4 US Economic Indicators with Crypto Implications This Week

This week, four major US economic indicators—Jobless Claims, PMIs, and Home Sales—could shift Bitcoin’s trajectory. As macro trends loom large, traders are watching for signs of weakness that could fuel crypto gains.

After last week’s US CPI (Consumer Price Index) and PPI (Producer Price Index) — two key economic indicators that influence the Federal Reserve’s monetary policy — traders and investors continue to watch data points with crypto implications.

Crypto markets will watch four US economic indicators this week as the influence of macro events on Bitcoin (BTC) continues to grow.

Top US Economic Data For Crypto Markets This Week

The following US economic data could influence sentiment for Bitcoin and crypto this week.

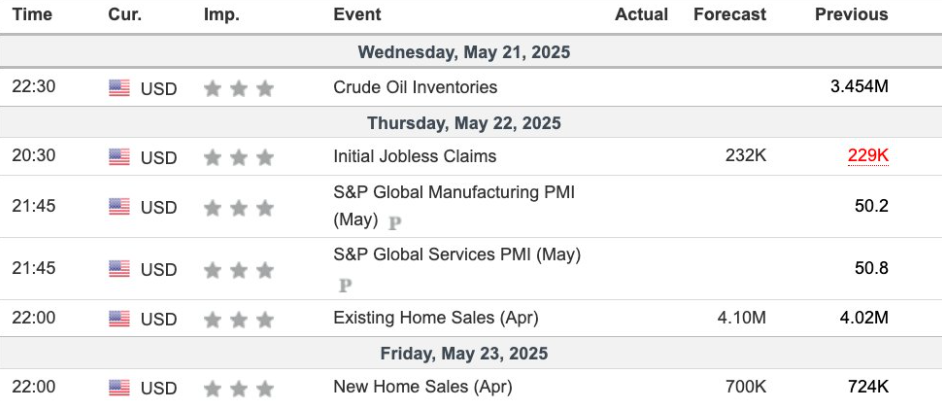

US economic indicators this week. Source:

Trading Economics

US economic indicators this week. Source:

Trading Economics

Initial Jobless Claims

Initial Jobless Claims, reported weekly, measure the number of individuals filing for unemployment benefits for the first time. This indicator reflects labor market health for crypto markets, influencing investor sentiment and monetary policy expectations.

“…A core labor market indicator that could shift market expectations on Fed policy,” noted an indicator expert in a post.

Data on Trading Economics shows a consensus forecast of 232,000 after a previous reading of 229,000. This indicates that economists projected economic weakness last week, a sentiment that could boost crypto if investors seek hedges against uncertainty.

Conversely, initial jobless claims below the 229,000 seen in the week ending May 17 would signal a strong economy. This could strengthen the USD and pressure risk assets like Bitcoin, as it may tilt the odds in favor of tighter monetary policy.

Against this backdrop, crypto traders will monitor this data, which is due on Thursday, for volatility. It influences USD strength and Fed rate decisions.

Recent trends show there have not been any signs of labor market stress, suggesting stability despite tariff-related uncertainties.

Services PMI

Released monthly by S&P Global, the Services PMI gauges activity in the US services sector. This US economic indicator covers areas like transport, finance, and hospitality.

For crypto markets, the Services PMI influences risk sentiment and USD dynamics. A reading above 50 indicates expansion, while readings below 50 signal contraction.

Strong data, such as April’s Services PMI at 50.8, suggests economic resilience, potentially strengthening the USD and reducing appetite for speculative assets like Bitcoin. On the other hand, weak data, potentially below last month’s 50.8 reading or 50.0, can fuel crypto rallies by signaling slowdowns.

Crypto traders track this indicator for its impact on macroeconomic trends, as services account for a significant portion of US GDP.

With forecasts for May’s flash PMI at 50.8, a drop below 50 could boost Bitcoin by highlighting economic fragility, especially amid tariff concerns.

The release on Thursday, May 22, alongside Manufacturing PMI and Jobless Claims, could amplify volatility, particularly if results diverge from expectations.

Manufacturing PMI

Reported by S&P Global, the Manufacturing PMI measures activity in the US manufacturing sector. Like with the Services PMI, a reading above 50 indicates expansion and below 50 signals contraction. For crypto markets, this indicator reflects industrial health and influences USD strength and risk appetite.

Recent tariff policies have strained manufacturing, with April’s PMI drop linked to supply chain disruptions. This increased crypto’s appeal as a hedge.

Crypto traders will watch Thursday’s flash PMI release for directional cues, with forecasts near 49.8. A reading below this projection could spark a crypto rally, signaling deeper economic challenges. However, if it comes in above 50, or above April’s 50.2, it may curb bullish crypto momentum.

“PMI data for April 2025 shows manufacturing contracting (PMI 50.2) and services slowing (PMI 50.8), signaling tariff impacts and domestic demand weakness,” one user noted on X (Twitter).

Existing Home Sales

The National Association of Realtors reports existing home sales monthly, which track the annualized rate of pre-owned home transactions.

