Data: Bitcoin Spot ETF Net Inflows Reached $2.75 Billion Last Week, Third Highest in History

According to a report by Jinse Finance, based on SoSoValue data, the net inflow of Bitcoin spot ETFs last week (from May 19 to May 23, Eastern Time) was $2.75 billion. The Bitcoin spot ETF with the highest net inflow last week was Blackrock's Bitcoin ETF IBIT, with a weekly net inflow of $2.43 billion, bringing IBIT's total historical net inflow to $47.98 billion. Following that was Fidelity's ETF FBTC, with a weekly net inflow of $210 million, and FBTC's total historical net inflow reaching $11.8 billion. The Bitcoin spot ETF with the highest net outflow last week was Grayscale's ETF GBTC, with a weekly net outflow of $89.17 million, and GBTC's total historical net outflow reaching $23.08 billion. As of the time of writing, the total net asset value of Bitcoin spot ETFs is $131.39 billion, with an ETF net asset ratio (market value as a percentage of Bitcoin's total market value) of 6.11%, and the cumulative historical net inflow has reached $44.53 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

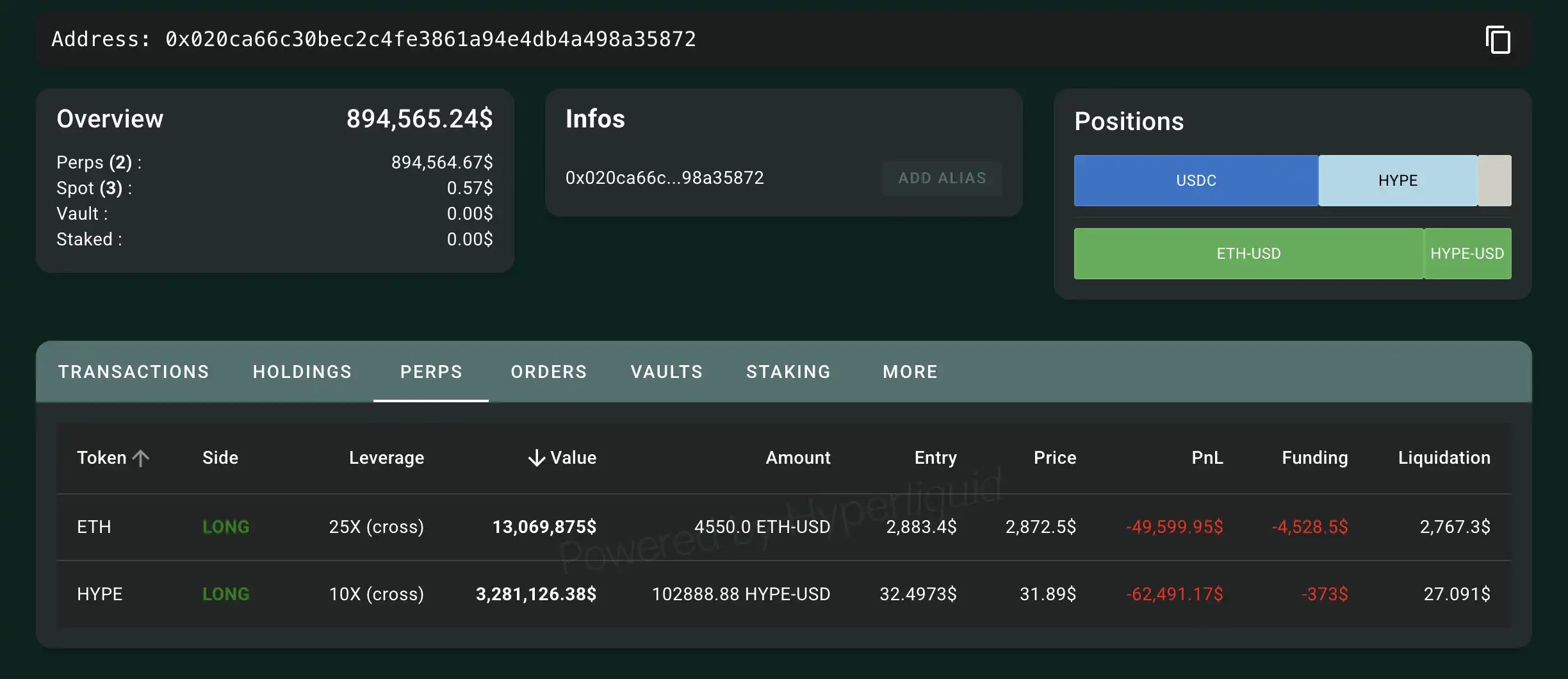

"Machi" holds unrealized losses of over $110,000 on Ethereum and HYPE long positions

The cumulative transfer amount of USDT0 has exceeded 50 billions USD.