Ripple’s XRP Futures ETF Debuts on Nasdaq with Strong Demand

- XRP ETFs officially begin trading on Nasdaq

- XRP Gains Institutional Traction with Regulated Funds

- Investors assess the impact of ETFs on the price of XRP

The North American cryptocurrency market has gained a new investment instrument with the debut of ETFs XRP futures — XRPI and XRPT — on Nasdaq. These products arrive at a time of significant institutional movement and growing demand for regulated vehicles that allow exposure to cryptocurrencies beyond Bitcoin and Ethereum.

The new funds track XRP futures contracts traded on the CME, offering investors a structured way to speculate on the asset’s movements. With a 0,95% management fee and liquidity guaranteed by top-tier market makers and providers, the ETFs aim to appeal to both retail and institutional traders.

The launch comes amid a resurgence in interest in XRP, fueled by Ripple’s legal advances and the expansion of the derivatives market. This combination could bolster the digital asset’s position among the industry’s top performers.

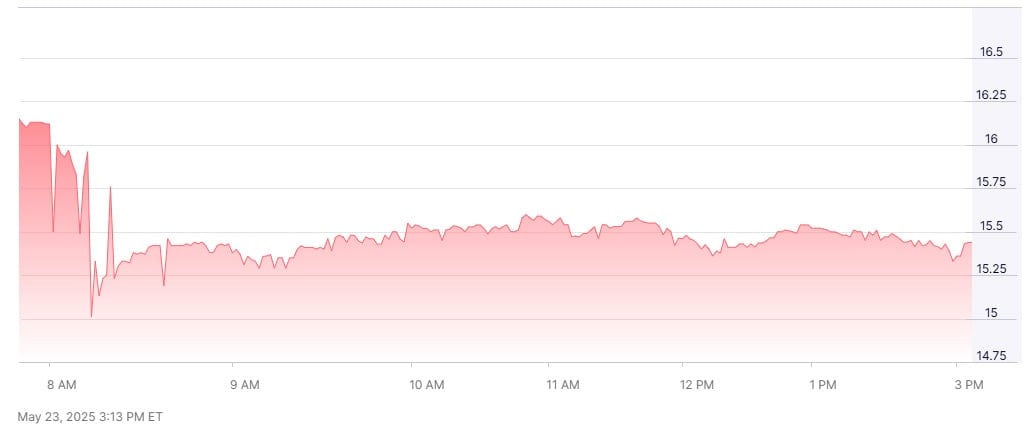

Volatility Shares Trust XRP ETF (XRPI)

According to initial pre-market data, the XRPI and XRPT funds are already showing strong uptake, with increasing volumes and robust movements in the first orders executed. The choice of Nasdaq for the launch reinforces the institutional appeal, with a compliance structure aligned with SEC requirements and custody guaranteed by qualified companies.

The launch also rekindles speculation about the future approval of an XRP ETF, similar to what is already happening with Bitcoin. Experts see the newly approved funds as a regulatory barometer and a possible bridge to products directly backed by XRP.

Despite the optimism, some analysts point to potential risks, such as tracking errors and contango impacts, which could affect returns when compared to directly purchasing the token.

The debut of ETFs comes in parallel with all-time highs in the Bitcoin derivatives market and record volumes in open interest, reinforcing the momentum of acceleration in the sector. With the consolidation of new products, XRP can expand its penetration and liquidity among large investors in the traditional financial market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services