades created steady downward pressure on Ethereum’s price, limiting growth compared to Bitcoin.

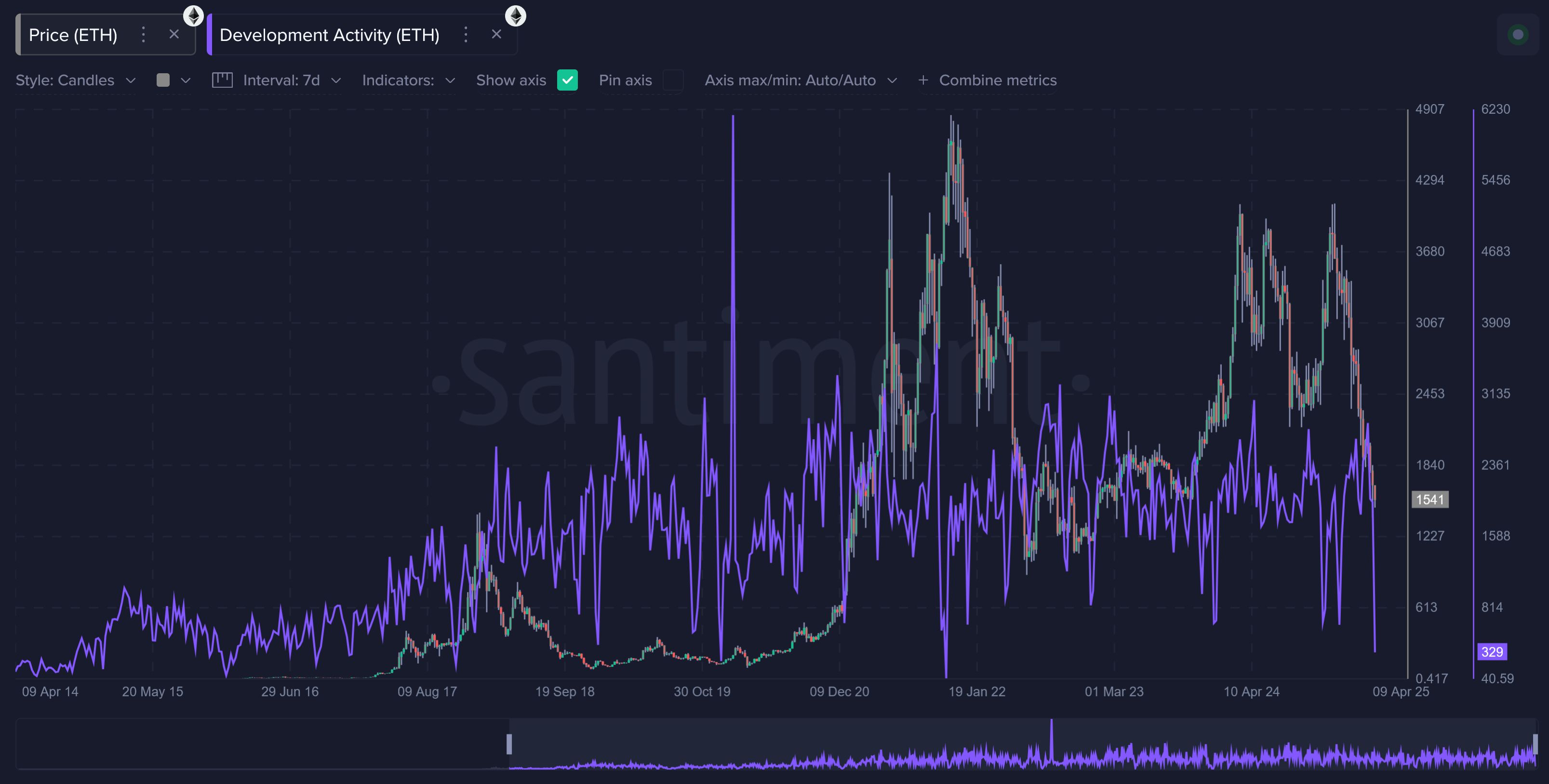

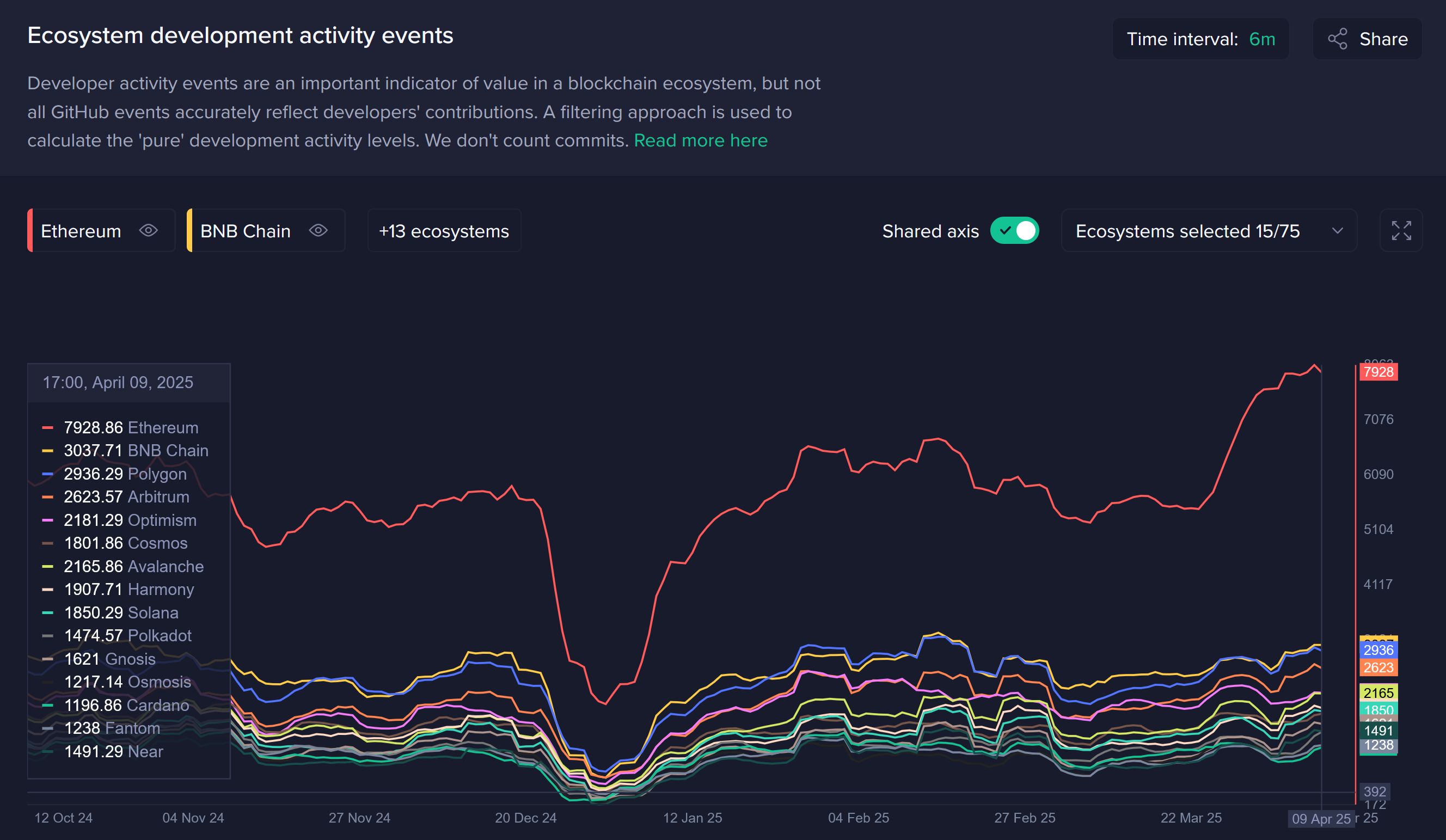

But for those who actually may have taken the skepticism to the extreme, Ethereum is not "a scam". The team has been working on improving and innovating at an incredibly high rate since it began being available for public trade in 2015, and is currently the 7th most developing asset in crypto over the past 30 days.

And we also need to note how many milestones and advancements the #2 market cap asset has made in recent years. Vitalik Buterin's creation has certainly not just sat idly by without significant progress, and the coin has seen the leading ecosystem contributors and development and expansion.

Here are some of the many milestones Ethereum has seen during its period of "letdown":

Ethereum’s Transition to Proof-of-Stake (The Merge) – September 2022

- Date: September 15, 2022

- Significance: Ethereum transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS), merging the original Ethereum mainnet with the Beacon Chain.

