Bitcoin ETFs Saw $3 Billion Weekly Inflows As US Investors Pivot to BTC

Analysts attribute Bitcoin's recent growth to its decoupling from traditional assets amid geopolitical tensions, forecasting substantial long-term price increases.

Bitcoin exchange-traded funds (ETFs) in the US recorded massive inflows of more than $3 billion last week.

This performance marks one of the strongest weeks for Bitcoin ETFs in 2025, driven by the recovering BTC price and renewed interest from institutional investors.

Bitcoin ETFs Post Strongest Six-Day Inflow Streak

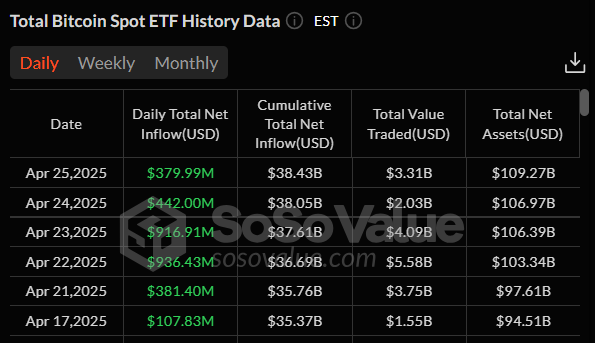

According to SoSoValue, the 11 spot Bitcoin ETFs recorded a combined inflow of approximately $3.06 billion over six consecutive trading sessions.

This wave of investment ranks as the second-largest net inflow on record for Bitcoin ETFs, highlighting increasing demand for crypto-focused financial products.

The largest inflows were seen on April 22 and April 23, when daily figures reached $936 million and $916 million, respectively. Analysts noted that these were among the best single-day performances since Donald Trump returned to the White House earlier this year.

US Bitcoin ETFs Six-Day Inflow Streak. Source:

SoSoValue

US Bitcoin ETFs Six-Day Inflow Streak. Source:

SoSoValue

The wave of investment lifted the total assets under management (AUM) for Bitcoin ETFs to $109 billion. BlackRock’s iShares Bitcoin Trust (IBIT) continues leading the market, now managing more than $56 billion. This accounts for roughly 3% of Bitcoin’s circulating supply.

Michael Saylor, Chairman of Strategy (formerly MicroStrategy), reportedly predicted that IBIT could become the world’s largest ETF within the next decade.

Meanwhile, analysts attribute the surge in ETF inflows to Bitcoin’s recent decoupling from traditional risk assets like U.S. stocks and gold. Rising geopolitical tensions, especially the global tariff battles, have further boosted Bitcoin’s status as a safe-haven investment.

Moreover, analysts from The Kobeissi Letter suggest that Bitcoin’s decoupling from macro assets has supported its price rebound. Since dipping under $75,000 on April 7, BTC’s price has surged by more than 25% and is now trading above $94,000.

“As global money printing continues so will Bitcoin’s price appreciation. The value of paper money is backed by nothing more than debt, and that debt has been running out of control for quite some time. Bitcoin is the solution to our broken monetary system,” Mark Wlosinski, a crypto analyst, said.

Looking forward, David Puell, an analyst at ARK Invest, remains highly optimistic about the top crypto.

Puell predicts Bitcoin could reach up to $2.4 million by 2030, driven by growing institutional adoption and its rise as a strategic treasury asset for corporations and even nation-states.

In more conservative scenarios, he forecasts Bitcoin reaching between $500,000 and $1.2 million within the same timeframe.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Federal Reserve's Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The essence of RMP, the mystery surrounding its scale, and its impact on risk assets.

Questioning the Necessity of Gas Futures: Does the Ethereum Ecosystem Really Need Them?