Date: Wed, April 23, 2025 | 08:30 AM GMT

After a challenging start to 2025, the cryptocurrency market appears to be regaining momentum. Bitcoin (BTC) has surged by 12% in the past week, while Ethereum (ETH) gained 13%, signaling a potential shift in sentiment across the major altcoins .

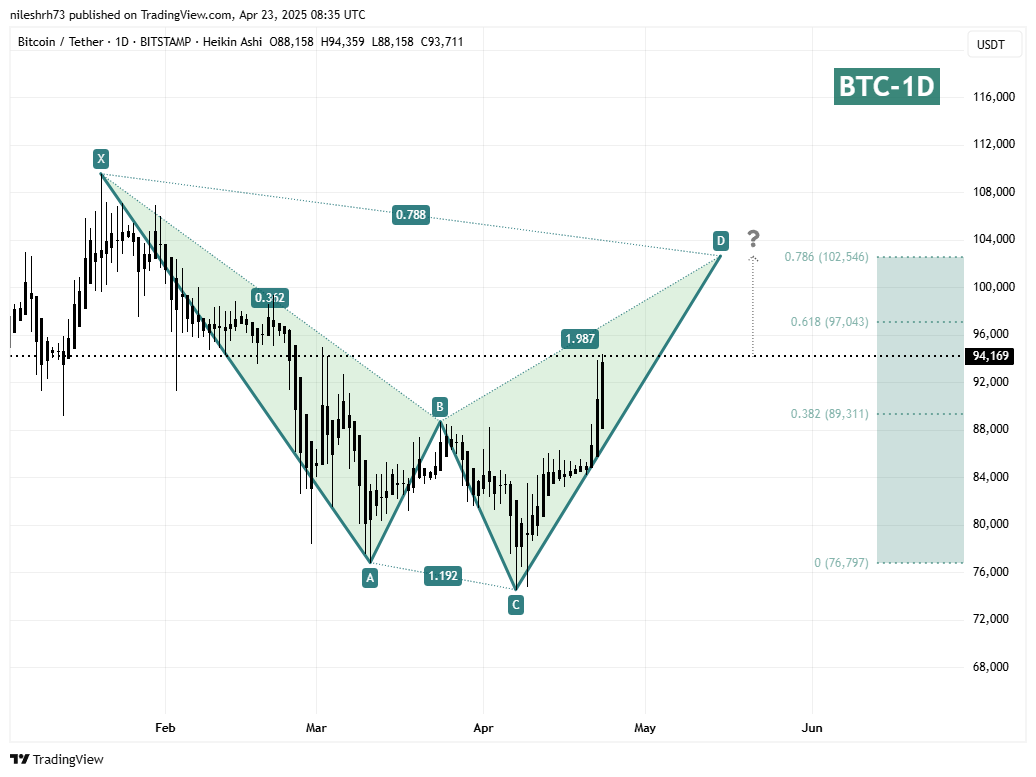

Today, Bitcoin pierced above the $94,000 mark with a strong 6% rally. Even more compelling, a classic harmonic pattern forming on the daily chart suggests this move might just be getting started.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Signals More Upside Move

The daily chart for BTC, viewed through the lens of Heikin Ashi candles, shows the emergence of a Bearish Cypher pattern — a harmonic formation that often signals a bullish continuation up to a key reversal zone.

The structure initiates at point X, marked by a rejection from Bitcoin’s all-time high of $109,557 on January 20. This led to a sharp decline to point A, followed by a recovery rally to point B, and then a deep correction to point C, which bottomed around $74,522 on April 7.

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Bitcoin (BTC) Daily Chart/Coinsprobe (Source: Tradingview)

Although point C does not fully reach the ideal Fibonacci extension of 1.27–1.41, it still sits within an acceptable deviation, allowing the overall Cypher structure to remain valid.

Currently, Bitcoin is in the midst of forming the CD leg — the final phase of this harmonic setup — with strong price action propelling it higher.

If the pattern plays out as expected, the next major target is point D, which aligns with the 78.6% Fibonacci retracement of the X to C move — located around $102,546. From current levels (~$94,169), this suggests a potential upside of around 9%.

What’s Next for BTC?

A rise toward the $102K level would mark the completion of the Cypher pattern and bring BTC into a critical resistance zone — a region that could potentially attract profit-taking or even catalyze a short-term reversal.

Before reaching that milestone, however, Bitcoin must first clear intermediate resistance around $97,043, which corresponds to the 61.8% Fibonacci retracement. A strong breakout above this level could pave the way for a faster ascent toward the final target.

From a technical standpoint, the overall bullish structure remains intact. Momentum indicators such as MACD and RSI (not shown in this chart) have also been turning positive, supporting the thesis of a continued upward push — at least in the short term.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.