Bitwise Anticipates A Record Influx Of $420 Billion Into Bitcoin By 2026

What if bitcoin became the new pillar of global finance? According to Bitwise, the trajectory is underway. The crypto index manager anticipates an unprecedented wave of investments: up to $420 billion by 2026. A projection that marks a strategic turning point for high net worth individuals, states, and asset managers.

In brief

- Bitwise forecasts up to $420 billion inflows into bitcoin by 2026, driven by ETFs, states, and large corporations.

- Three adoption scenarios are considered: $150 billion (cautious), $420 billion (central), and $600 billion (optimistic).

- Despite massive potential, regulatory hurdles persist, especially among asset management giants.

Bitcoin: an inflow of $420 billion in 2026?

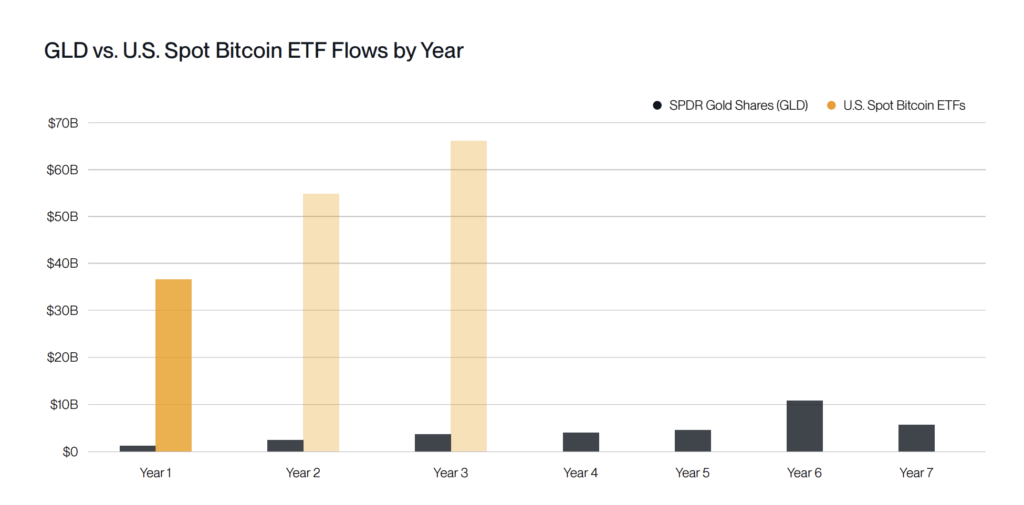

2025 and 2026 could be the tipping years for BTC, which has just broken a new all-time high at $111,000 . Indeed, Bitwise forecasts $120 billion inflows into bitcoin as soon as next year, before a second surge to $300 billion in 2026. This dynamic is based on a phenomenon already underway: the rapid adoption of Bitcoin ETFs, which attracted $36.2 billion in 2024.

Adoption forecasts for Bitcoin and Gold ETFs.

Adoption forecasts for Bitcoin and Gold ETFs.

The signals are strong. In one year, these products have reached $125 billion in assets under management! 20 times faster than gold-backed ETFs at their launch. For bitcoin advocates, it’s confirmation: the leading crypto is conquering its status as the safe haven asset of the 21st century. Three scenarios are emerging on the horizon:

Cautious scenario: $150 billion at stake

In its most moderate scenario, Bitwise imagines partial adoption. States would allocate only 1% of their gold reserves to bitcoin. Some American companies would hold a reserve of 10%, and asset management platforms would not go beyond 0.1%. Result: $150 billion inflows, a contained but real confidence signal.

Central scenario: $420 billion inflows

This is the scenario favored by Bitwise. Here, states reallocate 5% of their gold, companies double their exposure, and asset managers commit 0.5% of their portfolios. This movement would absorb 7.7% of bitcoin’s total supply. This would no longer be a speculative bet, but a true strategic realignment by major global economic entities.

Optimistic scenario: towards $600 billion

The most ambitious projection calls for massive adoption. States would allocate up to 10% of their reserves, sovereign wealth funds would fully position themselves, and companies would quadruple their holdings. Result: more than $600 billion inflows and 15% of the BTC supply absorbed. In this scenario, bitcoin would become the reserve asset of a post-dollar world.

A dynamic driven by bitcoin’s scarcity and the legitimacy of ETFs

With over 94% of the supply already mined, each BTC gains in scarcity. Major investors have understood this well: bitcoin is no longer a technological curiosity, but protection against inflation and monetary dilution.

The convergence between bitcoin and gold in terms of the Sharpe ratio also fuels this changing perspective. Even at Fidelity, the narrative is evolving: according to Jurrien Timmer, a BTC above $100,000 could seriously rival gold as a safe haven asset.

Persistent obstacles to overcome

But the inflow of $420 billion into bitcoin in 2026 remains fraught with pitfalls. Giants like Goldman Sachs or Morgan Stanley, managing more than $60 trillion in assets combined, continue to hamper access to these new products. Their regulatory caution still blocks several tens of billions in potential funds.

Yet the critical threshold could be crossed as Bitcoin ETFs establish a performance and compliance track record. And if this stage is passed, a flood of money could then crash into crypto markets.

By 2045, companies could hold 50% of bitcoins in circulation . At a time when $420 billion is about to flow in, a question arises: is Bitcoin becoming a tool of corporate sovereignty? Or will it remain the people’s asset? The debate is open.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The covert battle in the crypto industry intensifies: 40% of job seekers are North Korean agents?

The report shows that North Korean agents are deeply infiltrating the crypto industry using fake identities, accounting for up to 40% of job applications. They are obtaining system access through legitimate employment channels, and the scope of their influence far exceeds industry expectations.

Berachain exposed for signing dual contracts with VCs, allowing lead investors to invest without risk

Another VC has already lost $50 million.

Etherscan's Surcharge Scandal Exposes Ethereum Ecosystem's Data Dependency Dilemma

Etherscan's decision to stop offering free APIs across multiple chains has sparked an industry debate, reflecting a deeper contradiction between the commercialization and decentralization of blockchain data infrastructure.

SOL rebounds alongside wider crypto market bounce: Is $160 possible?