Experts Debate the Return of Retail Investors as Bitcoin, Ethereum Climb

Bitcoin's record-breaking surge past $100,000 and Ethereum's climb to $2,500 reignite the debate over retail investor involvement. Experts and data present conflicting signals, with online search trends rising while actual trading activity remains tepid.

The crypto market is showing mixed signals regarding retail investor participation, especially as Bitcoin surpasses $100,000 and altcoins like Ethereum draw increased attention.

Some believe retail investors are returning, while others remain more cautious. Let’s analyze the latest data and expert opinions to clarify the picture.

Mixed Signals About Retail Investor Presence

S4mmyEth from Decentralized AI Research pointed out a notable indicator: a sharp rise in Google search interest for “Etherium” (a common misspelling of Ethereum) in Australia over the past 30 days.

Search Trends For “Etherium” Over The Past Month. Source:

S4mmy

Search Trends For “Etherium” Over The Past Month. Source:

S4mmy

“Retail is coming. There’s been a spike in Google search trends for ‘Etherium’ rather than Ethereum,” S4mmy predicted.

Google Trends data shows a significant increase at the end of April and the beginning of May, with peak interest. S4mmy also noted similar spikes for other misspelled keywords like “Etherum,” “Eferium,” and “Ifirium.” These trends suggest a wave of interest from users unfamiliar with the correct terminology—a common sign of retail investor activity.

However, not everyone agrees with S4mmy’s perspective. Nic, co-founder of Coin Bureau, offered a different view.

According to Nic, the recent surge in altcoin prices, including Ethereum, may stem from institutional investors or whales—those holding large amounts of crypto. In addition, capital-allocated investors are showing a shift in sentiment, with growing expectations for an upcoming altcoin season.

“Retail isn’t here. This isn’t a retail-driven altcoin pump. It’s crypto natives chasing price coming back for another run at altseason,” Nic stated.

Recent reports from BeInCrypto also highlight this changing investor sentiment, which has been influenced by improving macroeconomic factors such as easing tariff tensions.

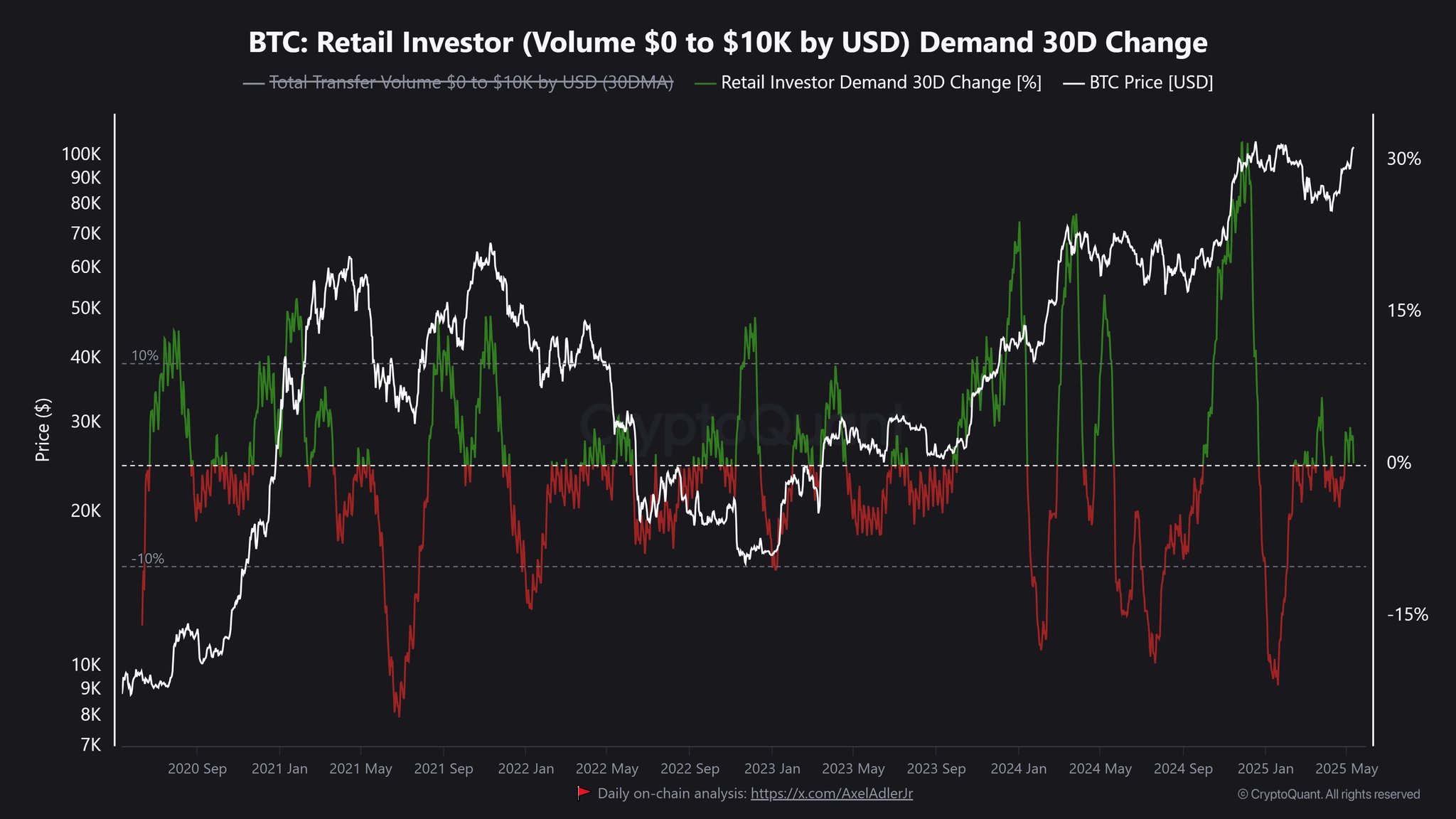

It’s not just Ethereum. Bitcoin also lacks small-volume transactions, typically linked to retail investors. Data from CryptoQuant reveals that transactions between $0 and $10,000 haven’t increased, even as Bitcoin crossed the $100,000 mark.

BTC: Retail Investor (Volume $0 to $10K by USD) Demand 30D Change. Source:

CryptoQuant

BTC: Retail Investor (Volume $0 to $10K by USD) Demand 30D Change. Source:

CryptoQuant

Nic’s argument gains further support from data provided by Wu Blockchain. Their latest report shows no signs of recovery in exchange trading volume or traffic over the past month.

Specifically, spot trading volume across exchanges fell by an average of 12.3%, with Binance’s spot volume dropping 16.8%. Additionally, exchange traffic declined by 8% on average, with Binance down 16% and Coinbase down 14%.

These figures suggest that despite recent price rallies, the absence of retail investors may make the uptrend unsustainable.

Alternatively, retail interest may be limited to online searches and has not yet translated into actual trading activity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services