ETH/BTC Pops 34 % in a Week—But History Says Altcoin Season Still a Long Shot

Ethereum’s breakout against Bitcoin has revived altcoin season discussions, but with low altcoin dominance, history suggests caution. Holding $2,814 is key for ETH to extend gains.

Ethereum has recently outpaced Bitcoin in growth, leading to a sharp rise in the ETH/BTC trading pair. This surge has sparked hopes of an upcoming altcoin season.

However, a closer look at historical data suggests that these expectations may be premature.

The Breakout That Imbued Hope

The ETH/BTC pair has recorded its first breakout since December 2024. For the first time in five months, the pair posted a higher low, which is generally considered a sign of an uptrend. This breakout is significant, marking a 34% rise in just one week.

Such a rise hasn’t been seen in almost three years. The last comparable surge occurred in July 2022 when the ETH/BTC pair shot up 56% in a month and a half. Despite this encouraging price action, it remains to be seen whether this momentum can sustain and spark a broad altcoin rally.

ETH/BTC Breaks Out. Source:

TradingView

ETH/BTC Breaks Out. Source:

TradingView

The rapid growth of Ethereum in 2022 offers insight into the current situation. Back then, Ethereum’s price surged by 121% in just over a month, climbing from about $1,800 to nearly $4,000. This impressive rally also managed to trigger a wider altcoin season.

Ethereum Price In 2022. Source:

TradingView

Ethereum Price In 2022. Source:

TradingView

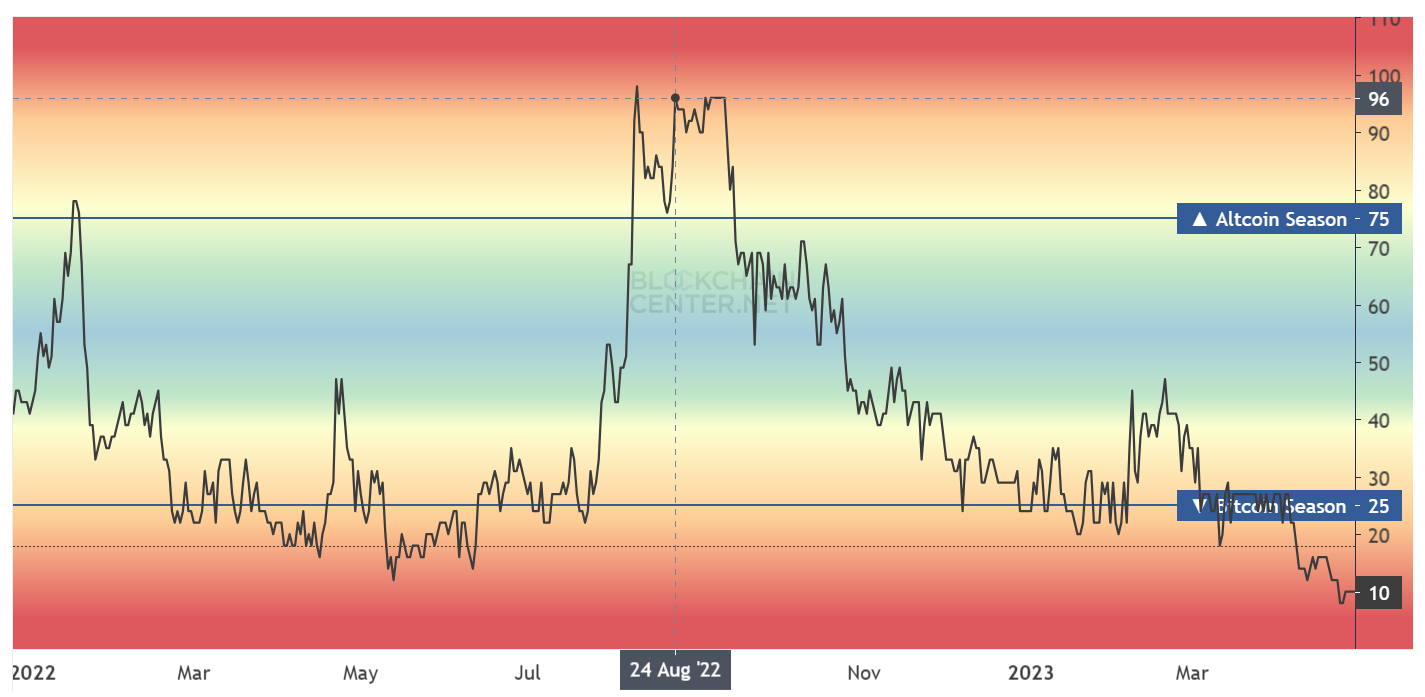

Historical data shows that following the July 2022 bull run, the market confirmed an altcoin season in August 2022. The critical condition was met: 75% of the top 50 cryptocurrencies managed to outperform Bitcoin over the last 90 days, with the altcoin index rising to 96. However, at the moment, the altcoin season index sits at 18, according to BlockchainCenter, indicating that Bitcoin still dominates.

Additionally, only 18% of the top 50 coins currently outperform Bitcoin. These metrics highlight that despite the recent ETH/BTC breakout, the likelihood of a full-fledged altcoin season remains low in the near term, but it is not completely out of the question. If the altcoins run up in the coming weeks by tagging on to Bitcoin’s growth, the market could witness an altcoin season before the end of Q2.

Altcoin Season Index Highlighting August 2022. Source:

BlockchainCenter

Altcoin Season Index Highlighting August 2022. Source:

BlockchainCenter

Can ETH Price Imitate The Past?

Ethereum’s price rally may not match the dramatic growth seen in July 2022. Although ETH has risen 32% over the past several days, it would require an additional 67% increase to reach $4,004 and replicate the previous surge, which would require consistent bullish market conditions.

Nevertheless, a more practical target for Ethereum would be to breach and hold the $2,814 support level. Successfully flipping this resistance into support could enable further gains, with a potential move beyond $3,000.

Ethereum Price Analysis. Source:

TradingView

Ethereum Price Analysis. Source:

TradingView

However, this bullish outlook depends on maintaining key support levels. If Ethereum fails to breach $2,654 and instead drops below $2,344 or even $2,141, it could erase recent gains and invalidate the positive price thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x POWER: Trade to share 4,387,500 POWER

New users get a 100 USDT margin gift—Trade to earn up to 1888 USDT!

Bitget Spot Margin Announcement on Suspension of DOG/USDT, ORDER/USDT, BSV/USDT, STETH/USDT Margin Trading Services

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!