US GDP Report Fuels Recession Concerns, But Bitcoin Holds Steady

Despite troubling economic reports, including a shrinking US GDP and tariff-induced recession fears, Bitcoin's strong performance hints at its role as a hedge against economic instability.

The US Bureau of Economic Analysis (BEA) released its PCE and GDP reports for Q1 2025 today. Although inflation was less than expected, US GDP shrank before the tariffs took effect, encouraging fears of a recession.

Despite this discouraging signal, Bitcoin has held up rather well, even hitting a new all-time high in Argentina. This lends credence to the notion that BTC is a safe haven from economic chaos.

Trump’s Tariffs May Cause Recession

The global economy is extremely complicated, full of signals that seemingly contradict each other. Since Trump’s tariff plan began taking effect, fears of a US recession have gripped the markets. However, when the BEA released its Q1 2025 PCE report this morning, it prompted relief from some sectors.

“Personal income increased $116.8 billion (0.5 percent at a monthly rate) in March, according to estimates released today by the [BEA]. The increase in current-dollar personal income in March primarily reflected increases in compensation and proprietors’ income,” the report claimed.

At first glance, this data looks highly encouraging. The PCE (personal consumer expenditures) report is the Federal Reserve’s preferred tool to measure inflation, and it’s full of reassuring points.

The core PCE price index (YoY) for March was 2.6%, the lowest since June 2024, and the MoM index was at its lowest since April 2020. In other words, the dollar still spends.

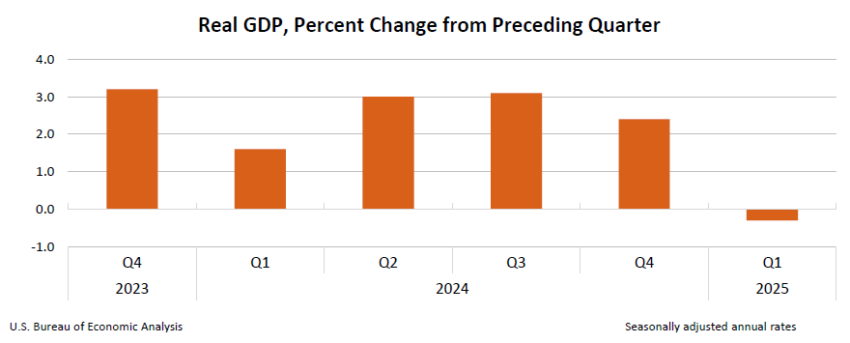

However, the BEA also released its GDP report today. Although the tariffs seemingly haven’t impacted inflation yet, a recession happens after two consecutive quarters of negative GDP growth. The US officially experienced one in Q1, and this report only concerns pre-tariff data:

Key Recession Indicator Before Tariffs. Source:

BEA

Key Recession Indicator Before Tariffs. Source:

BEA

CNN hypothesized that the inflation figures were artificially heightened thanks to the tariffs. Specifically, US consumers may have purchased more goods in anticipation of them becoming more expensive. This systematic behavior would throw off the usual metrics of inflation tracking.

How will these statistics impact the crypto industry? Simply put, Bitcoin isn’t acting like tariffs are about to cause a recession. It actually sustained its value, trading over $94,000.

Analysts have been wondering if BTC will be a safe haven in economic chaos, and recent data suggests it could benefit from trade disruptions.

Bitcoin also reached an all-time high in Argentina, surpassing 110 million ARS per BTC. This surge is likely due to the significant depreciation of the Argentine peso, which was trading near 1,165 per US dollar in official markets.

These developments indicate that Bitcoin might successfully function as a hedge against economic instability.

Ultimately, these claims are still speculation. Tariffs may or may not cause the US to enter a recession, which would truly test Bitcoin’s status as a safe haven. From today’s perspective, at least, the hypothesis seems reasonable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025