Are Tokenized Stocks the Next "ETF's" For Bridging Crypto With Equities?

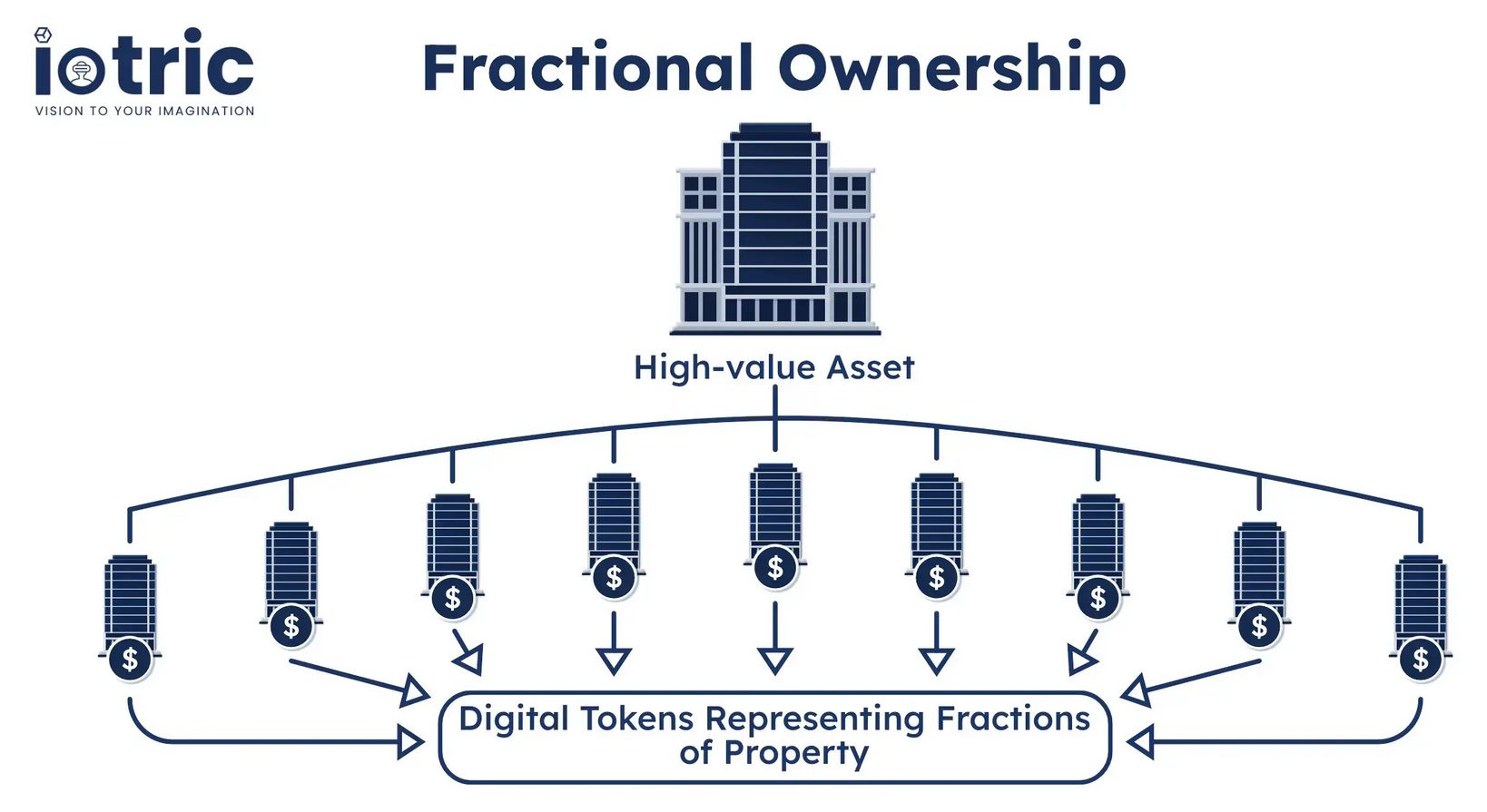

Are tokenized stocks a legitimate investment option? On the surface, they seamlessly blend traditional equities with the advantages of crypto blockchain technology. And unlike conventional shares stored in brokerage accounts, tokenized stocks exist as blockchain-based digital tokens, directly corresponding to actual company shares. This allows investors to easily buy fractional shares, removing the cost barriers often associated with traditional stock markets.

In early 2025, tokenized stocks saw a significant breakthrough when Coinbase announced plans to offer tokenized shares of its stock through Base, its Ethereum layer-2 network. This high-profile initiative not only illustrates growing mainstream adoption but also signals broader acceptance of blockchain-integrated financial products within traditional markets.

Liquidity improvements are one of the standout advantages of tokenized stocks. Traditional stock market trades can take days to settle, but blockchain transactions happen instantly, allowing investors to quickly capitalize on market-moving events. Platforms like AlloX now offer dedicated exchanges specifically designed for trading tokenized equities, providing 24/7 trading, lower fees, and immediate settlement—a notable upgrade from traditional stock exchanges.

Source: https://www.iotric.com/blog/what-is-fractional-ownership-in-real-estate-investment-with-blockchain/

Source: https://www.iotric.com/blog/what-is-fractional-ownership-in-real-estate-investment-with-blockchain/

Another critical development came with major institutions such as Citi and JPMorgan fully embracing tokenization by deploying on-chain products. Citi, for instance, partnered with SDX to tokenize shares of private, venture-backed companies, providing global investors easier access to otherwise restricted investment opportunities.

The growing market capitalization of tokenized stocks is a clear indicator of their rising popularity. By April 2025, the market cap of these digital assets surpassed $350 million, with projections from industry leaders suggesting it could eventually exceed $1 trillion.

But while tokenized stocks offer considerable benefits, regulatory clarity remains in a bit of a gray area. Under this pro-crypto presidency in the U.S, there could be more and more openings. And regions like Switzerland and the European Union have begun establishing clear frameworks to support tokenized securities, significantly boosting investor confidence and potentially driving even greater market adoption in the coming years.

Integrating tokenized stocks with crypto portfolios also presents exciting possibilities for traders. Crypto investors can easily convert their assets like Bitcoin or Ethereum into tokenized equities, helping diversify risk. This integration can contribute stability to crypto markets by linking them more closely with traditional, less volatile financial assets.

However, investors must remain cautious about potential risks associated with tokenized stocks. This announcement from @BackedFi on X below, for example specifically mentions that the tokenized version of Coinbase's stock ($COIN) is now available on the Base network. The tokens ($wbCOIN) are described as being fully backed, freely transferable, and representing a legal claim to the value of the actual Coinbase stock. The crowd's enthusiasm (and their 595K engagements to the post) was noticeable:

Companies exploring tokenized equity issuance have already demonstrated some pretty encouraging success. With institutions like BlackRock and JPMorgan developing real-world tokenization products, it's clear this trend will continue. Tokenization not only simplifies the capital-raising process for businesses but also reduces the operational complexities associated with managing traditional equities.

Looking ahead, tokenized stocks may help boost crypto adoption by providing traditional investors a familiar (yet exciting) gateway into crypto. Their ease of access, especially for smaller retail investors and international participants, can offer plenty of new investment opportunities. However, practical adoption depends on the level of regulation and security nations wish to implement on them. While they won't replace conventional markets, tokenized stocks can definitely help bridge the gap between digital and traditional assets, similar to the way Bitcoin and Ethereum ETF's have.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget adjusts the maximum leverage for spot cross margin trading to 5x

Bitget adjusts the maximum leverage for spot cross margin trading to 5x

Bitget adjusts the collateral ratios for cross spot margin trading pairs

MONUSDT now launched for futures trading and trading bots