Since the Pi Network mainnet launch, users’ expectations with the project are towering. But now as May 2025 approaches, Pi is no longer just an ambitious vision, as its token at a crossroad.

After the euphoric launch and short-lived rally to $3, the price had continued to drop. At the time of writing, late April 2025, Pi Network’s native currency, Pi Coin, is down approximately $0.6077, from 15% in losses in the last month.

It is one of the few major tokens in recent times to drop in a conspicuous manner. The frustration is being experienced by several early investors as they mined or purchased Pi to realize that it’s not experiencing an upward drive. As Bitcoin gains momentum, the opposite action by Pi spooks many of its holders.

According to Bitget Wallet COO Alvin Kan, Pi’s early excitement came from mobile mining and community referrals, but that momentum has faded. Now, Pi struggles due to limited exchange listings, low real-world utility, and poor liquidity. These issues are making it hard for the project to attract new buyers or retain old ones.

Chaikin Money Flow Of Pi Coin, Source: TradingView

Chaikin Money Flow Of Pi Coin, Source: TradingView

Technical indicators such as the Chaikin Money Flow (CMF) show that money is still coming into Pi. Nonetheless, the general flow is negative, indicating that selling pressure exceeds buying desire. This means that any minor gains are being wiped out by subsequent sell-offs.

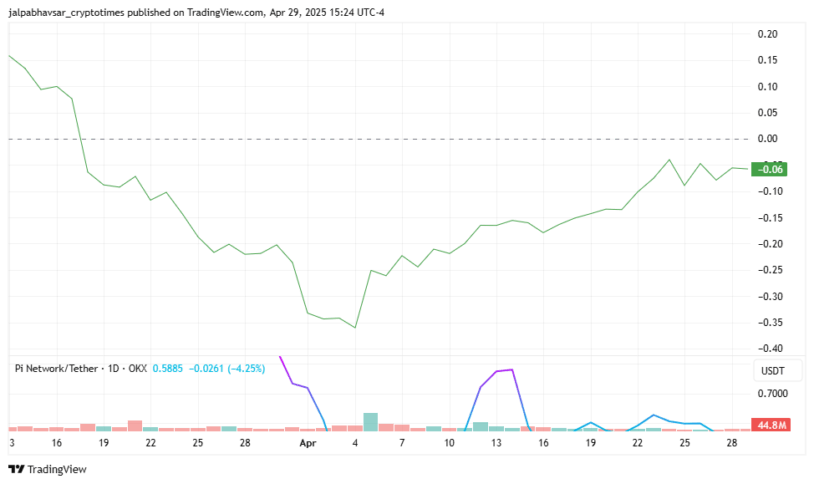

Pi Coin Price Chart

Pi Coin Price Chart

Pi’s Relative Strength Index (RSI) is at 38, nearing oversold territory, and the MACD is about to turn negative. Both factors point to a probable further downturn. The coin has been trading in a sideways band of $0.59 to $0.67, but it is now testing the lower end, threatening a drop to $0.5192 or perhaps it’s all-time low of $0.40.

In April alone, 21.4 million PI tokens (worth over $12 million) were unlocked. In the following year, monthly unlocks will average 131 million tokens, adding circulating supply and threatening further price declines unless demand increases. Without a token burn or significant ecosystem update, selling pressure will continue to be strong.

In spite of the bearish sentiment, Pi can still recover if it can break above $0.8727 and establish it as support. That would indicate a potential trend reversal.

But to achieve that, the project must demonstrate its long-term worth with actual use cases and better market access. What Pi Network needs is a utility first approach and meaning full integrations in retail and defi both sectors.

May 2025 may not be the time for Pi to moon but it needs to be the the time where Pi matures.