Date: Wed, April 23, 2025 | 12:48 PM GMT

In the cryptocurrency market, after facing a continuous decline since the start of this year, the market is finally starting to show signs of upside momentum. Bitcoin (BTC) has surged by 13% and Ethereum (ETH) by 14% over the past week, reigniting positive sentiment across altcoins.

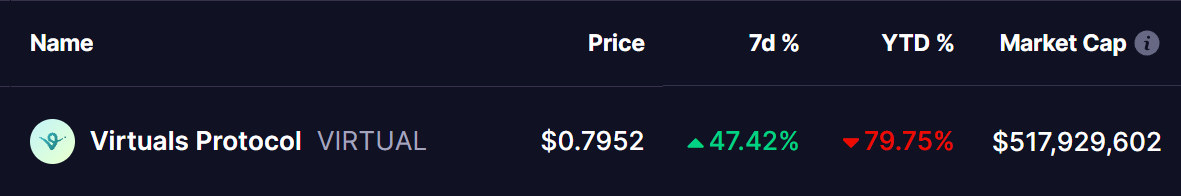

Following this broader market rally, Virtuals Protocol — the AI agent token creation platform — has managed an impressive comeback. Its native token, VIRTUAL, which recently endured a brutal correction, has rebounded by a remarkable 47% over the past week, narrowing its year-to-date loss to 79%.

Source: Coinmarketcap

Source: Coinmarketcap

Interestingly, a classic harmonic pattern now hints that this rise could continue even further.

Harmonic Pattern Signals More Upside Move

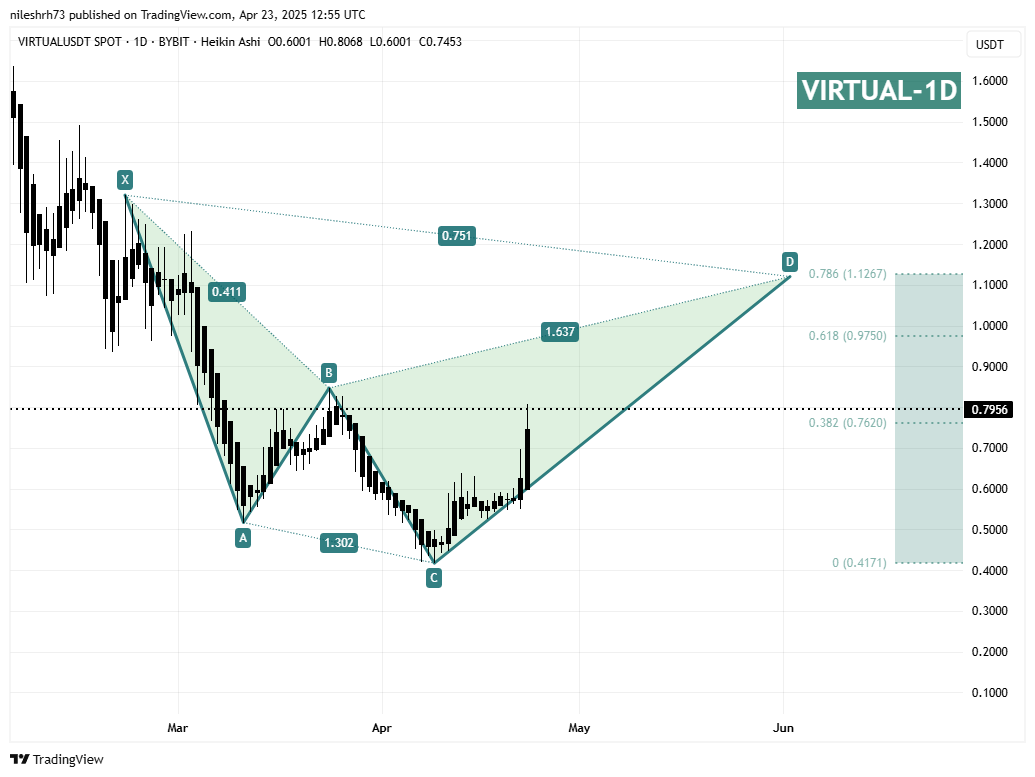

The daily chart for VIRTUAL reveals the development of a Bearish Cypher pattern, a highly regarded structure in harmonic trading that often precedes a bullish impulse move toward the pattern’s completion point before any potential reversal risk emerges.

The structure began at point X, marked by a sharp rejection on February 21 after VIRTUAL reached its all-time high of $1.3199. Following that, the token experienced a strong drop down to point A, then a corrective bounce to point B, and subsequently a steep decline toward point C. This bottomed near $0.4171 on April 9, representing a significant 67% drop from the peak at X.

Virtuals Protocol (VIRTUAL) Daily Chart/Coinsprobe (Source: Tradingview)

Virtuals Protocol (VIRTUAL) Daily Chart/Coinsprobe (Source: Tradingview)

Although the BC leg extended slightly more than ideal, the overall geometry and Fibonacci alignments of the Cypher pattern remain valid and compelling. This suggests that the pattern is still structurally sound and worth monitoring.

Currently, VIRTUAL is building out the CD leg, the final phase of this harmonic setup. The token has bounced confidently from its lows, and its price action has remained constructive over the past two weeks, signaling renewed bullish interest.

If the pattern completes as expected, the next major upside target sits at point D, which aligns with the 78.6% Fibonacci retracement level of the XC move — near $1.1267. From current levels, this points to a potential upside of around 40%, offering an encouraging prospect for bulls.

What’s Next for VIRTUAL?

A move toward the $1.1267 target would not only fulfill the Cypher harmonic structure but also place VIRTUAL into a key technical resistance zone. Historically, areas around harmonic completions often attract profit-taking or even trigger sharp pullbacks, so traders will be particularly attentive as price approaches this level.

Before reaching that final target, however, bulls must clear an important intermediate resistance around $0.9750. This area coincides with the 0.618 Fibonacci retracement level of the XC move and represents a critical hurdle. A decisive breakout above $0.9750 could add momentum to the rally and help accelerate the CD leg’s completion toward $1.1267.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.