Ethereum Gains Traction Among Retail Investors Amid Ongoing ETF Outflows

Ethereum's price has seen growth amid a surge in retail demand, with increased buying activity on Coinbase. However, institutional investors remain cautious, withdrawing from ETH-backed ETFs and signaling concerns over the altcoin's future performance.

Leading altcoin Ethereum has seen its price climb 5% over the past week, riding the wave of a broader market recovery. This price growth has reignited demand for the altcoin, particularly among US-based ETH retail traders, as indicated by on-chain data.

However, institutional investors appear to remain skeptical. They continue to pull their capital from ETH-backed funds, signaling their lack of confidence in any near-term price rebound.

Retail Interest in Ethereum Grows as Coinbase Premium Signals Buying Surge

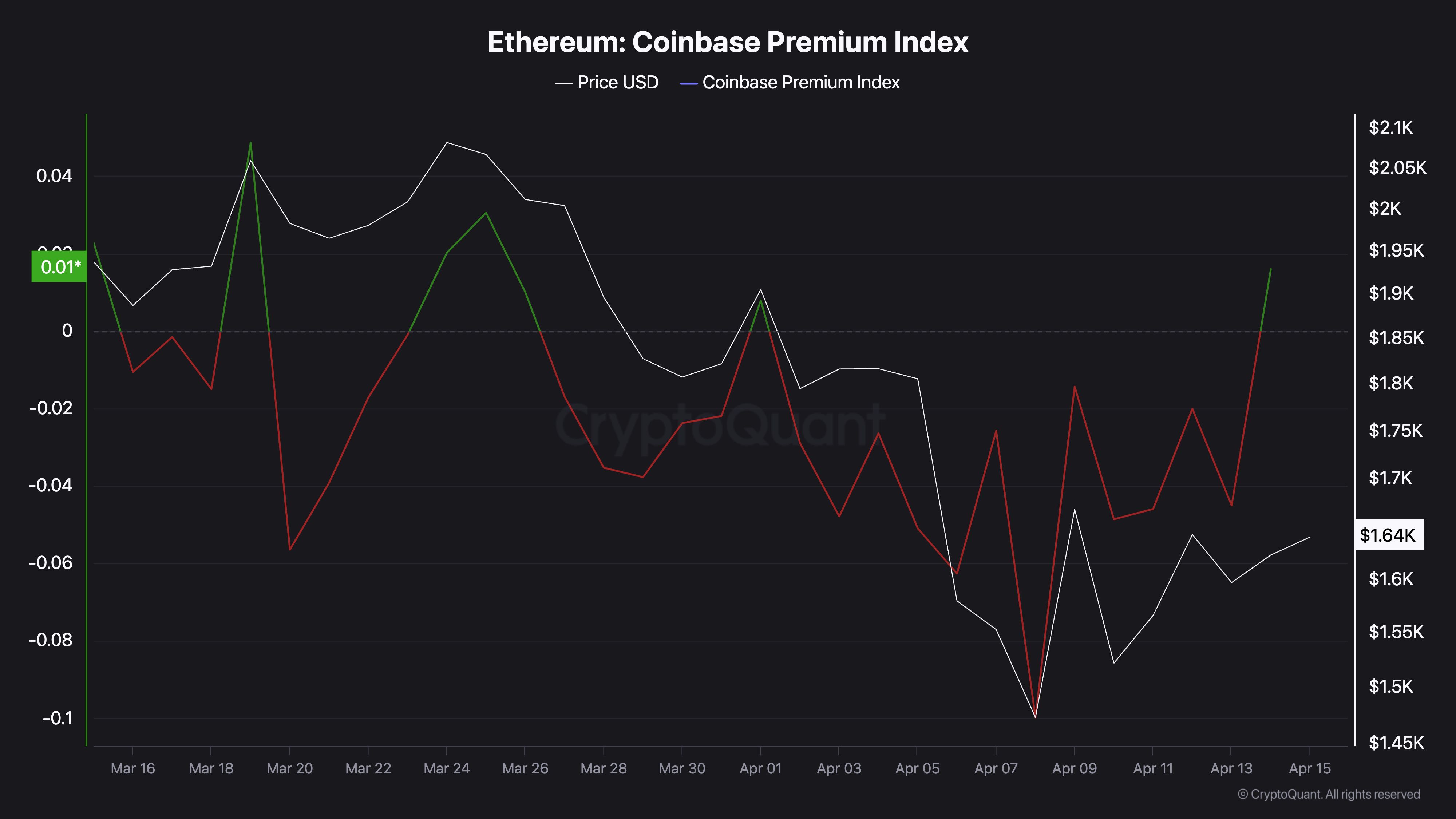

The increase in retail interest is evident in ETH’s Coinbase Premium. It has moved back above zero, signaling heightened buying activity from US investors. At press time, this is at 0.016.

