Mantra CEO Breaks Silence After Historic OM Crash

Storms can break out in the blink of an eye in the crypto sphere. Mantra (OM), once hailed by its supporters, has just suffered a vertiginous 95% drop. As accusations of manipulation and opacity fly, John Mullin, CEO of the project, steps up. Between firm denial and promises of recovery, the scenario mixes a crisis of confidence and survival strategies.

Dramatic drop of the Mantra (OM) crypto: the project CEO reacts

The collapse of Mantra (OM) has awakened the old demons of the crypto-sphere: insider sales, rug pull, opacity… Allegations that John Mullin dismisses with a wave of his hand.

During a recent exchange with the community, the CEO described these rumors as fantasies unrelated to reality. Laser Digital , accused of an alleged leak before the crash, would be innocent. “No wallet linked to our partners was emptied,” he insists, brandishing a transparency report meant to clarify the origin of the transactions.

But then, what is the cause of this collapse? Mullin points to a technical domino effect: massive liquidations on exchange platforms.

Specifically, traders would have used the OM crypto as collateral for loans. When the price began to shake, bots took over, automatically selling cryptos to cover losses. A cold, almost mechanical chain of events that would have precipitated the fall. “It’s not a criminal scenario, just an algorithm gone wild,” he summarizes.

To reverse the trend, Mantra envisions a bold move: buying back OM cryptos on the market and burning part of them. A classic but risky strategy aimed at creating artificial scarcity. “We will inject our own liquidity if necessary,” Mullin says. The question remains whether these purchases will be enough to calm the now wary investors’ psychosis.

A 109 million dollar fund ready to support the recovery

At the heart of the turmoil, Mantra unveils its secret weapon: an ecosystem fund of 109 million dollars. “This money is a safety net, but also a lever to rebuild,” explains Mullin .

Intended to finance partnerships, technical developments and marketing campaigns, this windfall could breathe new life into the OM crypto. Yet, the community whispers: what if this fund is primarily used to cover the project’s flaws?

Despite doubts, the numbers speak: the OM crypto has slightly recovered, now flirting with 0.60$, for a capitalization of 585 million dollars. A fragile improvement, hailed by the team as a sign of resilience. “We are going through a crisis, not a shipwreck,” Mullin tempers. Some observers see, however, a mirage, reminding that massive buybacks can temporarily distort the market.

The road will be long. Between buyback procedures, fund management and regaining trust, Mantra will have to juggle expectations and suspicions. “Transparency will be our mantra,” promises the CEO, skillfully playing on words. But in an ecosystem where promises often shatter, the challenge is great.

The collapse of Mantra (OM) reveals a harsh truth: in crypto, crises arise as quickly as hopes. While Mullin tries to extinguish the fire with technical explanations and emergency measures, mistrust persists. The 109 million fund and token buybacks offer a lifeline, but will they be enough to avoid the shipwreck?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

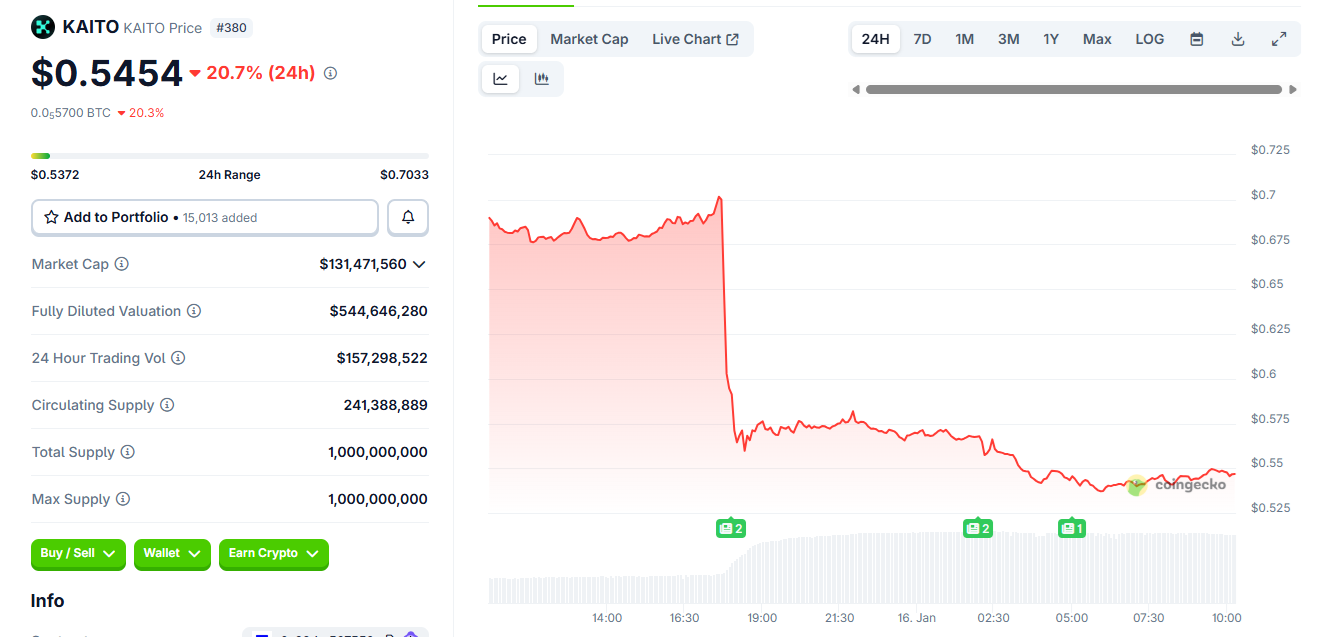

Kaito retires Yaps as token falls near all-time lows

The US Treasury market is experiencing a level of stagnation that is approaching record highs

DASH Breaks Key Technical Levels Amid Privacy-Driven Momentum in 2026