Solana (SOL) Traders Shift Gears as Rising Short Interest Signals Caution

Solana's recent bullish rally faces headwinds as its long/short ratio drops and market sentiment turns bearish, raising concerns of a price dip.

Popular altcoin Solana has witnessed a 30% rally over the past 30 days. It has traded within an ascending channel since mid-April, highlighting the surge in buying pressure in the market.

However, this bullish momentum now appears to be facing a significant headwind, as traders’ sentiment begins to shift.

Solana’s Long/Short Ratio Hits Monthly Low

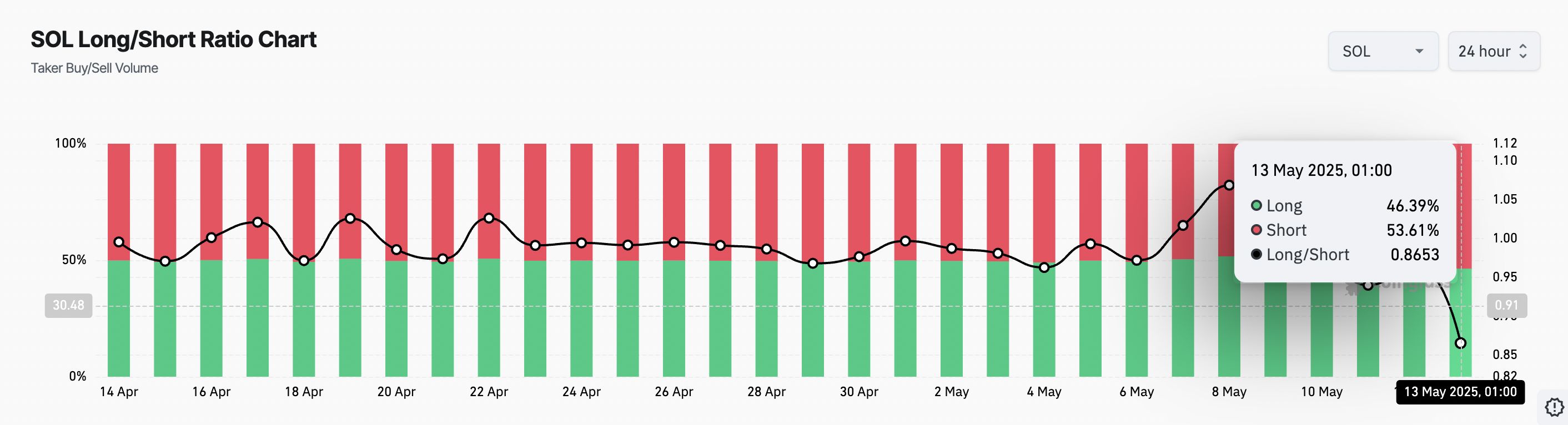

According to Coinglass data, Solana’s long/short ratio has dropped to 0.86, its lowest level in the past 30 days. This decline indicates that bearish sentiment is at its highest point in a month, with traders increasingly favoring short positions over longs.

SOL Long/Short Ratio. Source:

Coinglass

SOL Long/Short Ratio. Source:

Coinglass

The long/short ratio measures the proportion of long positions to bearish short ones in the market. When the ratio is above one, there are more long positions than short ones. This indicates bullish sentiment, with many traders expecting the asset’s price to rise.

On the other hand, a long/short ratio below one signals a preference for short positions as traders bet on an asset’s price decline.

For SOL, the dip in the ratio indicates a growing number of traders are positioning for a pullback, as they expect the coin’s rally to lose more steam. If this trend continues, SOL could face short-term pressure, increasing the likelihood of consolidation or a drop from its recent highs.

