Bitcoin has found a place in Bank of Russia’s latest report evaluating returns on various investment options available on the Russian market.

Purchases of the leading cryptocurrency have proved to be more profitable than gold, stocks and bank deposits in the past year, the regulator’s stats show.

Russia’s central bank adds Bitcoin to its financial overview

The cryptocurrency with the largest market cap is now on the radar of Russia’s monetary authority. The Central Bank of Russia ( CBR ) has included Bitcoin (BTC) in its latest study of financial instruments available to Russian investors.

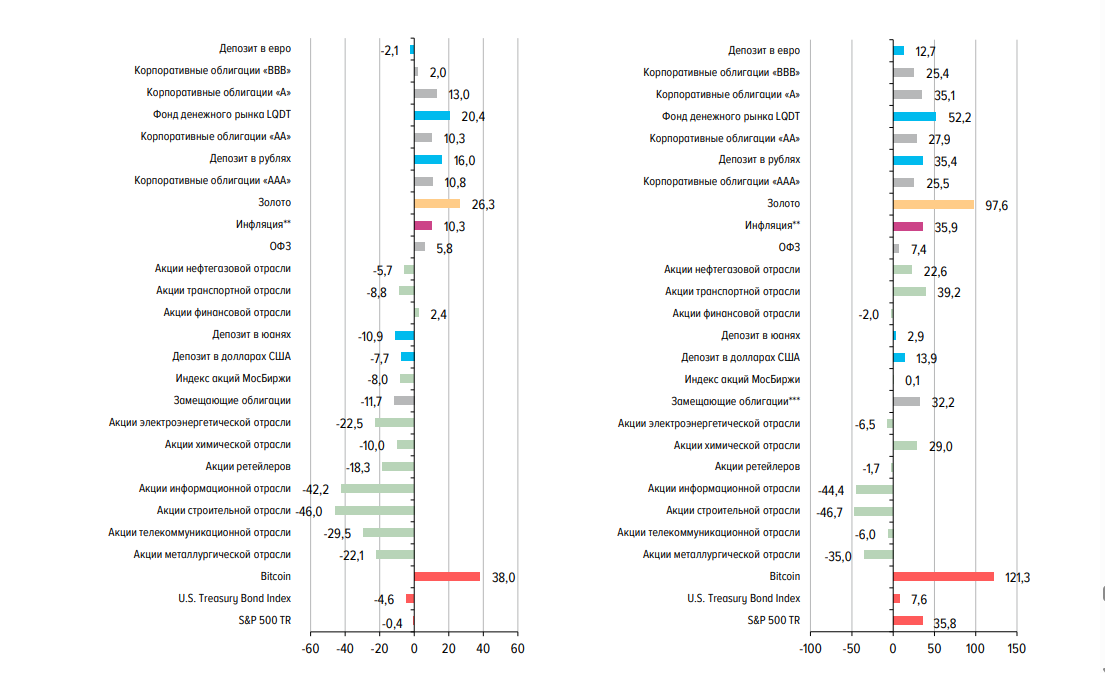

According to the numbers published by the regulator in the last edition of its Overview of Financial Market Risks, Bitcoin yielded better profits than all surveyed investments over the past 12 months, providing a rate of return of 38%.

The oldest crypto left behind traditional assets such as gold (26.3%), Russian ruble deposits (at 16%), and stocks represented by the S&P 500 TR index, which declined by 0.4%. Russian inflation was 10.3% during the same period.

Deposits in major foreign fiat currencies were all in negative territory, including the U.S. dollar (-7.7%), Chinese yuan (-10.9%), and euro (-2.1%). Тhe greatest losses, however, were recorded for shares in the construction and information technology sectors, over -40% in both cases.

Returns on Bitcoin investments exceed 120% since 2022

Bitcoin dwarfs other investment options when it comes to long-term profitability, Bank of Russia data indicates. It gained 121.3% since the beginning of 2022, much more than stocks and bonds. At 97.6%, gold is the only other asset that comes close.

The Russian ruble inflated by 35.9% while ruble deposits returned 35.4% over the past three years. The CBR notes that its yield calculations are based on the full actual ruble yield for the period, while exchange rates have been taken into account when evaluating instruments denominated in foreign currencies.

Return on investments in Russian financial market instruments over the last 12 months and since 2022 (%). Source: CBR.

Return on investments in Russian financial market instruments over the last 12 months and since 2022 (%). Source: CBR.

The trend hasn’t been so positive for Bitcoin in the first months of this year, when the profitability of BTC declined by 18.6%. Meanwhile, gold returns barely remained above zero between January and April 2025, at 0.7%, while euro and dollar deposits lost 11.9% and 19.4%, respectively.

Then, in April, the major cryptocurrency returned to positive growth rates and scored 11.2%, outperforming all other entries in the Bank of Russia survey by a wide margin. For comparison, euro deposits were a distant second, at 4%.

Russia’s attitude towards crypto is still complicated

The Russian Federation is yet to legalize cryptocurrency, including it as a financial investment instrument. Despite recognizing Bitcoin in this role in its profitability report, the CBR remains strongly opposed to permitting its free circulation within the Russian economy.

In March, the central bank suggested the establishment of an “experimental legal regime” to help Russian companies use digital coins in cross-border settlements. It also proposed to allow a limited number of “ highly qualified ” investors to put money into crypto assets.

To fall in that category, private individuals would have to prove investments in securities or deposits exceeding 100 million rubles (approx. $1.25 million at the time of writing) and annual income from the past year of more than 50 million rubles ($625,000).

Meanwhile, in another study released in early April, the CBR acknowledged that Russians have tripled their investments in cryptocurrencies in the past three years. The bank also registered a six-fold increase in Russian investments in precious metals like gold and silver over the same period.

KEY Difference Wire : the secret tool crypto projects use to get guaranteed media coverage