Ethereum Coinbase Premium Index. Source:

CryptoQuant

Ethereum Coinbase Premium Index. Source:

CryptoQuant

ETH’s Coinbase Premium Index measures the difference between the coin’s prices on Coinbase and Binance. When its value climbs above zero, it suggests significant buying activity by US-based investors on Coinbase.

Conversely, when it declines and dips into the negative territory, it signals less trading activity on the US-based exchange.

ETH’s Coinbase Premium Index reflects bullish sentiment in the market, as traders are willing to pay a premium to purchase the coin on Coinbase. In the short term, this can drive up the altcoin’s value, as it signals growing investor interest.

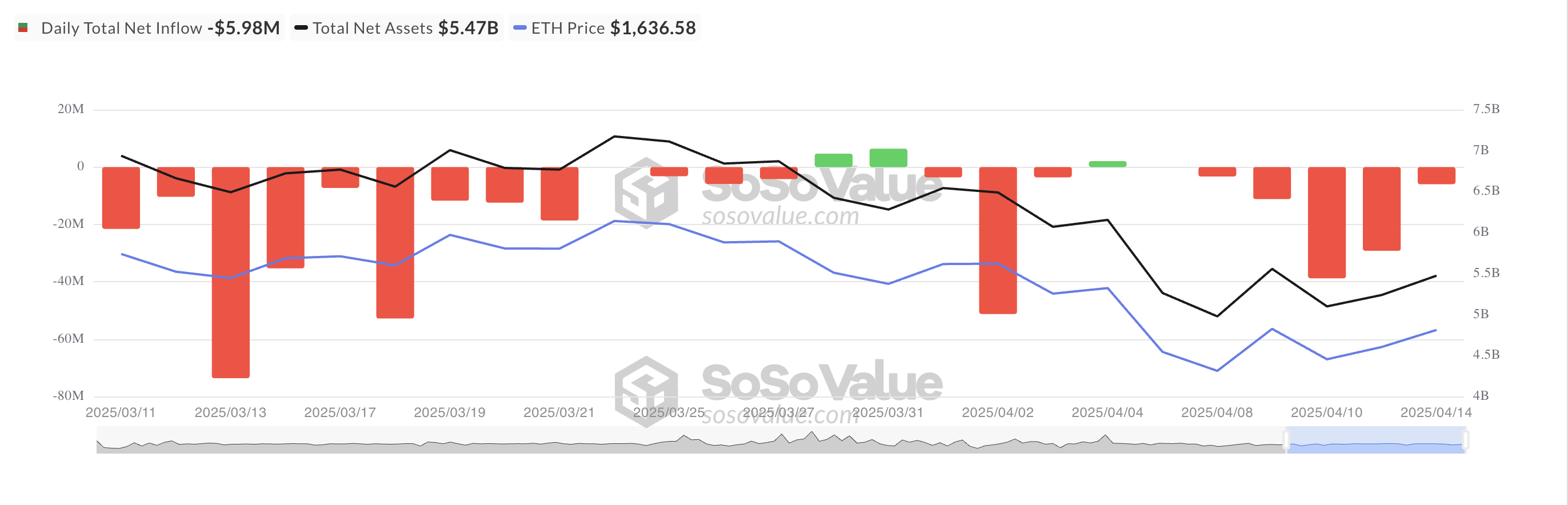

However, institutional investors in the US remain cautious. This is evident in the ongoing outflows from US-based spot ETH exchange-traded funds (ETFs), marking the altcoin’s seventh consecutive day of withdrawals.

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

The continued exit of institutional capital stands in stark contrast to the growing enthusiasm among retail traders. This divergence suggests that while US retail investors are increasingly optimistic about ETH’s short-term prospects, institutional players are more cautious, possibly due to macroeconomic uncertainty.

ETH Shows Strong Capital Inflows, But Bearish Sentiment Could See Price Drop

ETH’s Balance of Power (BoP) is positive at press time, reflecting today’s market recovery. This indicator, which measures buying and selling pressures, is in an upward trend at 0.57.

A positive BoP like this indicates more capital inflow into ETH than outflow, signaling an accumulation trend. If this continues, it could push the altcoin’s price to $2,114.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, if market sentiment turns bearish and ETH retail traders reduce their demand for the altcoin, it could lose recent gains and drop to $1,395.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone