A comprehensive review has exposed rampant fraud within Pump.fun, an altcoin issuance platform operating on the Solana $175 Blockchain. According to a Solidus Labs report, over seven million altcoins created via this platform between January 2024 and March 2025 had only a 1.4% survival rate. The remaining 98.6% turned into classic rug-pull or pump-and-dump schemes, adversely affecting investors. Pump.fun became a hub for coin speculation, lured by Solana’s low transaction fees and user-friendly DEX interface.

Pump.fun Report Reveals Startling Data

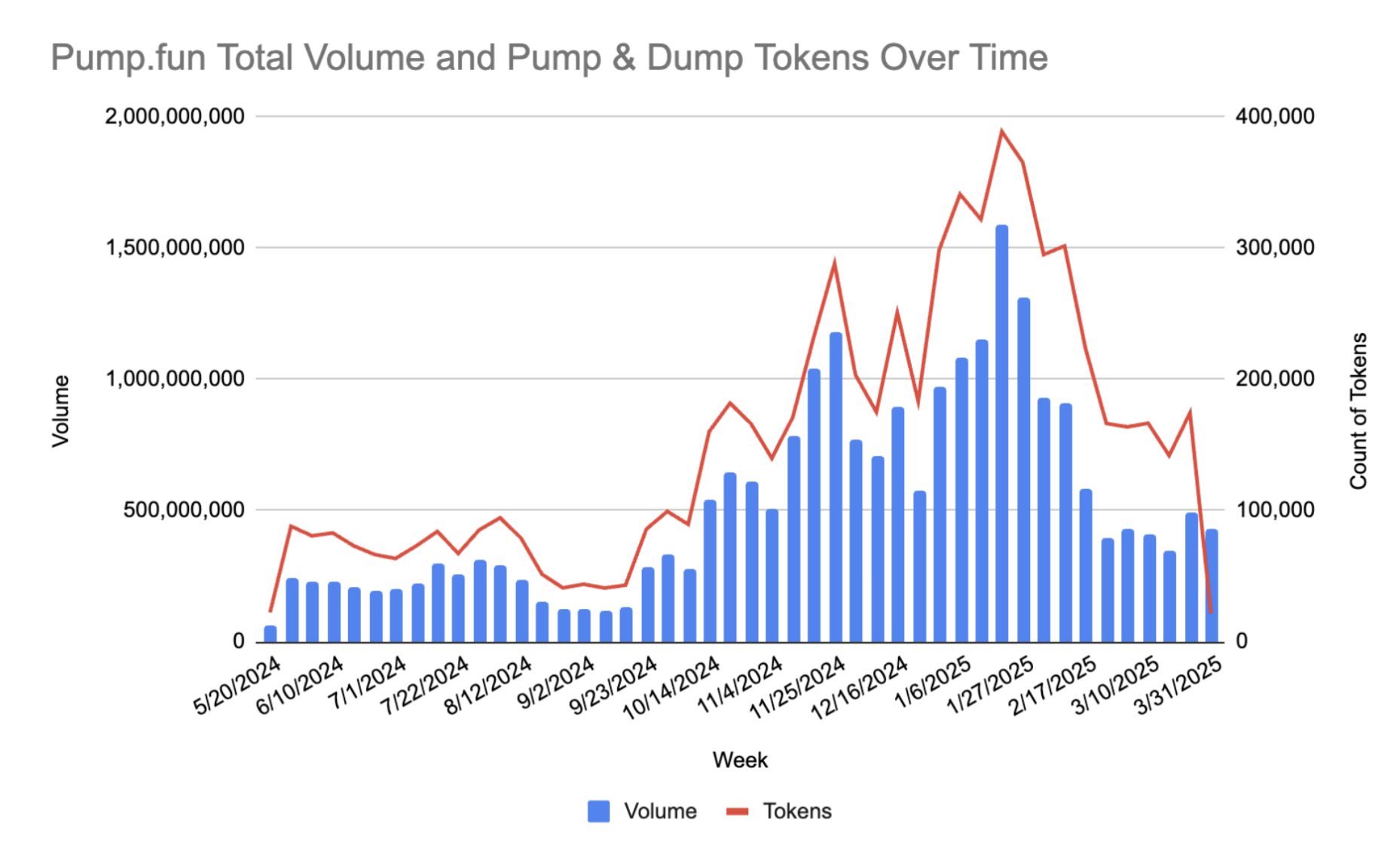

Altcoins traded on Pump.fun showed a daily volume exceeding 100 million dollars, with the report indicating that this activity was primarily fueled by short-term profit seekers. Pine Analytics’ research, covering the same period, highlighted a practice known as “same-block sniping,” where transactions occur within the same block as coin issuance, giving creators an advantage. On Raydium DEX, 93% of the examined 388,000 liquidity pools showed sudden liquidity withdrawal activities.

Solidus Labs’ meticulous analysis revealed that of the 7,050,000 coins generated on Pump.fun with at least five transactions, only 97,000 managed liquidity over a thousand dollars. The rest, at 98.6%, quickly lost value, resembling Ponzi-like structures. This scenario demonstrates the exploitation of the platform’s user-friendly interface and low fee policy.

For altcoin creators, the platform’s automated market maker (AMM) model and its bonding curve caused prices to multiply with each purchase, allowing early entrants to gain high returns while subsequent participants suffered losses. This imbalance, growing with the site’s popularity, increased the number of victims.

Expected Outcome: Pump.fun Faces Legal Troubles

In January, Pump.fun faced two class-action lawsuits, accused of violating U.S. securities laws. The complaints emphasized unregistered coin offerings and a roughly 500 million-dollar fee imposition, shaking investor confidence.

In December, due to creators’ offensive live streams to pump prices, Pump.fun temporarily suspended its broadcasting features. Following this move, the platform’s weekly revenue plummeted from 22 million dollars to nearly zero. On-chain data shows a direct correlation between this revenue crash and the regulatory action.

Experts advise more caution against traps formed by sudden liquidity withdrawals and unlimited coin creation. The pervasive fraud wave within the Solana ecosystem necessitates regulators and exchange platforms to reassess their oversight mechanisms.