QCP: If institutions like Strategy and Metaplanet reduce their purchasing efforts, it may reverse the current BTC upward trend

On May 21, according to QCP Capital's analysis, Bitcoin attempted to break through the $108,000 level today but failed, primarily due to a lack of sustained buying momentum. The current price trend is closely related to the buying behavior of the two major institutions, Strategy and Metaplanet, which remain the main buyers at the current price level. The analysis points out that the market is concerned these institutions may be the last marginal buyers, especially as Bitcoin approaches historical highs. If these institutions reduce their purchasing power, it could trigger profit-taking by other market participants and potentially reverse the current upward trend. QCP Capital notes that despite adverse factors such as rising bond yields, increased tariffs, and the risk of stagflation in the U.S. economy, Bitcoin has shown strong resilience over the past month. If it breaks new highs, it could trigger a new round of buying, bringing in off-market funds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

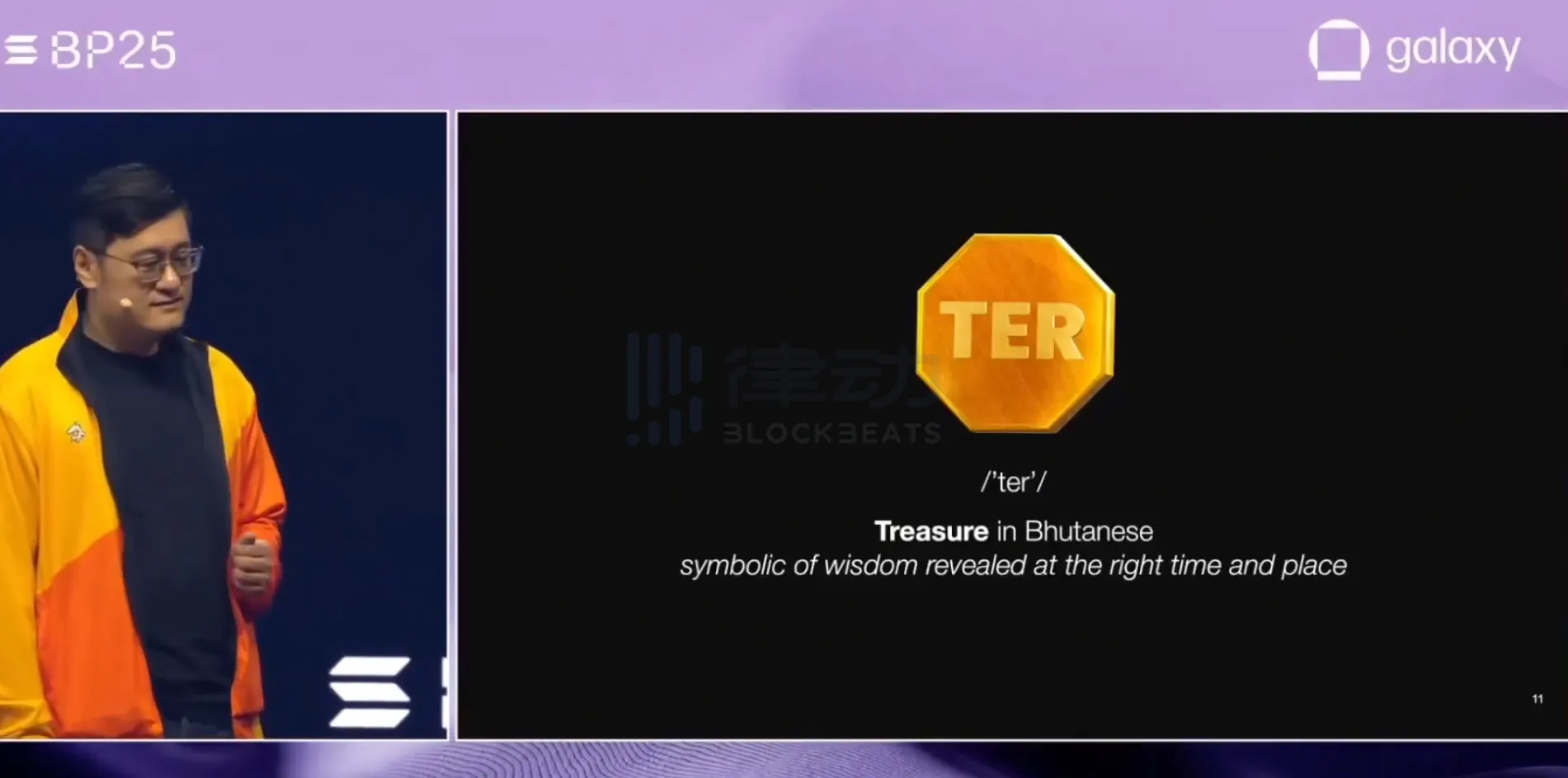

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana

dYdX launches spot trading on Solana and opens access to US users

JPMorgan issues Galaxy short-term bonds on the Solana network