Dow Jones up 150 points, stocks inch up with U.S. debt in focus

U.S. stock indices edge higher despite rising bond yields and debt concerns.

U.S. stock indices inched up on Thursday, even as rising bond yields and concerns over mounting government debt cast uncertainty over the broader economy.

On May 22, the Dow Jones Industrial Average traded at 42,013 points, up 153 points or 0.36 percent. The S&P 500 rose 0.31 percent to 5,863 points, while the tech-heavy Nasdaq gained 0.59 percent, reaching 21,203 points.

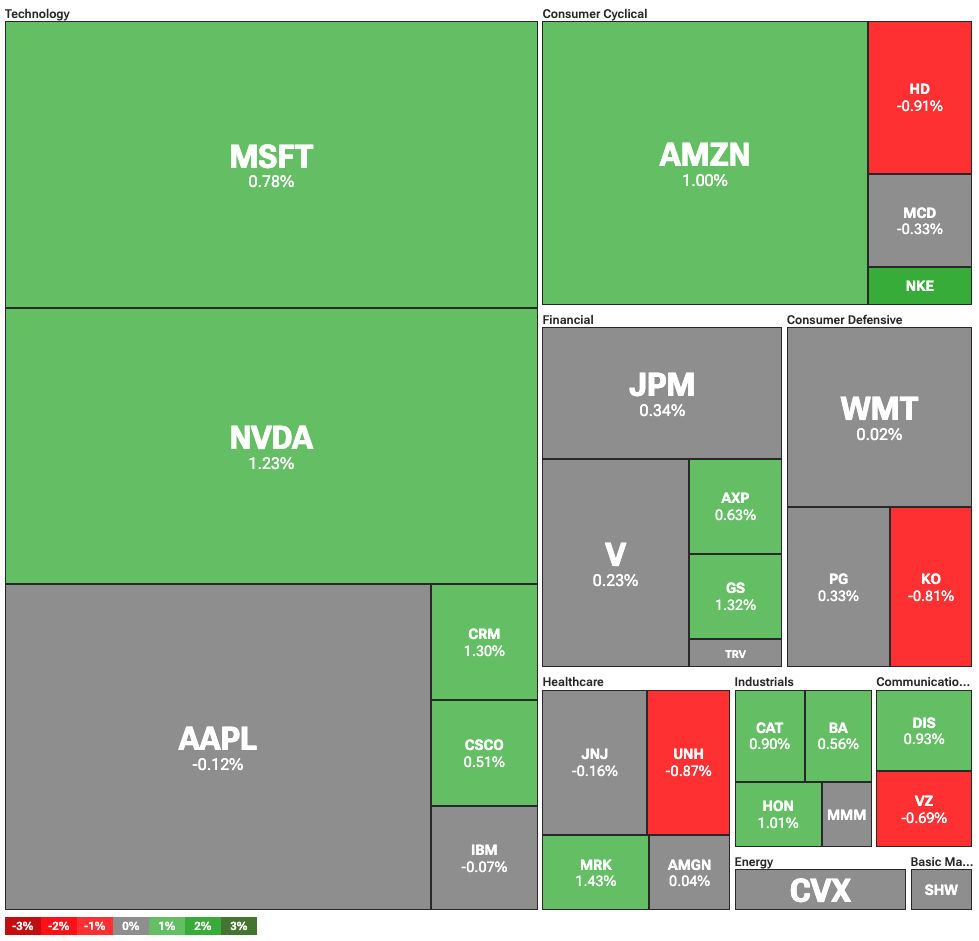

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Tech giants Nvidia, Amazon, and Microsoft were among the key drivers of the Dow’s performance, while Apple posted modest losses.

The market’s positive move came despite a climb in bond yields, which have failed to attract significant investor demand. Long-term U.S. Treasury yields crossed the 5 percent threshold, with the 30-year bond yielding 5.128 percent.

Typically, rising bond yields pull capital away from equities as investors seek stable, fixed returns. However, the attractiveness of Treasuries has declined, largely due to growing concerns over U.S. dollar-denominated debt and the expanding federal deficit.

Are bonds, or Bitcoin, a safe haven?

Uncertainty around U.S. fiscal policy has intensified after proposed tax cuts by former President Donald Trump were projected to significantly expand the national deficit. Combined with elevated Treasury yields, the cost of servicing government debt is expected to climb, prompting some investors to reconsider the role of bonds as a traditional safe haven.

Higher Treasury yields are also driving up mortgage rates. As of May 22, the average 30-year fixed mortgage reached 6.86 percent, the highest level since February. This rise in borrowing costs could reduce housing affordability and weigh on consumer spending, especially for homeowners with variable-rate loans.

Instead, an increasing number of traders are turning to alternative assets like gold and Bitcoin (BTC) . Bitcoin rose 4 percent on May 22, reaching a new all-time high of 111,970 dollars. Gold, on the other hand, slipped 0.49 percent and was trading at 3,298 dollars per ounce.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services