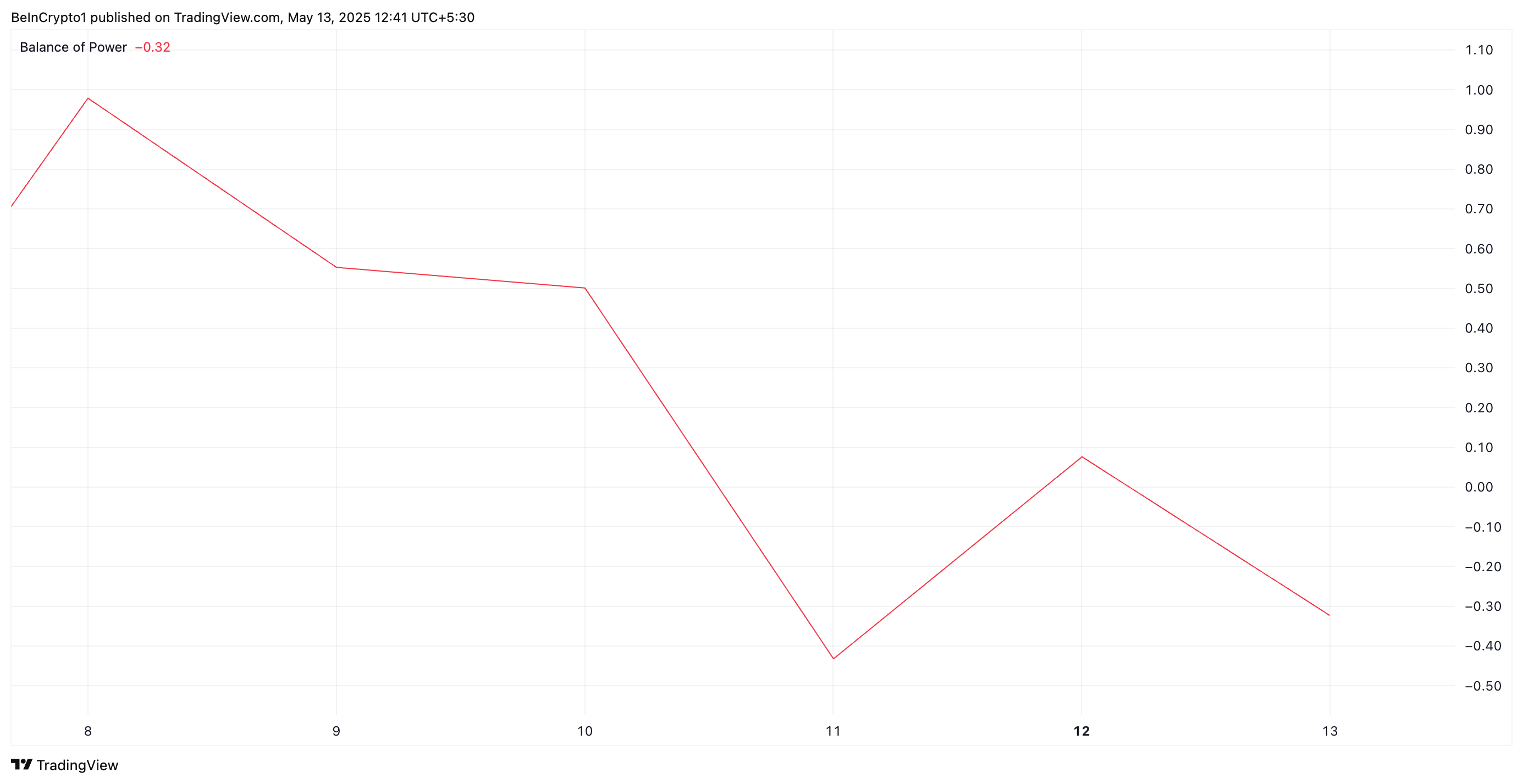

Furthermore, on the daily chart, SOL’s negative Balance of Power (BoP) confirms this bearish outlook. As of this writing, this key momentum indicator stands at -0.32.

SOL BoP. Source:

TradingView

SOL BoP. Source:

TradingView

The BoP indicator measures the strength of buying versus selling pressure in an asset’s price action. When it is negative, it signals that sellers are currently dominating the market, suggesting increased profit-taking or bearish momentum.

Solana Faces Sell Pressure as Market Cools

Amid the broader market decline of the past day, SOL’s price has fallen by 3%. If short interest continues to rise and sell pressure builds, the coin could struggle to maintain its recent breakout levels in the days ahead.

In this case, SOL’s price could break below the lower line of its ascending channel, which currently forms support at $161.85. A break below this level strengthens the price dip and could force SOL to drop to $142.32.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

However, if the bulls regain dominance and buying pressure spikes, SOL’s value could climb to $181.45.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services