Trump Retreats After A Decisive Call From Von Der Leyen

Donald Trump is convinced: the United States has been “too good, for too long.” They offered their markets, stability, and consumers to a hungry world. Result: an America exploited, drained by its trade partners. That era would be over. Now, the time is for a brutal rebalancing. And this involves the president’s favorite weapon: tariff surcharges. In his sights? China, Africa… but mostly Europe. Until a phone call changed (almost) everything.

In Brief

- Ursula von der Leyen secured a delay of the tariff surcharges after a simple phone call.

- Europe was preparing customs retaliation measures valued at over 100 billion euros against the United States.

- Trump threatened to impose 50% surcharges on all European imports starting in June.

- The trade climate remains tense despite the delay; negotiations resume in apparent calm.

Ursula von der Leyen: A Phone Call to Save the European Economy?

The idea of a “Liberation Day”, where the United States would break the chains of their trade dependency, went around the world, even on Wall Street and in the crypto industry . Trump wanted to strike hard. June 1 was supposed to mark a turning point. He threatened to impose a 50% surcharge on all European products. In Africa, the fear of a domino effect was palpable. In China, Beijing was preparing for a new affront and new worrying economic choices .

In Europe, Ursula von der Leyen picked up the phone. She called Trump. The result:

I had a good call with President Trump. Europe is ready to move quickly. To achieve a good agreement, we would need time until July 9.

Trump confirmed: “Ursula just called me… She asked for a delay and told me she wants serious negotiations.“

Behind these diplomatic phrases is an unexpected customs truce. A five-week reprieve , obtained without warning. A feat for von der Leyen, given the belligerent tone Trump adopted two days earlier.

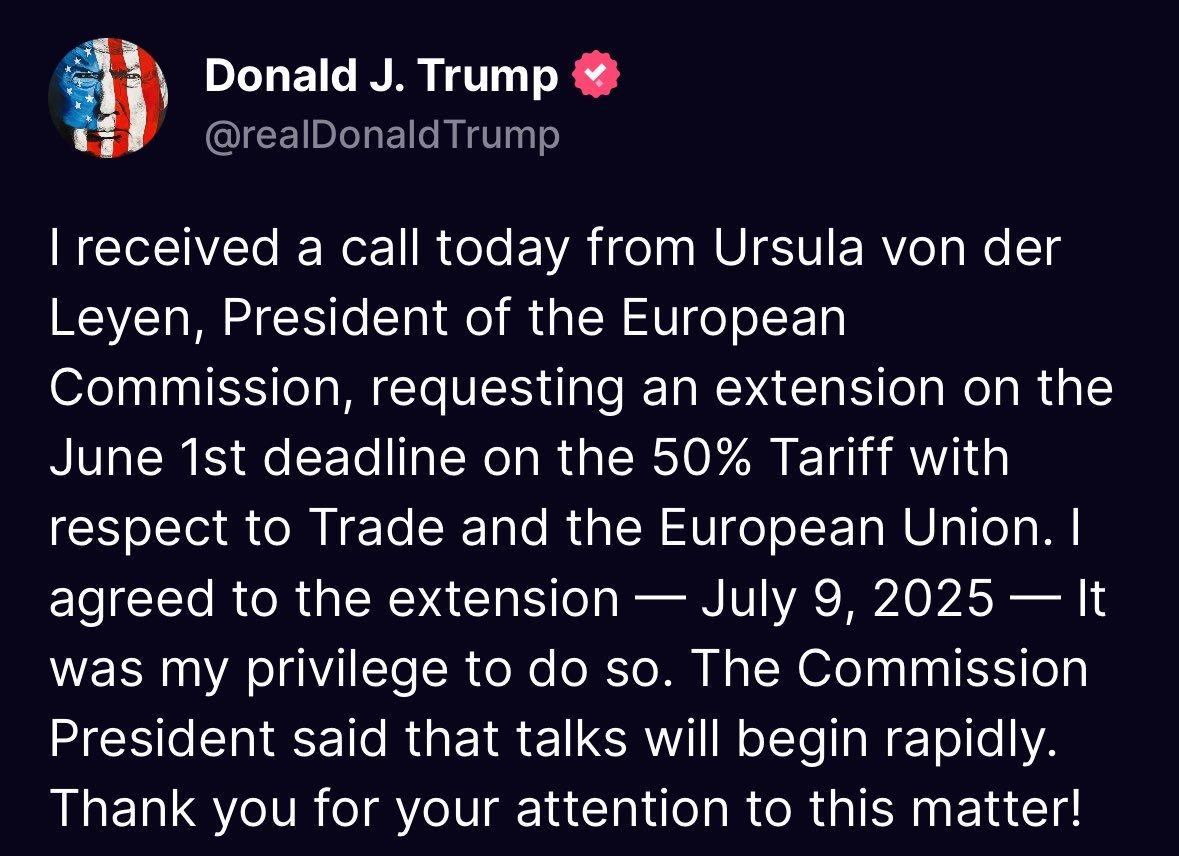

Confirmation by Trump of the call between him and von der Leyen – Source: X

Confirmation by Trump of the call between him and von der Leyen – Source: X

Europe Threatened to Retaliate: When the Trade War Nearly Broke Out

The European economy prepared to counter-attack. Faced with the announced surtaxes, Brussels drew up a list of targeted American products. Potential value of retaliation: 116 billion euros. American wine, cars, aircraft and pharmaceutical products were all targeted.

Ursula von der Leyen, in a solemn statement , warned:

The announced tariffs will have massive consequences. The global economy will suffer.

She mentioned an immediate price increase for citizens, especially the most vulnerable.

Trump, for his part, repeated that “the EU was created to take advantage of the United States” and hammered that “America doesn’t want a deal, only justice“. Existing surcharges – 25% on steel and aluminum – remained intact. A “ reciprocal tariff ” of 20% had been announced, then suspended.

The trade war was no longer a threat. It had become imminent. In this context, European negotiators increased exchanges to avoid an escalation that would have shaken the economies of both blocs.

Reprieve or Lasting Peace? What Lies Ahead for the Transatlantic Economy

Today, a precarious calm reigns. The June 1 deadline has been postponed. The new deadline runs until July 9. This respite guarantees nothing. Trump has already threatened to resume tariff increases. Maros Šefčovič, European Commissioner for Trade, warned:

Transatlantic trade must be guided by mutual respect, not threats.

Trump, for his part, sends mixed signals. He calls Ursula’s call “very pleasant“, but criticizes “European bureaucratic slowness“. Negotiations resume. But the economy remains hanging on every presidential tweet.

Key figures to remember:

- The US-EU trade deficit was 236 billion dollars in 2024;

- Europe threatened 116 billion euros in customs retaliation;

- Existing duties include 25% on steel, aluminum, and 10% on all imports;

- A 50% surcharge on all European products was mentioned, which immediately affected the bitcoin price , then was suspended.

This reprieve creates more doubts than certainties. The European economy, squeezed between threats and diplomacy, must protect its interests without provoking an escalation. Behind the figures, a war of narratives is playing out. Washington shows its strength, Brussels buys time. To prevent this major economic relationship from falling into chaos, some in Brussels are already discussing another option: turning towards the BRICS . A strategic alternative that could well reshuffle the global cards.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x POWER: Trade to share 4,387,500 POWER

New users get a 100 USDT margin gift—Trade to earn up to 1888 USDT!

Bitget Spot Margin Announcement on Suspension of DOG/USDT, ORDER/USDT, BSV/USDT, STETH/USDT Margin Trading Services

BGB holders' Christmas and New Year carnival: Buy 1 BGB and win up to 2026 BGB!