New Bitcoin Whales Now Hold Majority of BTC Capital | Weekly Whale Watch

On‑chain report from CryptoQuant shows that short‑term “New Whales” now hold 52.4% of Bitcoin’s Whales Realized Cap, overtaking long‑term holders for the first time. BTC trades near $96,800, driven in part by fresh capital entering the market at high price levels. New Bitcoin Whales Collectively Hold More Assets than Long-Term Holders Realized cap values each … <a href="https://beincrypto.com/new-bitcoin-whales-dominate-btc-capital/">Continued</a>

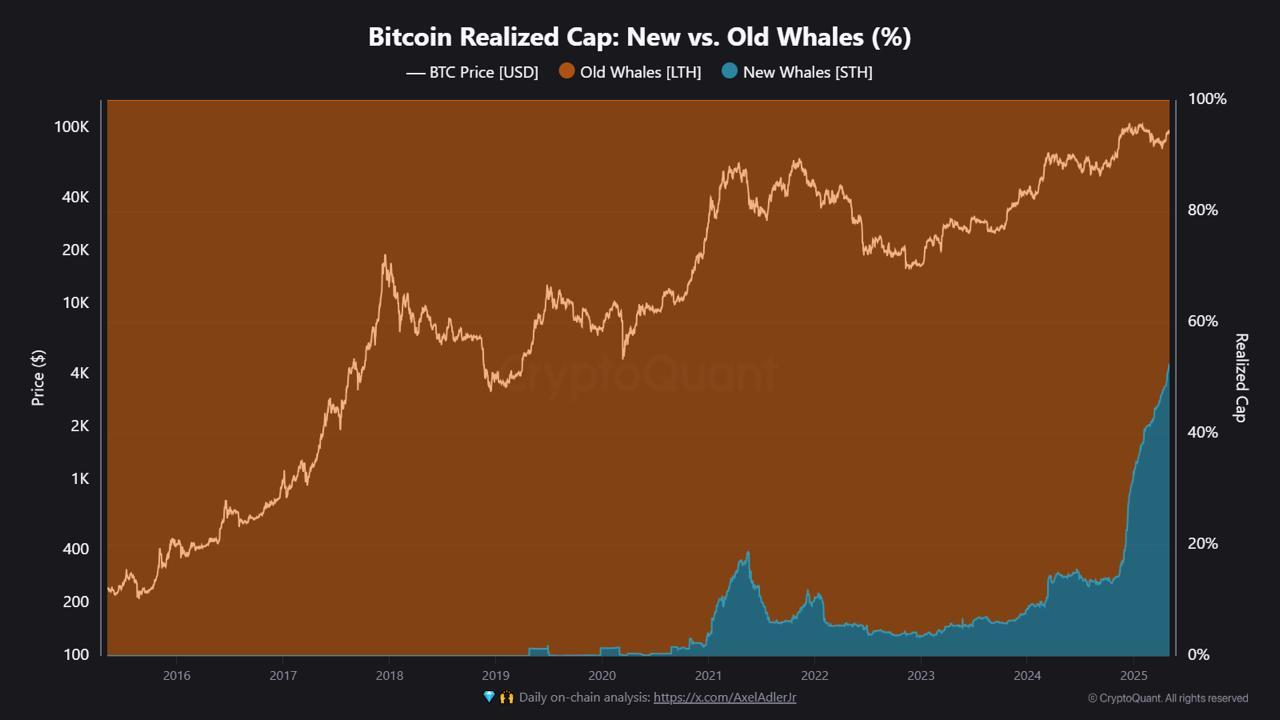

On‑chain report from CryptoQuant shows that short‑term “New Whales” now hold 52.4% of Bitcoin’s Whales Realized Cap, overtaking long‑term holders for the first time.

BTC trades near $96,800, driven in part by fresh capital entering the market at high price levels.

New Bitcoin Whales Collectively Hold More Assets than Long-Term Holders

Realized cap values each Bitcoin at the price when it last moved on‑chain. CryptoQuant analyst JA Maartunn explains that active addresses within the past 155 days count as New Whales.

Meanwhile, those dormant no longer qualify as Old Whales.

New Whales’ average cost basis is $91,922, compared with $31,765 for Old Whales. This shift marks a historic change in capital distribution among major holders.

Bitcoin New vs Old Whales. Source:

CryptoQuant

Bitcoin New vs Old Whales. Source:

CryptoQuant

From 2015 through late 2019, new Bitcoin whales accounted for under 5% of whale realized cap as prices climbed from $200 to $10,000.

During the 2020–early 2021 bull run, their share rose toward 25% as retail‑level investors and institutions piled in.

The bear market of 2021–2022 saw New Whale participation fall below 10% amid capitulation. Recovery throughout 2023 and early 2024 pushed their share back to roughly 20 %.

Since mid‑2024, Bitcoin’s price has surged from $30,000 to $100,000. The chart shows New Whales’ share climbing sharply from about 20% to 52.4 % in tandem with the rally.

At the same time, realized cap held by Old Bitcoin Whales now represents just 47.6%

What Does it Mean for Bitcoin’s Price Dynamics?

CryptoQuant’s data means that most of Bitcoin’s “big‑money” holders today are those who piled in recently at much higher prices. Over half of whale‑level capital sits in coins last moved within the past five months.

Overall, this is a major momentum driver for the BTC market. Fresh whale buys at $90,000 pushed BTC toward $97,000. Their demand created much of the recent rally.

Bitcoin 90-Day Price Chart. Source: BeInCrypto

Bitcoin 90-Day Price Chart. Source: BeInCrypto

Also, New Whales’ average cost is about $92,000, so they only have a small unrealized gain. A drop below their cost could spur quick selling, adding downward pressure.Meanwhile, long‑term whales bought at $31,000 on average. They have no reason to sell now, which limits supply from that group.In simple terms, Bitcoin’s current strength rests on these new, high‑cost buyers. If they hold, the uptrend can continue. If they start selling around their break‑even point, expect sharper swings

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK