Market Pulse: Week 21

Bitcoin hit $106K, pushing 97% of supply into profit - entering a high-risk, euphoric zone. ETF and Options markets remain strong, but cooling netflows and weakening Spot and Futures activity highlight slowing demand. A correction looms if fresh capital doesn’t return.

Overview

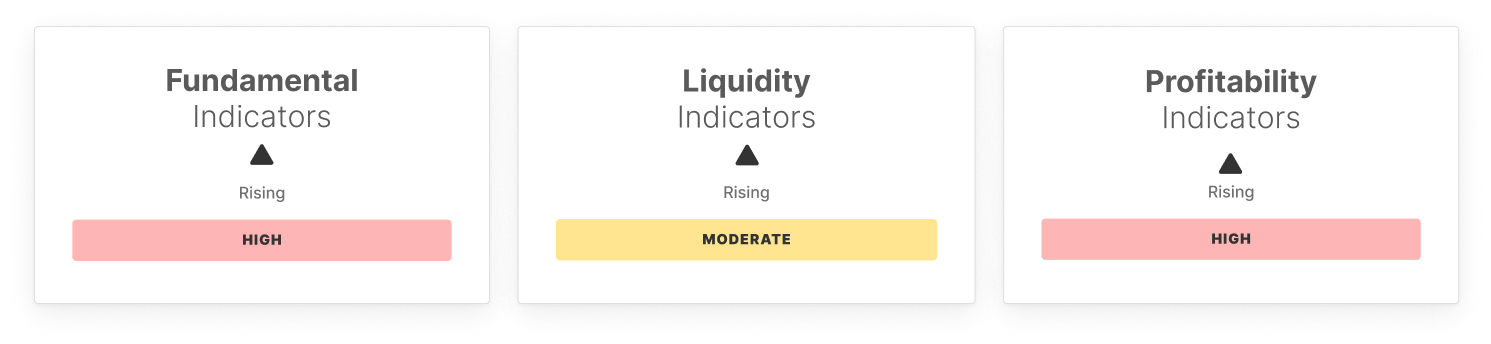

Bitcoin briefly pushed to $106K this week, elevating several key metrics into historically risky territory. The percentage of supply in profit surged to 97%, marking an entry into the euphoric zone. While the profitability intensity still has room to stretch higher, the dominance of profitable supply increases the risk of a corrective phase if new demand fails to keep pace.

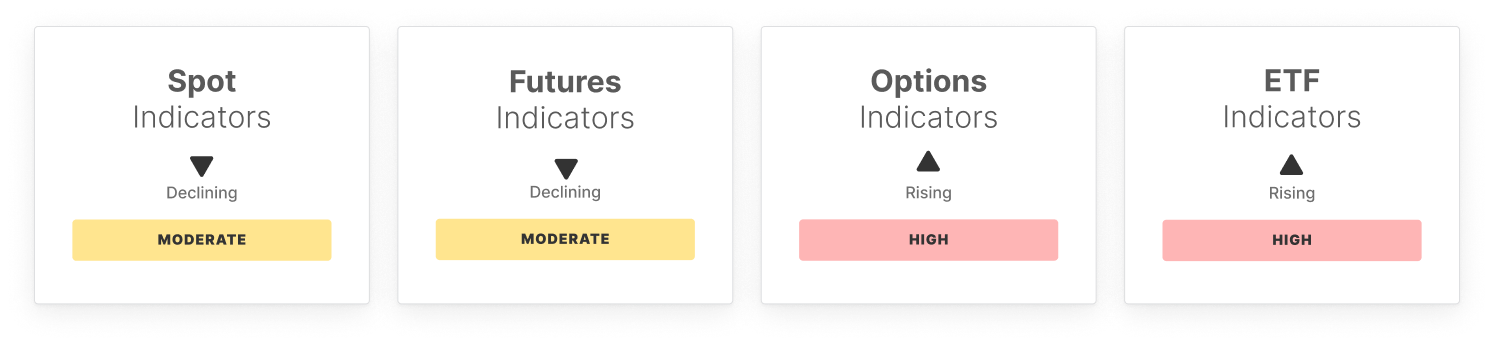

The ETF and Options markets continue to lead in terms of strength, with indicators for both rated High and Rising. Options open interest and volatility pricing are accelerating aggressively, while ETF MVRV reflects elevated unrealized profits. However, ETF netflows have cooled for the third week, signaling reduced fresh capital inflow, a key support that now shows fragility.

On the flip side, Spot and Futures markets are weakening, with indicators marked as Moderate and Declining for both. Spot volume dropped below the low band, and Spot CVD turned negative, confirming retail and discretionary buying pressure is fading. Futures open interest is still climbing, but funding and perpetual CVD suggest hesitance after a period of aggressive long buildup.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe now- Follow us and reach out on X

- Join our Telegram channel

- For on-chain metrics, dashboards, and alerts, visit Glassnode Studio

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies.

Please read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services