Hyperliquid Nears All-Time High – What’s next for HYPE Price?

Hyperliquid (HYPE) is surging toward record highs with $56 million in monthly fees, yet RSI and BBTrend suggest caution amid rising volatility.

Hyperliquid (HYPE) is surging, up 24.5% in the last 24 hours and nearly 82% over the past 30 days. The platform continues to rank among the most profitable in crypto, generating $5.6 million in fees in the past day and $56 million in the last month—making it the 9th highest-earning chain or protocol.

As HYPE breaks above $33 and approaches its all-time high, technical indicators show both strength and potential warning signs. Momentum remains elevated, but overbought RSI levels and a sharp drop in BBTrend suggest short-term volatility could follow.

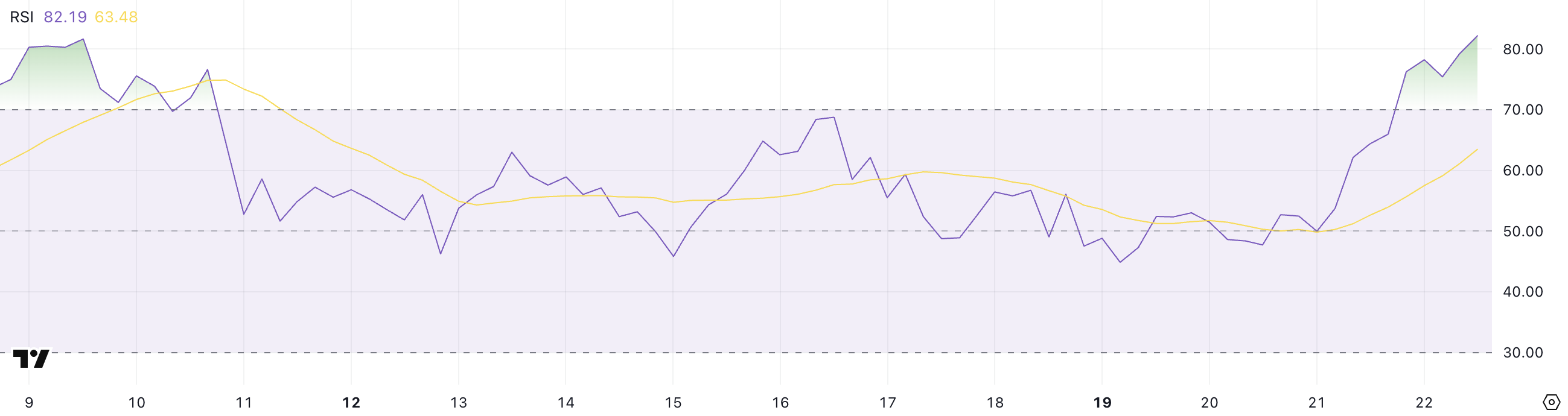

HYPE RSI Hits 82, Signaling Overbought Conditions After Sudden Surge

HYPE’s Relative Strength Index (RSI) has surged to 82.19, up sharply from 49.98 just one day ago—a strong sign of rapid momentum buildup.

The RSI is a momentum oscillator that measures the speed and change of price movements, ranging from 0 to 100.

Readings below 30 typically suggest an asset is oversold, while readings above 70 indicate it is overbought and may be due for a pullback or consolidation.

HYPE RSI. Source:

TradingView.

HYPE RSI. Source:

TradingView.

With HYPE’s RSI now well above the 70 threshold, the token is currently in overbought territory.

This level often signals that bullish momentum has stretched too far too quickly, increasing the likelihood of short-term corrections or sideways movement.

However, strong RSI readings can also persist in parabolic moves, especially if volume and market sentiment remain elevated. Traders will be watching closely for signs of weakening momentum or bearish divergence that could mark a potential reversal.

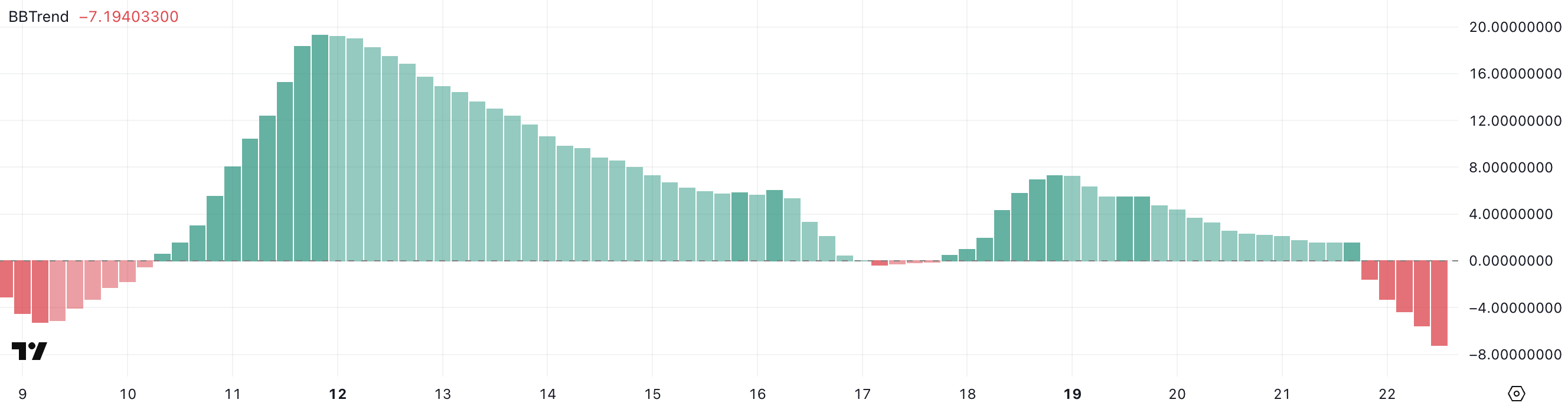

HYPE BBTrend Turns Negative, Signaling Sharp Momentum Reversal

HYPE’s BBTrend has dropped sharply to -7.19, down from 1.57 just a day ago, ending a three-day streak in positive territory. The BBTrend (Bollinger Band Trend) measures the strength and direction of price moves relative to the Bollinger Bands.