The latest data shows a projected 700,000 sales for April 2025, down from March’s 724,000. For crypto markets, this indicator reflects consumer confidence and housing market health, indirectly shaping monetary policy and risk sentiment.

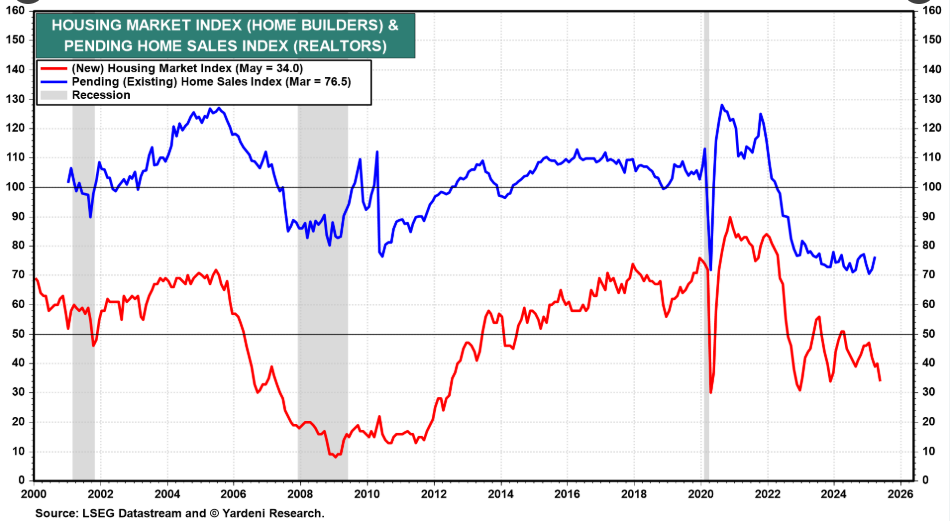

Existing and new home sales. Source:

Rymond Inc on X

Existing and new home sales. Source:

Rymond Inc on X

A sharp decline to 700,000 signals an economic slowdown, potentially boosting crypto as investors seek alternatives. This drop, combined with tariff pressures and high mortgage rates, could enhance Bitcoin’s appeal as a hedge, especially if paired with weak PMI or Jobless Claims.

“April Existing Home Sales are expected to reflect the housing market’s response to high interest rates and limited inventory,” a user on X remarked.

Conversely, if sales stabilize or exceed expectations, it may strengthen the USD, pressuring crypto prices as confidence in traditional markets grows.

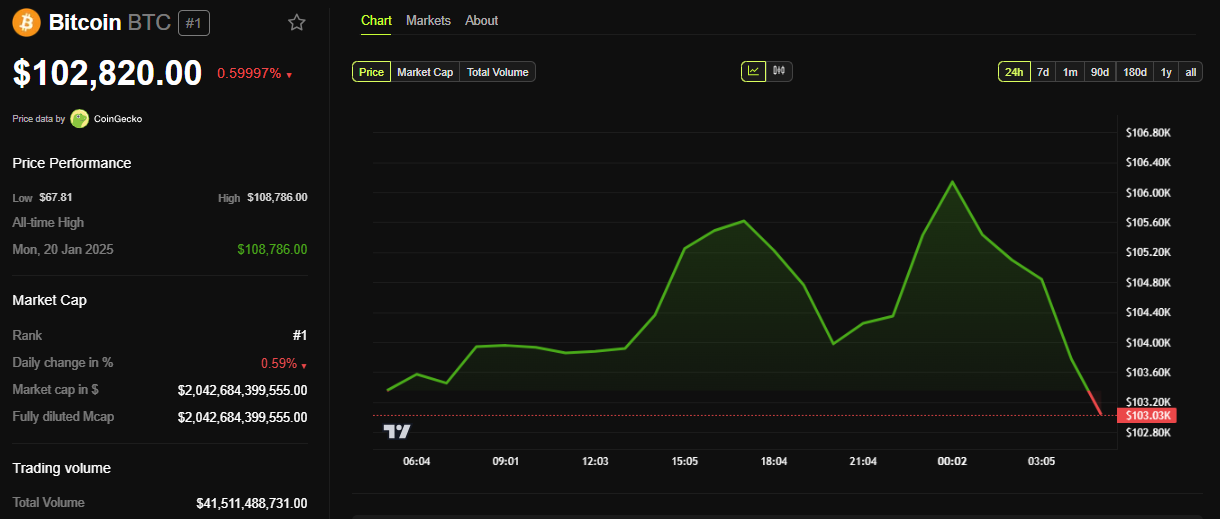

Bitcoin (BTC) Price Performance. Source:

BeInCrypto

Bitcoin (BTC) Price Performance. Source:

BeInCrypto

As of this writing, Bitcoin traded for $102,820, down by 0.5% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x POWER: Trade to share 4,387,500 POWER

New users get a 100 USDT margin gift—Trade to earn up to 1888 USDT!

Bitget Spot Margin Announcement on Suspension of DOG/USDT, ORDER/USDT, BSV/USDT, STETH/USDT Margin Trading Services

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!