-

XRP faces downward pressure, dropping over 7% in a week, as momentum fades indicated by the RSI nearing oversold territory.

-

Technical analysis paints a grim picture, as the Ichimoku Cloud setup shows an unwavering bearish trend, lacking signs of a potential reversal.

-

Recent analysis indicates that without reclaiming the $2.18 resistance, XRP might slide towards $2.03, amidst concerns over a future EMA death cross.

This article explores the recent decline in XRP’s price, key technical indicators, and potential support and resistance levels as market sentiment weakens.

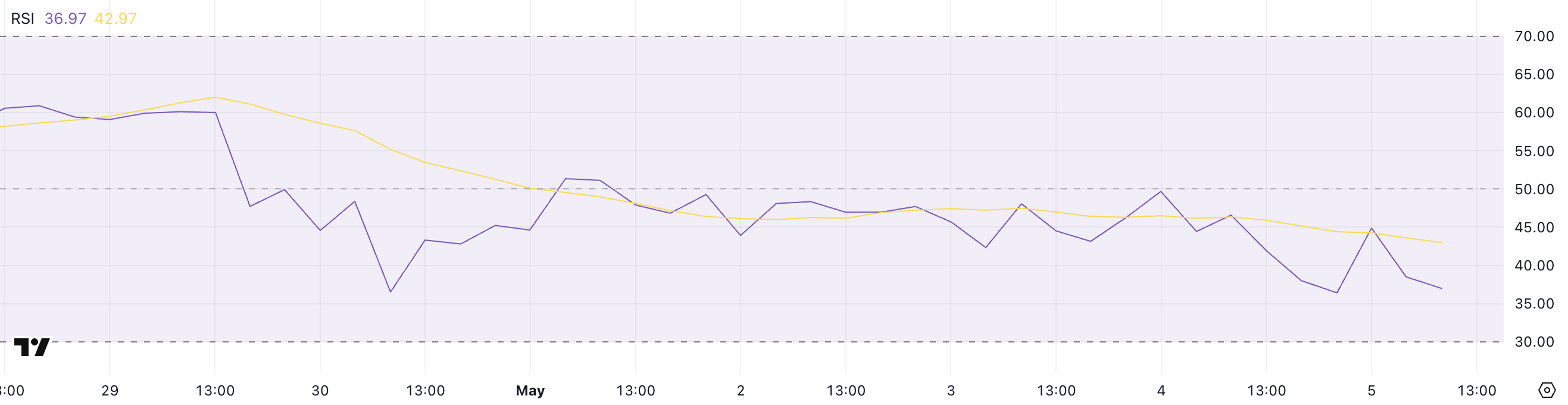

RSI at Critical Levels: Is XRP Primed for a Rebound?

XRP’s Relative Strength Index (RSI) dipped to 36.97, a notable fall from 49.68 within a single day. This movement signifies a considerable loss of buying momentum and pushes the indicator closer to oversold territory.

The RSI, which fluctuates between 0 and 100, serves as a crucial momentum gauge for traders identifying potential trend reversals.

Typically, readings exceeding 70 indicate an overbought status, while values below 30 signal an asset nearing an oversold condition, priming it for potential rebounds.

Currently, XRP’s RSI at 36.97 shows it is approaching oversold levels but has yet to breach this critical threshold. Continued selling pressure could lead to further declines within the short term.

However, should the RSI decline below 30 and stabilize, it might attract traders anticipating a reversal and a subsequent bounce.

Overall, XRP remains in a pivotal caution zone, indicating that near-term price action will be essential in guiding its future trajectory.

Ichimoku Cloud Analysis Reveals a Bearish Setup for XRP

The Ichimoku Cloud analysis for XRP presents a distinctly bearish structure, with the price residing firmly below both the Tenkan-sen (blue line) and the Kijun-sen (red line), showcasing alignment toward a further downturn.

This bearish setup typically signals persistent selling activity with no immediate indicators of market reversal, supported by the Chikou Span (green lagging line) lagging below both the price and the cloud.

This alignment demonstrates XRP’s continued susceptibility to downward momentum, highlighting the failure of buyers to regain control over the asset’s trajectory.

The Kumo (cloud) has turned red, projecting future price resistance firmly downward—further emphasizing the bearish outlook. The significant distance from the cloud confirms that XRP remains in a pronounced downturn as per Ichimoku analysis.

Additionally, a widening gap between the Senkou Span A and B lines (cloud edges) points to strengthening bearish momentum. For a trend shift, XRP must first surpass the Kijun-sen and eventually penetrate the cloud, neutralizing the prevailing bearish sentiment.

Until that occurs, the technical landscape for XRP remains bleak, warranting a cautious approach from traders looking for entry points.

Market Outlook: EMA Death Cross Risks and Key Resistance Levels

XRP’s exponential moving averages (EMAs) indicate a potential death cross on the horizon, highlighting further concerns about market stability.

A death cross occurs when a short-term EMA drops below a long-term EMA, often signaling the onset of a prolonged downtrend. If confirmed, this bearish crossover could lead XRP to test its support level at $2.11.

A failure to maintain this level could lead to accelerated losses, possibly targeting $2.03.

Conversely, should XRP succeed in regaining upward momentum, it may set its sights on the $2.18 resistance level.

A breakout surpassing this level would serve as a short-term bullish indicator, potentially propelling prices toward $2.24. Sustained buying pressure could pave the way for targets at $2.30 and eventually $2.36, particularly if prevailing market sentiment improves.

Conclusion

In conclusion, XRP currently navigates a challenging market environment with mounting bearish technical signals. As key indicators suggest potential further declines, traders should closely monitor significant support and resistance levels while remaining vigilant about any signs of reversal. The forthcoming days will be critical in determining whether XRP can regain bullish momentum or if it will succumb to further selling pressure.