Bitcoin Price Crashes, But $2.8 Billion Accumulation Prevents Further Losses

Bitcoin’s price correction finds support from $2.88 billion in recent buys. Strong accumulation near $102,734 may fuel a rebound, but long-term holder exits could still threaten a drop to $100,000.

Bitcoin has faced notable volatility in recent days, with strong market growth on Sunday, followed by a complete wipeout on Monday.

Despite these fluctuations, the hope for a recovery remains, fueled by FOMO (fear of missing out) and greed-driven investors. These sentiments could play a crucial role in Bitcoin’s price movement.

Bitcoin Investors Are Bullish

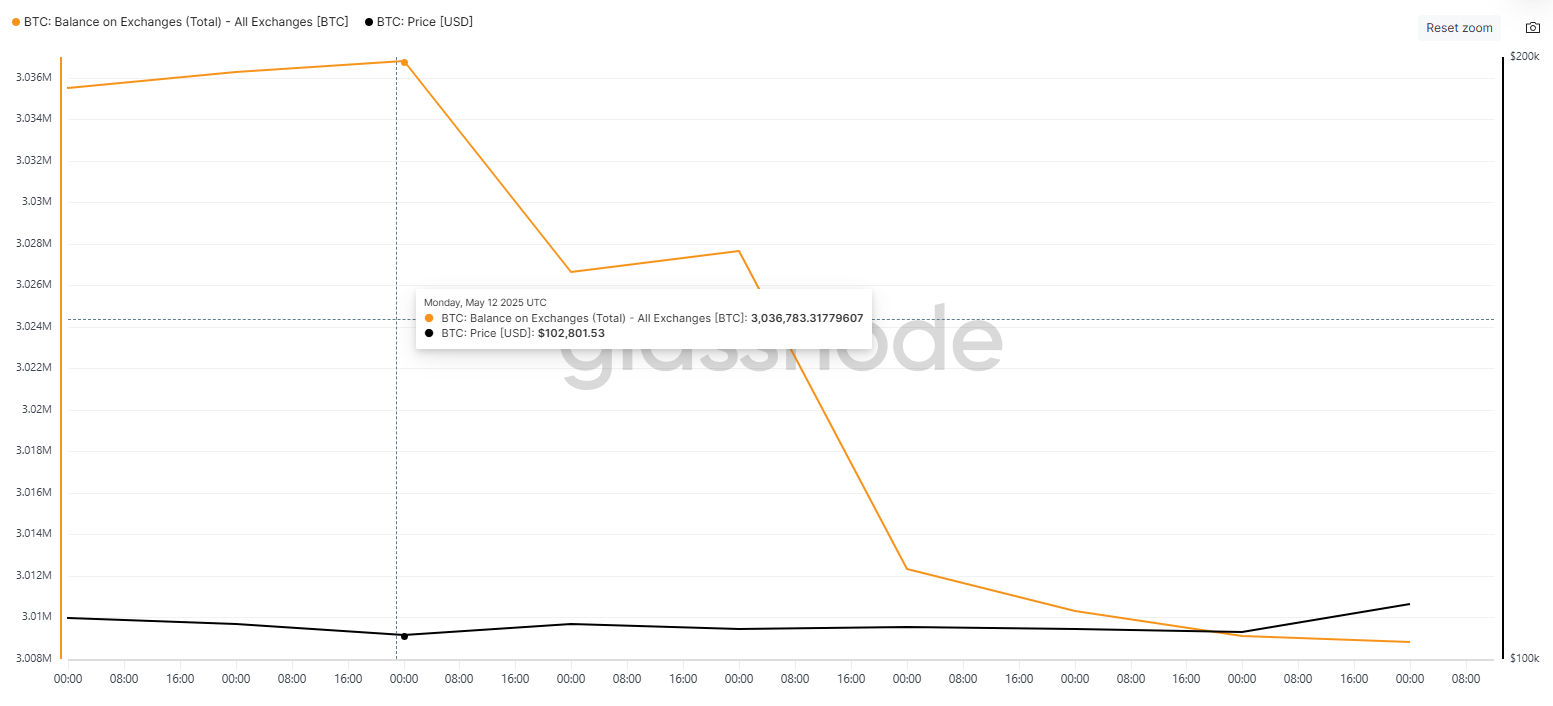

The continued decline in exchange balances signals a pattern of accumulation. Over the past week, more than 27,976 BTC, worth over $2.88 billion, was purchased by investors. This has reduced the available supply to approximately 3 million BTC.

