Dow drops 180 points as caution prevails ahead of U.S.-China talks

U.S. stocks erased their gains from earlier in the trading day, as traders became increasingly cautious ahead of trade talks between the U.S. and China.

Despite some positive news on the trade front, investors remain skeptical. On Friday, May 9, major U.S. stock indices were down across the board. The Dow Jones lost nearly 200 points or 0.48%, the S&P 500 fell 0.24%, while the tech-focused Nasdaq declined 0.19%.

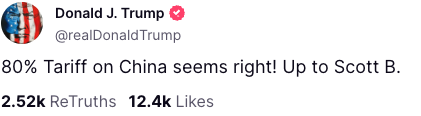

The markets are eagerly awaiting developments in trade talks between the U.S. and China. U.S. President Donald Trump signaled that he was prepared to lower tariffs on all Chinese goods to 80%. He added that the decision would ultimately be up to Treasury Secretary Scott Bessent.

Trump’s post on Truth Social, dated May 9 | Source: Truth Social

Trump’s post on Truth Social, dated May 9 | Source: Truth Social

While this rate remains prohibitively high for many exporters, it is lower than the previous 145% imposed earlier. More importantly, Trump’s rhetoric suggests a tone of de-escalation ahead of the crucial trade negotiations with China. The talks could help reduce reciprocal tariffs between the two countries, as China had retaliated with its own 125% tariff on U.S. goods.

Strategy, Palantir, among the biggest losers, gold gains

Among tech stocks, Palantir was among the worst performers, down 2.23% today. The stock is set to close the week down 5% as investors reassess its high valuation. Notably, on Tuesday, its shares dropped 12%, losing 35 million in market cap due to a drop in quarterly earnings .

Interestingly, shares of Strategy, a leveraged Bitcoin investment firm, were also down 1.78% since market open. This is despite Bitcoin (BTC) posting a 1.23% increase over the last 24 hours and a 5% increase over seven days.

On the other hand, bearish sentiment in the stock market prompted many traders to increase their gold exposure. The precious metal was up 1.16%, reaching $3,344 per ounce.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x POWER: Trade to share 4,387,500 POWER

New users get a 100 USDT margin gift—Trade to earn up to 1888 USDT!

Bitget Spot Margin Announcement on Suspension of DOG/USDT, ORDER/USDT, BSV/USDT, STETH/USDT Margin Trading Services

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!