Tesla accumulates more than US$ 1,25 billion in Bitcoin and reinforces institutional bet

- Tesla Holds Over $1,25 Billion in Bitcoin

- Institutions increase reserves with a focus on the long term

- Bitcoin Surpasses $108K With Institutional Support

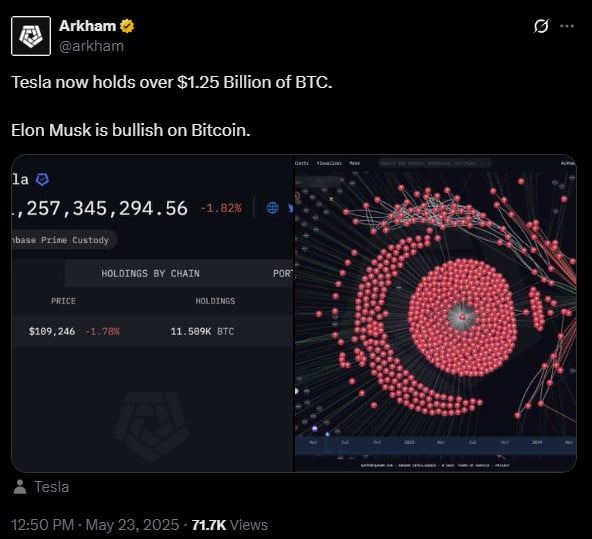

Tesla reaffirms its confidence in Bitcoin by maintaining one of the largest corporate positions in the cryptocurrency. According to data from Arkham Intelligence, Elon Musk's company holds approximately 11.900 BTC, currently valued at more than $1,25 billion.

This move solidifies Tesla as one of the leading institutional HODLers, reinforcing the growing role of large corporations in the cryptocurrency market. The decision to maintain this robust reserve amid volatility demonstrates a long-term vision, in line with the strengthening of Bitcoin’s thesis as a store of value.

Tesla’s history with Bitcoin began in 2021, when the company announced it had purchased $1,5 billion worth of BTC and considered accepting the cryptocurrency as payment for its vehicles. Although it paused that option over environmental concerns and liquidated a small fraction of the investment, the bulk of its reserves remained intact.

In its Q2025 XNUMX earnings report, Tesla confirmed that it has not made any moves on its Bitcoin holdings this year. This puts to rest rumors of a possible sale or restructuring of the company’s crypto portfolio.

Meanwhile, Bitcoin continues to trade above $108. This surge has prompted other companies to follow Tesla’s lead, including Michael Saylor’s Strategy, which recently increased its position by 1.895 BTC at an average price of $95.167. The company maintains the world’s largest corporate Bitcoin wallet, with over 555.000 BTC.

The movement of private institutions has also been accompanied by initiatives from state governments, which are now considering BTC as a strategic asset for their reserves.

Even with the slight 0,50% decline in Tesla shares, quoted at US$ 339,34, the company's positioning in relation to Bitcoin remains firm. The trend of continued institutional adoption shows how BTC is consolidating itself as a relevant asset in corporate treasury management.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone