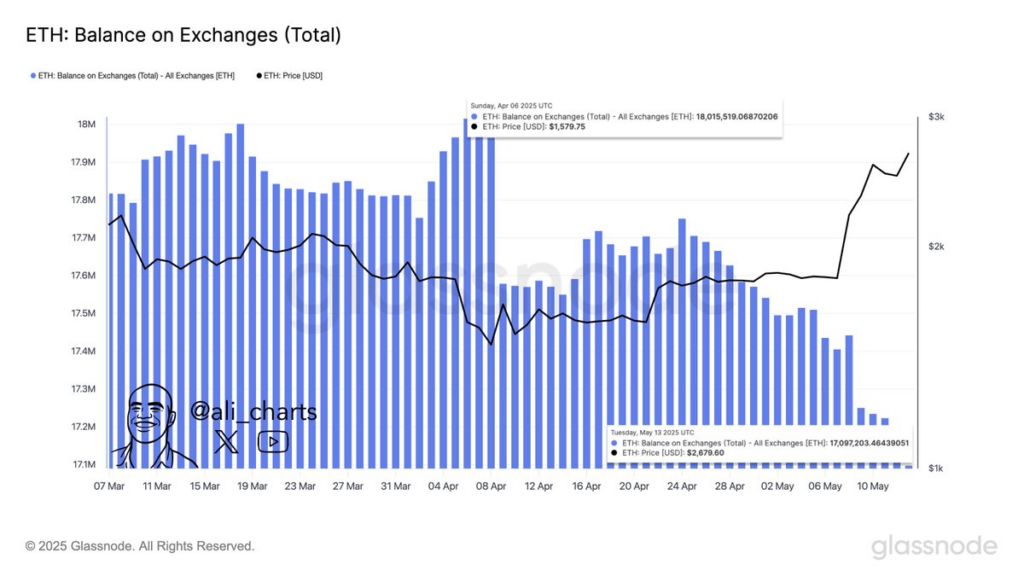

- Ethereum moved from $1579 to $2870 as over 917000 ETH left exchanges between April and May

- The exchange supply dropped from 18 million to 17.09 million in just over thirty days of activity

- This level of outflow may reduce sell pressure and drive stronger support during any future price pullback

Ethereum’s total exchange balance dropped from 18.01M to 17.09M ETH between April 8 and May 13, 2025. This decline of nearly 1 million ETH comes amid a rapid price increase from $1,579.75 to $2,870.60. Analysts are tracking this outflow as a potential bullish supply signal.

Source:

X

Source:

X

Exchange Balances Decline as ETH Price Surges

The recent data, shared by market analyst Ali on May 15, 2025, highlights a steep decrease in Ethereum held across major exchanges. ETH balances peaked at over 18 million coins on April 8, then fell sharply by over 917,000 ETH within five weeks. As of May 13, the total stood at 17,097,203 ETH.

This decline in exchange balances coincided with a strong uptrend in ETH’s market value. The price increased from $1,579.75 to nearly $2,870, gaining over 81% in that same timeframe. Historically, large-scale exchange withdrawals are often viewed as signs of reduced selling pressure.

When tokens are moved off exchanges, they typically shift to cold storage or private wallets. This behavior signals investor intention to hold, not sell. Consequently, lower exchange balances can reduce available supply, potentially driving prices higher.

Supply Shift Sparks Talk of Bullish Shock

The rapid drop in available ETH supply has drawn the attention of market participants. Ali’s post, viewed nearly 20,000 times, stated, “Nearly 1 million Ethereum $ETH have been withdrawn from exchanges in the past month.” Community reactions suggested anticipation of a supply-driven rally.

Users have responded by labeling the development a “bullish supply shock.” Such an event occurs when demand rises while liquid supply falls, often resulting in price spikes. In this case, the timing has coincided with a parabolic ETH price movement in early May.

On-chain analytics platform Glassnode provided the chart data used in the analysis. The visual shows a strong divergence between ETH balances on exchanges and price action. While the balance decreased, the price steadily moved higher, indicating potential market optimism.

Is Ethereum Entering a New Accumulation Phase?

This shift in ETH from exchanges raises one key question: Is Ethereum now entering an extended accumulation cycle?

Exchange outflows of this scale usually follow or precede long-term accumulation by institutions or experienced holders. The consistency of the decline suggests more than retail withdrawal patterns. The steep pace, almost 1 million ETH in a month, marks one of the largest outflows in recent months.

As ETH prices have surged above $2,870, the reduced exchange supply could create support in case of pullbacks. Supply shocks of this nature can reduce downward volatility. With fewer coins available for sale, even modest buying pressure may push prices higher.