Bitcoin miners show confidence, but leveraged long positions raise volatility risks amid price stability optimism.

-

Miner’s sell pressure hits 2025 low, showing bullish conviction despite rising market leverage.

-

BTC stays above $100K, but overbought RSI and heavy longs hint at volatility ahead.

Bitcoin [BTC] miners are showing signs of conviction, with selling pressure falling to its lowest level since early 2024. This trend reflects increasing confidence in price stability, yet it coincides with a highly leveraged market. With long positions piling up, even a sharp price movement could trigger renewed volatility and forced liquidations.

Miner selling pressure hits 2025 low

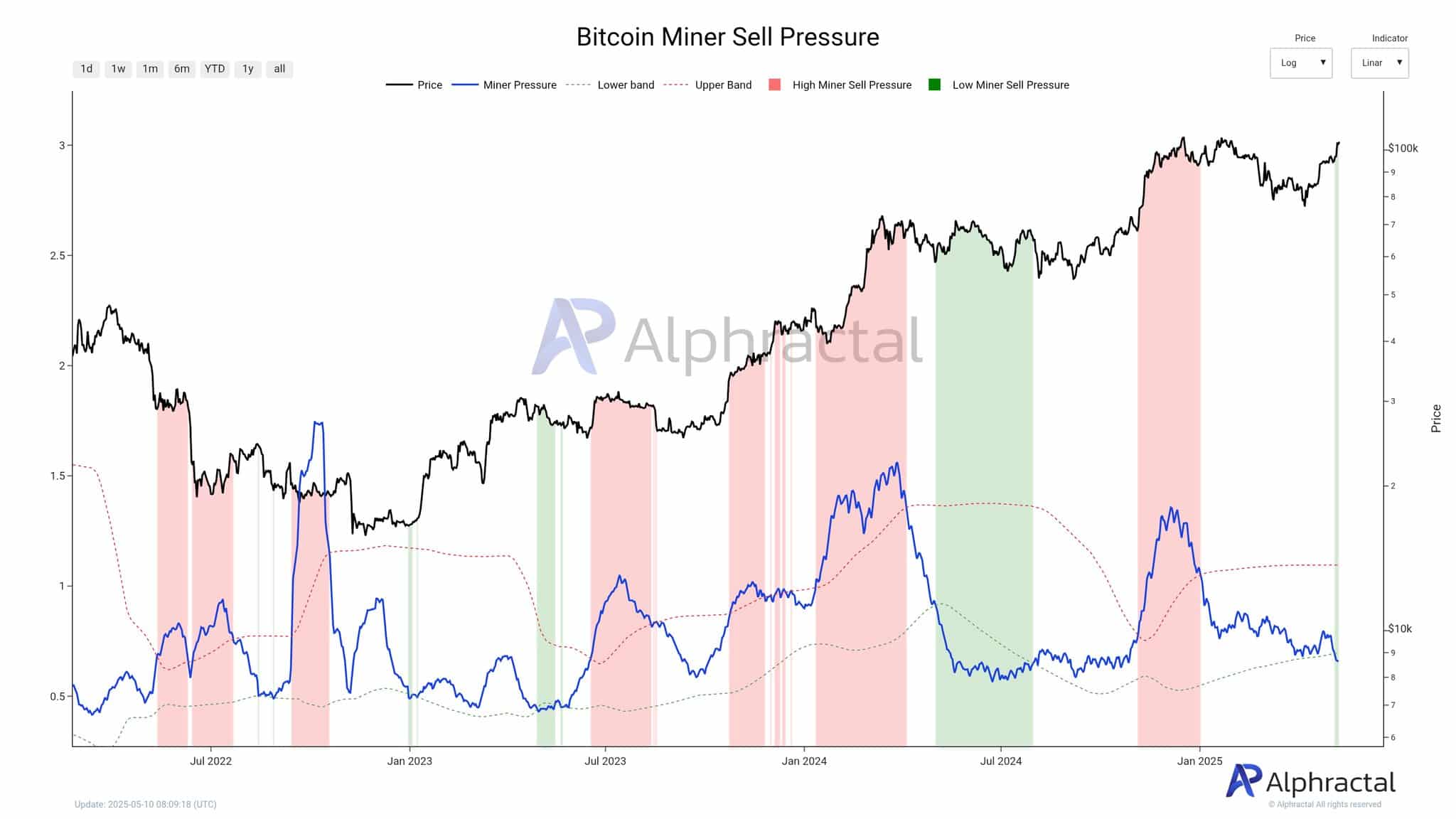

Bitcoin miner sell pressure has dropped to its lowest level since early 2024, according to Alphractal data, with the miner pressure metric now hugging the lower band. This indicator, which compares 30-day miner outflows to average reserves, suggests that miners are choosing to hold rather than sell – a historically bullish signal for price stability.

Source: Alphractal

The last time pressure was this low, Bitcoin entered a period of relative calm before its next major move. However, with leveraged long positions building up, any abrupt price shift could prompt miners to reconsider their stance, potentially reigniting volatility.

Longs in the danger zone?