Positive values indicate upward momentum, while negative values suggest increasing downside pressure.

HYPE BBTrend. Source:

TradingView.

HYPE BBTrend. Source:

TradingView.

A BBTrend reading of -7.19 signals a sudden shift toward bearish momentum. This steep drop may reflect rising volatility to the downside and could lead to further selling if the trend persists.

For Hyperliquid, this reversal suggests caution—especially if it coincides with fading volume or key support levels being tested.

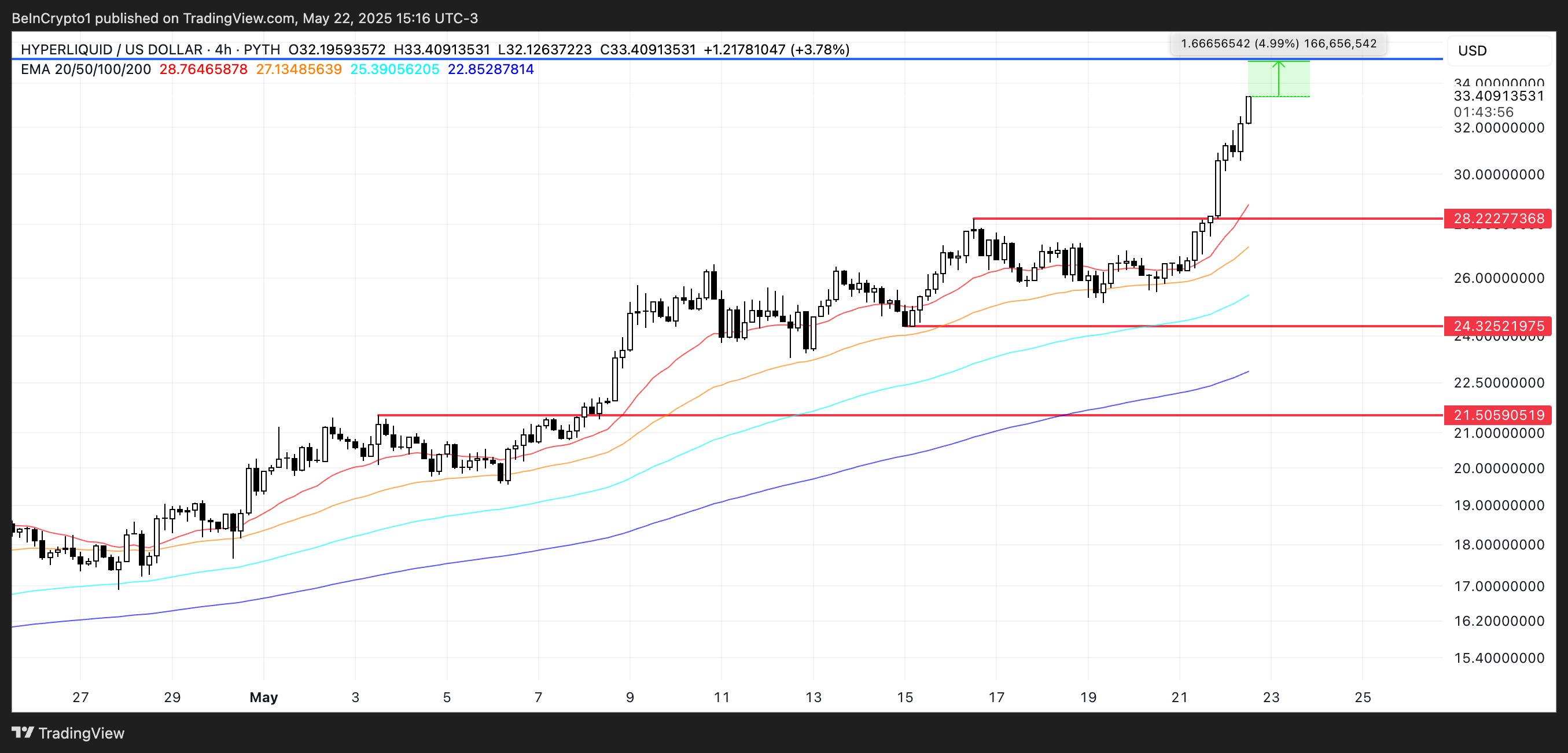

Hyperliquid Breaks $30, Just 5% From ATH—but BBTrend Flags Caution

HYPE is now just 5% below its all-time high, breaking above $30 today for the first time since December 2024.

The EMA structure remains strongly bullish, with short-term moving averages positioned above long-term ones—typically a signal of sustained upward momentum.

If the current trend holds, HYPE could break past $34 and potentially reach $35 in the near term.

HYPE Price Analysis. Source:

TradingView.

HYPE Price Analysis. Source:

TradingView.

However, the recent drop in BBTrend suggests the uptrend may be weakening.

If momentum shifts, Hyperliquid could test support at $28.2.

A break below that level could send the price down to $24.32, with further downside risk to $21.5 if bearish pressure intensifies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services