Lorenzo Protocol Ecosystem Roundup — March 2025

Welcome to the March edition of our ecosystem roundup! This is your quick, monthly update on all key happenings across the Lorenzo Protocol ecosystem.

Let’s explore what’s new!

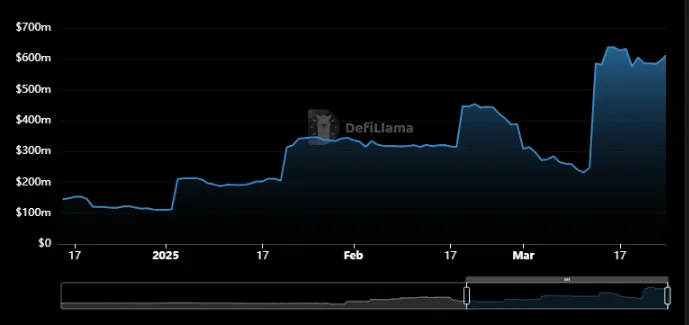

Lorenzo Hits $600M In TVL

We’ve officially crossed a major milestone — Lorenzo has now exceeded $600 million in Total Value Locked, with our latest all-time high reaching $637M, according to DeFiLlama.

This achievement is a testament to the trust our community has placed in us — and the momentum is only building.

Track our growth in real-time: Lorenzo on DeFiLlama

We’re just getting started. Let’s keep climbing!

enzoBTC and stBTC Go Live On Hemi Mainnet

We were excited to support our friends and partners at Hemi for their mainnet launch, with our enzoBTC and stBTC tokens going live on the chain for day 1 of launch.

Please note: The contracts are live, but functionality for the tokens are still to come. Stay tuned for future updates on activating your liquidity with Hemi!

Quietly Building

For team Lorenzo, March has been a month of quiet, intense work across all divisions.

We’re targeting significant expansion, new milestones, and exciting launches.

To everyone supporting us in the Lorenzo Nation, we thank you.

Final preparations are underway…

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Tether's Risky Reserve Change: Exposure to Cryptocurrency and Gold Poses a Challenge to Stablecoin Stability

- Tether's USDT faces scrutiny as Arthur Hayes warns a 30% drop in gold/Bitcoin reserves could trigger insolvency risks. - S&P downgraded USDT's stability rating to "weak" over 5.6% Bitcoin exposure exceeding overcollateralization margins. - Tether CEO dismissed criticism, claiming no "toxic" assets while regulators globally intensify reserve transparency demands. - Debate centers on balancing crypto volatility with liquidity resilience amid $34B cash shortfall and redemption risks.

Zcash Halving and Its Effects on the Dynamics of the Cryptocurrency Market

- Zcash's halving mechanism reduces block rewards every four years, enhancing scarcity and mimicking Bitcoin's deflationary model while offering optional privacy features. - Historical halvings (2020, 2024) triggered sharp price swings, with Zcash surging 1,172% post-2024's NU5 upgrade and institutional adoption via Grayscale Zcash Trust. - Next halving projected for late 2028 faces risks from regulatory scrutiny of shielded transactions and competition from privacy coins like Monero. - Long-term investors

Zcash (ZEC) Rallies as Interest in Privacy Coins Grows: Can the Momentum Last?

- Zcash (ZEC) surged 900% in Q4 2025, peaking at $702.04, driven by institutional adoption and regulatory clarity via the CLARITY/GENIUS Acts. - The November 2025 halving reduced block rewards by 50%, historically correlating with price surges, while shielded transactions now account for 20-25% of supply. - Zcash diverged from broader crypto weakness, gaining 35% weekly in November despite Bitcoin's decline, fueled by privacy-focused retail demand and $2B+ trading volume. - Upgrades like Zashi wallet and P

Trending news

MoreBitcoin News Update: Tether's Risky Reserve Change: Exposure to Cryptocurrency and Gold Poses a Challenge to Stablecoin Stability

Bitget Daily Digest (Dec. 1) | Bitget Daily Briefing (December 1)|Long liquidations hit $478 million in the past 24 hours; Spot Chainlink ETF expected to launch this week; 55.54 million SUI unlocks today