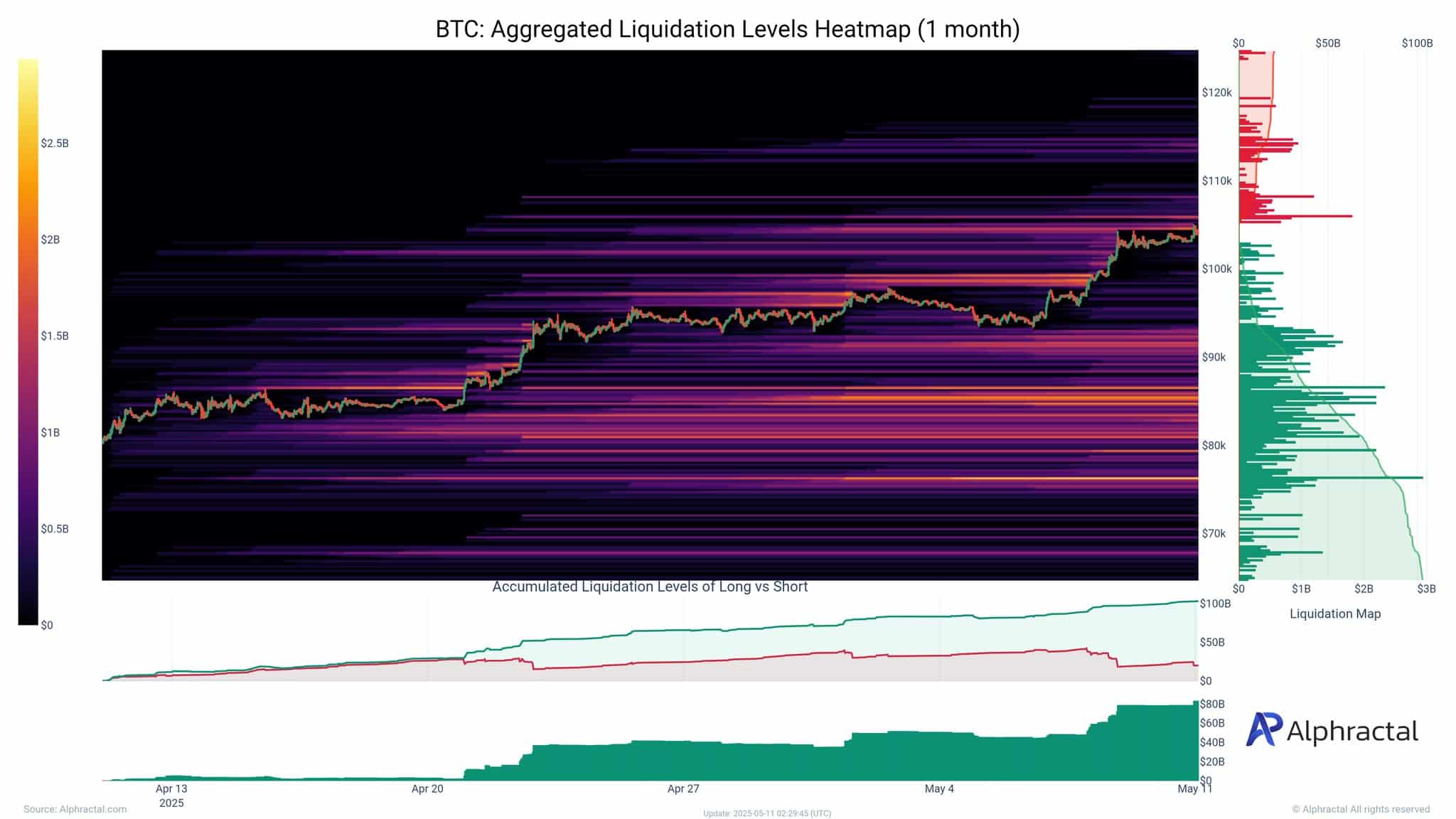

While miners are holding firm, the derivatives market is a bit more fragile. BTC’s liquidation heatmap reveals a significant accumulation of high-leverage long positions, especially between $100K and $110K.

Source: Alphractal

The risk? A swift move downward could cascade into billions in liquidations, intensifying volatility. With nearly all recent growth in open interest driven by leveraged longs, the market is heavily tilted – offering opportunity, but also sharp downside risk.

Bitcoin’s price outlook

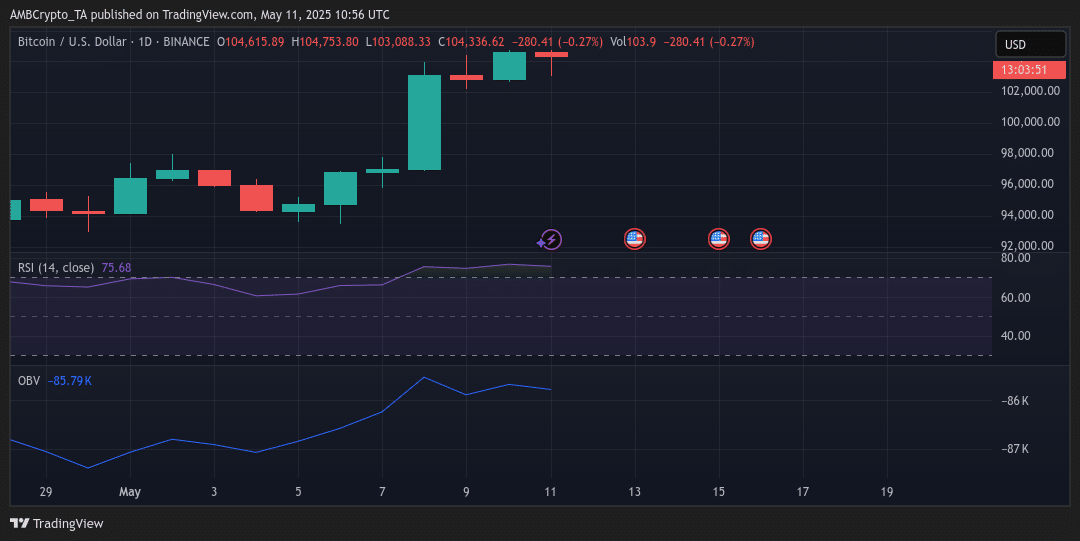

At press time, BTC was trading at $104,336, a modest intraday decline of 0.27%. Despite the minor pullback, BTC remains above the critical $100K support level. The RSI was hovering around 75; overbought conditions indicate a potential cooldown.

Source: TradingView

Meanwhile, the OBV had flattened after recent gains, suggesting buyer momentum may be slowing. With bullish sentiment still intact but leverage risks looming, BTC could either consolidate above $100K or face a sharp correction if selling pressure returns.

Conclusion

In summary, while Bitcoin miners show increased confidence with reduced selling pressure, the presence of heavily leveraged long positions raises concerns about potential volatility. As traders navigate this landscape, maintaining awareness of fundamental trends and market sentiment is key for future positioning.