- Impact: Energy consumption dropped by over 99.9%. ETH issuance reduced significantly, moving Ethereum towards becoming deflationary. Set foundation for future scalability upgrades.

Shanghai (Shapella) Upgrade – April 2023

- Date: April 12, 2023

- Significance: Enabled withdrawals of staked ETH for validators on Ethereum’s Beacon Chain

- Impact: Greatly improved liquidity of staked ETH, boosting confidence among institutional investors. Completed Ethereum’s PoS transition, as validators could now freely withdraw rewards and principal.

Launch of EIP-4844 (Proto-Danksharding) – Planned 2023-2024

- Testnet Launch: Late 2023 (Deneb-Cancun Testnets); Expected Mainnet: Mid-2024

- Significance: Introduction of “blob-carrying transactions” to significantly reduce Layer-2 costs.

- Impact: Dramatically lowered transaction costs (gas fees) for Layer-2 rollups like Optimism, Arbitrum, Base, and zkSync. Marked a critical step toward full Ethereum scalability (Danksharding).

Rise of Layer-2 Networks and Adoption (2022-2024)

- Significance: Explosive adoption and maturity of Ethereum Layer-2 (L2) solutions, notably:

- Optimistic Rollups: Arbitrum One, Optimism, Base (Coinbase-backed)

- Zero-Knowledge (ZK) Rollups: zkSync Era (zkSync 2.0), Polygon zkEVM, StarkNet, Scroll

- Impact: Daily transactions on Layer-2 exceeded Ethereum Mainnet by late 2023. Reduced congestion and gas fees on Ethereum mainnet, making Ethereum viable for mainstream adoption and consumer applications.

Ethereum Futures ETF Approval (US) – October 2023

- Date: October 2023

- Significance: The SEC approved the first Ethereum Futures ETFs in the United States, including products from VanEck, ProShares, and others.

- Impact: Opened Ethereum to mainstream institutional investment through regulated financial products. Increased ETH's legitimacy in the eyes of traditional finance, boosting liquidity and price stability.

Rapid Expansion of Liquid Staking Derivatives (LSDs) – 2023-2024

- Significance: Massive growth of liquid staking platforms such as Lido Finance, Rocket Pool, Coinbase cbETH, and Frax ETH.

- Impact: LSD protocols captured billions in TVL, becoming dominant DeFi protocols.

- Enhanced ETH staking flexibility, adoption, and decentralization.

Decentralized Social Networks and On-chain Identity (2023-2024)

- Significance: Growing adoption of decentralized social protocols (Lens Protocol, Farcaster, Ethereum Name Service) for decentralized identities and social media.

- Impact: Broadened Ethereum’s use-case from DeFi/NFT speculation into broader decentralized applications (dApps). Increased ecosystem activity and developer adoption significantly.

Ethereum’s Dominance in DeFi Resurgence (2023-2024)

- Significance: Ethereum maintained its dominance in decentralized finance (DeFi), with major protocols (Uniswap V4, Aave V3, Curve stablecoin crvUSD, MakerDAO’s Endgame Plan) evolving to become more sustainable, secure, and accessible.

- Impact: Ethereum solidified its position as the undisputed DeFi backbone despite competition from other chains. Improved risk management and resilience in decentralized lending and stablecoins.

And on that note... yes, there are still plenty of believers in Ethereum, which is currently sitting with a market value of ~$1,540 at the time of this writing. If there weren't people buying others' consistent selloffs, the asset likely would have lost its #2 market cap position long ago.

Remember that there are cases for Ethereum to be a good buy in 2025. With the crowd showing an increased level of bearishness, this adds to the bullish case. Markets always move the opposite direction of the crowd's expectations, and the logic of "it has under performed for so long, therefore it will continue to do so" is typically not a strong enough argument to be taken seriously.

Other cons we have listed in this article (revolving mainly around ETH's speed and cost) are more legitimate reasons, but remember that there is quite the dedicated team that is innovating and improving the project on a daily basis. And that usually doesn't lead to a coin's demise.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Spot Margin Announcement on Suspension of DOG/USDT, ORDER/USDT, BSV/USDT, STETH/USDT Margin Trading Services

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!

Bitget Trading Club Championship (Phase 20)—Up to 2400 BGB per user, plus a RHEA pool and Mystery Boxes

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— enjoy up to 8% APR and share 30,000 USDT!