Date: Sun, May 25, 2025 | 11:10 AM GMT

The cryptocurrency market is cooling off slightly after a month of strong gains. Bitcoin (BTC) hit a fresh all-time high of $111,970 before retracing to $107,000, while Ethereum (ETH) touched $2,700 and is now hovering around $2,500.

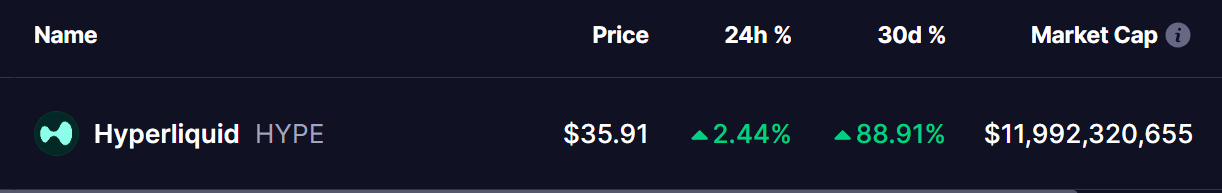

However, despite this mini pullback, one of the standout performers — Hyperliquid (HYPE) — is still trading in the green today with its impressive monthly gains of 88%. Now, a recognizable harmonic pattern is forming on the chart, hinting at a possible continuation of its strong upward trend.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Signals More Upside

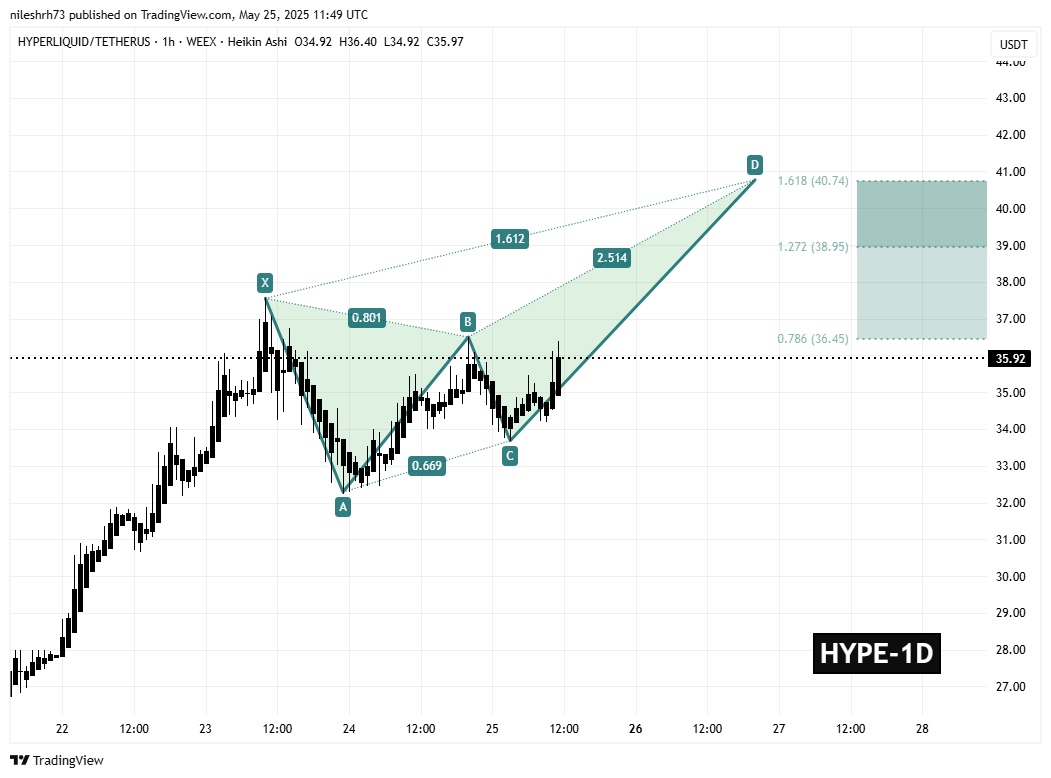

On the 1-hour timeframe, HYPE is forming a Bearish Crab harmonic pattern — a reliable structure in technical analysis known for predicting short-term price spikes before a potential reversal.

The pattern began on May 23, when HYPE was rejected from around $37.55 (marked as point X). It then dropped nearly 15% to bottom out near $32.24 (point A).

HYPE 1H Chart/Coinsprobe (Source: Tradingview)

HYPE 1H Chart/Coinsprobe (Source: Tradingview)

From there, a steady recovery followed:

- AB leg retraced around 80.1% of the XA leg.

- BC leg corrected nearly 66.9% of AB, fitting well within the expected range for a Bearish Crab pattern.

- HYPE then stabilized near the $33.68 zone (point C), where buyers stepped back in.

The final CD leg is now playing out, with bullish momentum pushing prices higher. If the pattern completes, the D point target lies at $40.74, aligning with the 1.618 Fibonacci extension of the XA leg — a common reversal zone.

What’s Next for HYPE?

With the current price sitting near $35.92, there’s room for another 13–14% upside if HYPE can make its way to the $40.74 target. Before that, though, it faces a minor resistance at the 0.786 Fibonacci retracement level around $36.45, which could act as a short-term hurdle.

That said, traders should remain cautious. While the pattern is playing out cleanly, overall market sentiment—especially ETH’s sluggish price action—could influence whether the breakout extends or fizzles out.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.