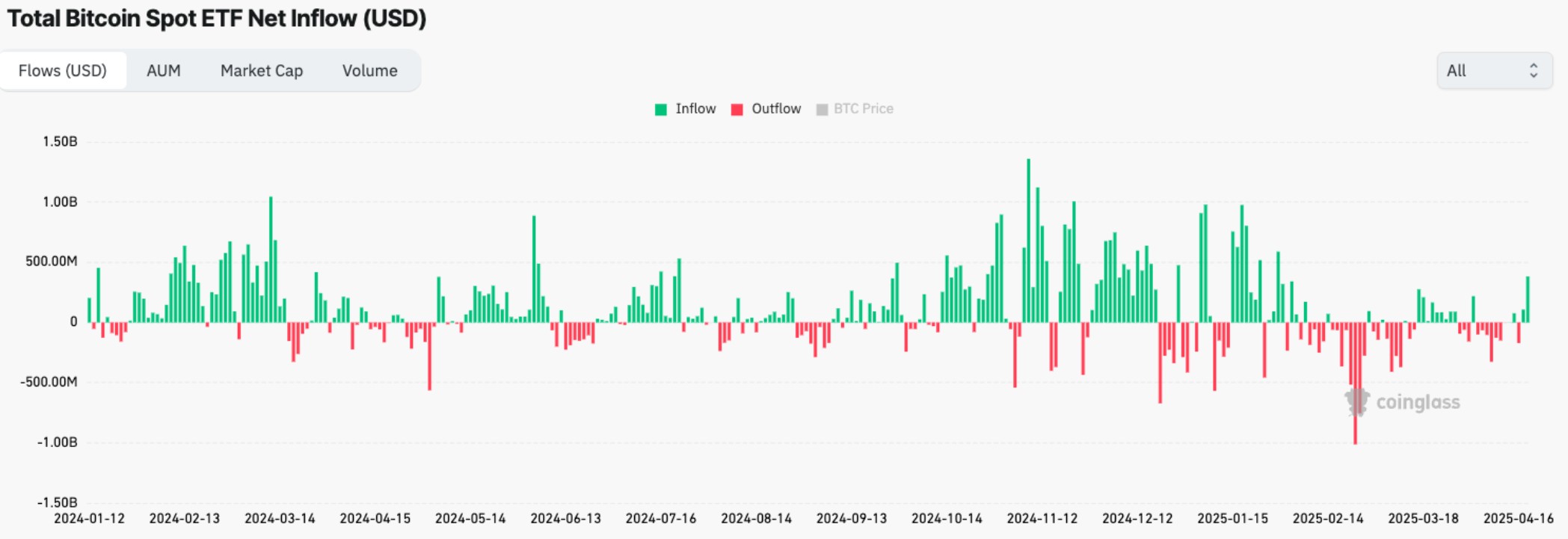

Bitcoin price surged past $90,000 on April 22. This came after U.S. spot Bitcoin ETFs recorded the highest net inflows since January. According to CoinGlass, the 11 approved Bitcoin ETFs pulled in over $380 million in net inflows on April 21. These ETF inflows supported the latest rise in Bitcoin price.

Bitcoin ETF Inflows and Outflows Since Launch. Source: CoinGlass

Bitcoin ETF Inflows and Outflows Since Launch. Source: CoinGlass

Bitcoin ETF inflows have played a growing role in the market since the start of 2024. Analysts now link Bitcoin price changes closely to institutional demand through ETFs. Standard Chartered and Intellectia AI reviewed the impact in their recent reports. They stated that ETF inflows could help push Bitcoin price to $200,000 in 2025.

Institutional Demand Adds to Bitcoin Price Strength

Institutional demand continues to shape the Bitcoin market. Bitcoin price movements now reflect increasing participation from large financial players. According to Bitcointreasuries.net, corporate Bitcoin treasuries hold close to $65 billion worth of BTC. These include large firms using Bitcoin as part of their reserve strategy.

Coinbase and Kraken were also named in the Intellectia AI report as platforms supporting institutional accumulation. Their role in handling large transactions adds to market stability. These firms are helping drive consistent ETF inflows into the Bitcoin market.

Standard Chartered analysts said that macroeconomic conditions are pushing firms toward alternative stores of value. Bitcoin price has responded to these shifts in investor behavior.