The idea that Bitcoin has not yet reached its all-time high (ATH) encourages further investment, as many believe the current price levels represent an opportunity that won’t last long. FOMO remains a significant driver, as retail and institutional investors alike bet on Bitcoin’s future potential.

Bitcoin Balance on Exchanges. Source:

Glassnode

Bitcoin Balance on Exchanges. Source:

Glassnode

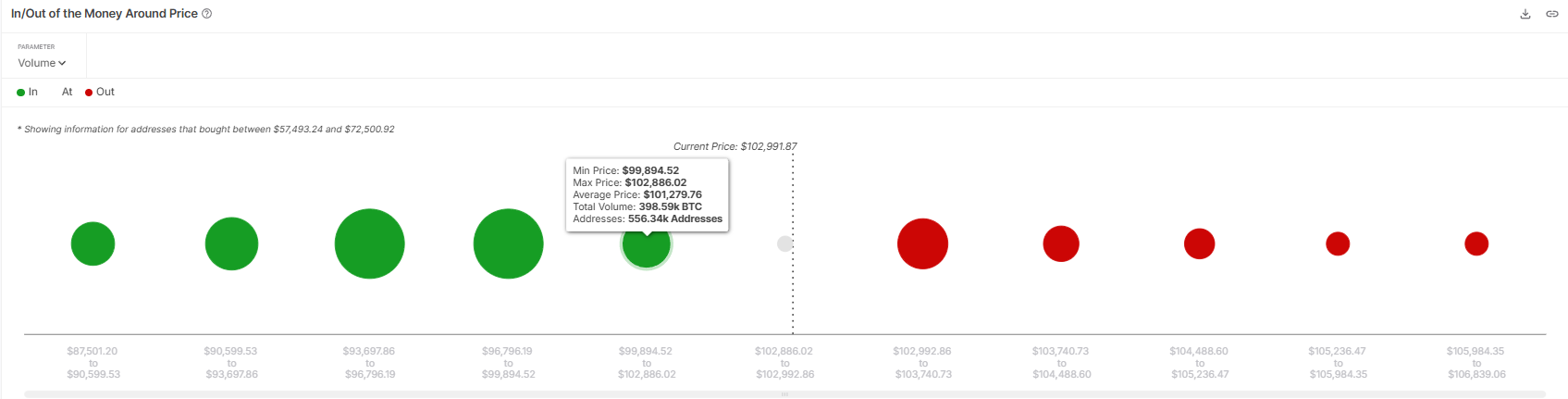

The IOMAP (In/Out of the Money Around Price) indicator suggests that Bitcoin has strong support around the $102,886 to $99,894 range, where investors have accumulated over 398,590 BTC worth more than $41 billion. This makes the region a strong buying zone, with many investors holding onto their positions in anticipation of Bitcoin’s next upward movement.

A decline below this support is unlikely because investors are waiting for a price increase rather than selling. In addition to the strong accumulation zone, the general market sentiment is bullish. The ongoing support at these levels reinforces the view that Bitcoin is positioned to continue its rise.

Bitcoin IOMAP. Source:

IntoTheBlock

Bitcoin IOMAP. Source:

IntoTheBlock

BTC Price Can Bounce Back

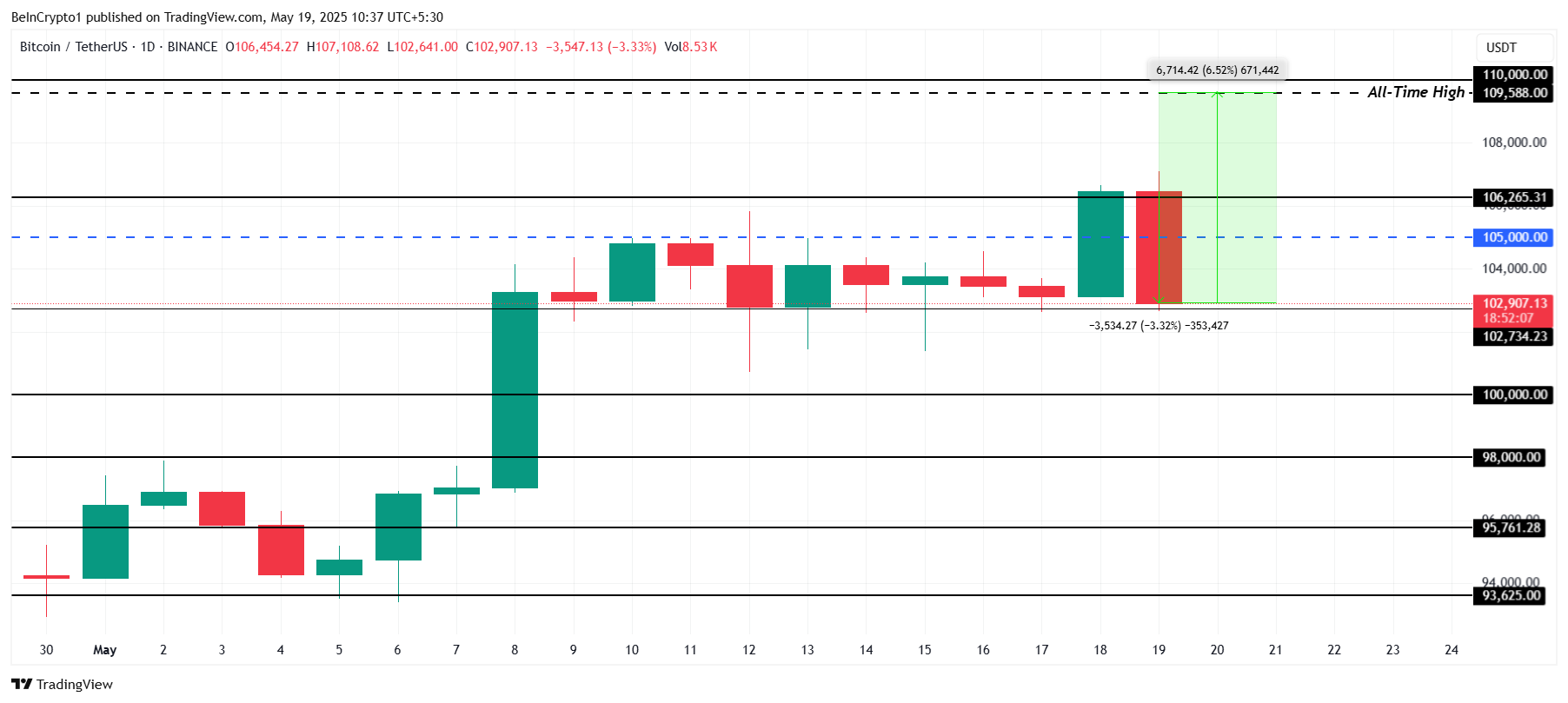

Bitcoin is currently trading at $102,907, just above the critical $102,734 support level. Despite today’s 3.3% drop, further price declines seem unlikely due to the strong demand zone just below this level. Buyers appear willing to step in at these price points, suggesting stability in the short term.

With Bitcoin having briefly risen to $107,108 earlier in the day, it seems likely the cryptocurrency will recover its losses. Investor accumulation is expected to push Bitcoin higher, and it could breach the $105,000 level again, forming consolidation above the $102,734 support. This would set Bitcoin on course for continued growth, bringing it closer to its ATH of $109,588, which it stands 6.5% away from.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, the bullish outlook could be invalidated if long-term holders (LTHs) decide to sell off their positions to secure profits. If this happens, Bitcoin’s price could slip below the critical $102,734 support, potentially bringing it down to the $100,000 range.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Market Thrives as Ethereum Gains and ARB Coin Potential Rise

In Brief The crypto market shows signs of activity ahead of the Fed meeting. Ethereum's strong performance is sparking widespread interest. ARB Coin shows potential with consistent TVL growth.

The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

Record Outflow on Solana ETFs, 21Shares' TSOL Crypto ETF Loses $42M in Record Time

$93.5K Rejection Adds To Bitcoin's Technical Woes