Bitcoin and Gold Remain Key Hedge Assets

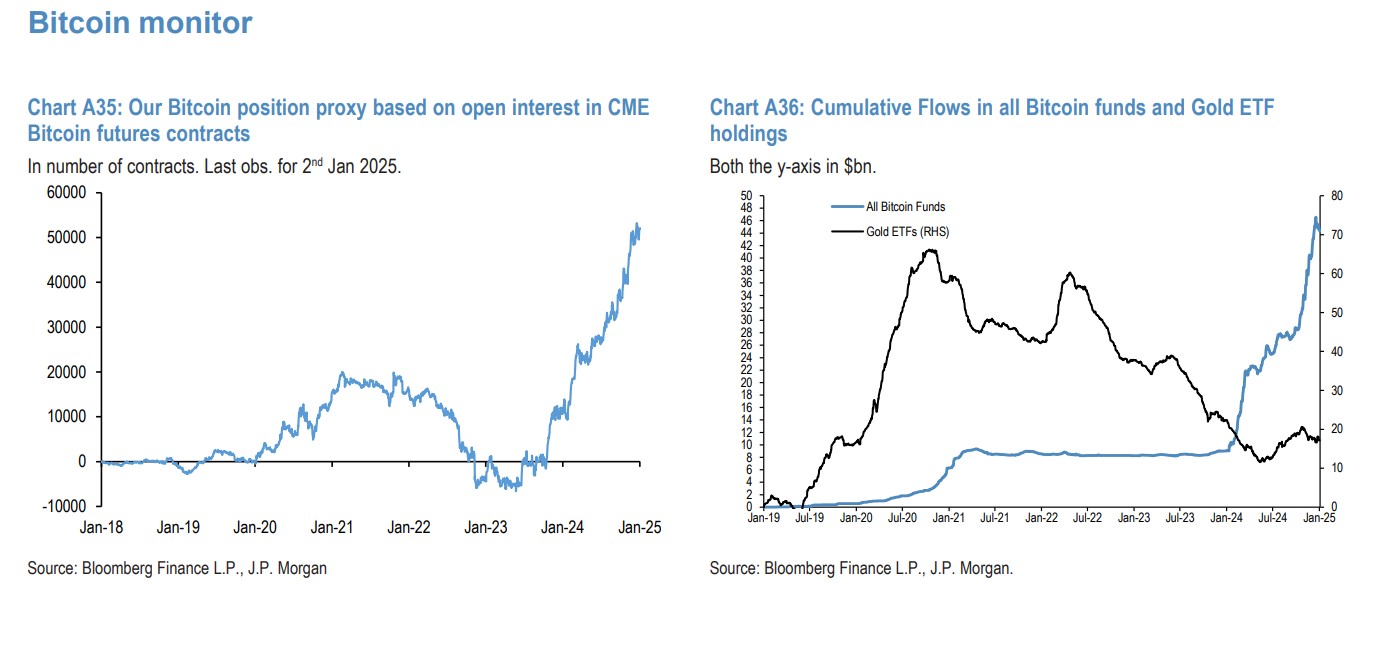

Bitcoin and gold remain key options for investors seeking to manage geopolitical risk and inflation. A January research note from JPMorgan confirmed this trend. It stated that Bitcoin and gold are now structural parts of many investment portfolios.

Bitcoin Futures Open Interest and ETF Flows Compared to Gold. Source: J.P. Morgan

Bitcoin Futures Open Interest and ETF Flows Compared to Gold. Source: J.P. Morgan

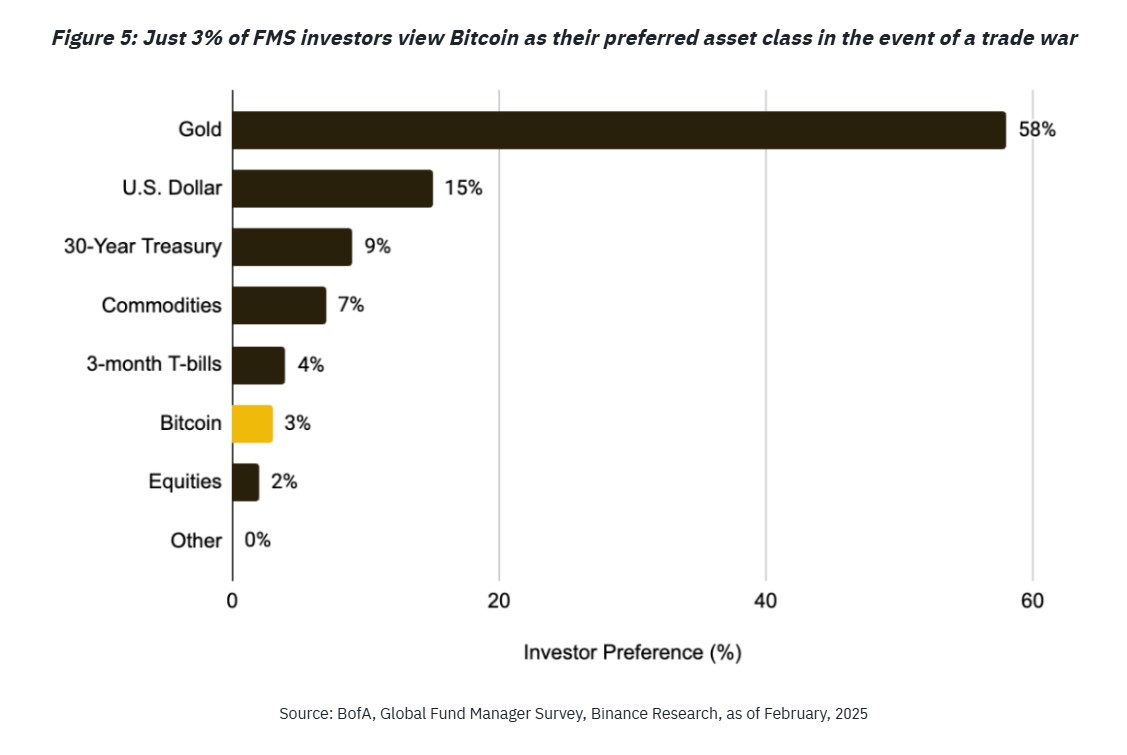

However, Binance Research pointed to a shift after April 2, when Donald Trump announced import tariffs. Since then, Bitcoin has moved more in line with equities than gold. The April 7 Binance report noted that this change in correlation could affect Bitcoin’s role as a hedge.

Bitcoin Seen as Minor Hedge in Trade War Scenarios. Source: Binance Research

Bitcoin Seen as Minor Hedge in Trade War Scenarios. Source: Binance Research

Disclosure:This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Kriptoworld.com accepts no liability for any errors in the articles or for any financial loss resulting from incorrect information.